| Finance (Photo credits: www.myhardhatstickers.com) |

Money Hacker Business, Finance and Investment Article Database

This is a post from Sherin Dev; Follow me in Twitter

Money

Hacker is a huge data base of business, finance, investment, economy

and all other personal finance related articles. It is not easy to digg

and read each and every article in this blog that I have added from last

three years. Though, I have added an 'Archive' link in the right

sidebar of this blog for readers to select and read the most interested

topic to them.

Money

Hacker is a huge data base of business, finance, investment, economy

and all other personal finance related articles. It is not easy to digg

and read each and every article in this blog that I have added from last

three years. Though, I have added an 'Archive' link in the right

sidebar of this blog for readers to select and read the most interested

topic to them.

In this section, I am again listing all my articles for the readers to easily scan and select the articles to read and/or book mark this page for feature use. I am sure, no one can digg and read all the articles in this list within a single day or a week. My best advice is to bookmark this page for future references and subscribe this blog to get all the forth coming articles in this blog from the next one.

There are articles on various interesting subjects, links and list post, series articles, videos, interviews and much more can find in this blog. More over the same, each article have links to various related article to the subject. An interesting reader can easily find all the resources that he want to read, is right here in this blog. Have a look and enjoy this effort of simplifying blog search to present all the required resources to readers in a single click!

Money

Hacker is a huge data base of business, finance, investment, economy

and all other personal finance related articles. It is not easy to digg

and read each and every article in this blog that I have added from last

three years. Though, I have added an 'Archive' link in the right

sidebar of this blog for readers to select and read the most interested

topic to them.

Money

Hacker is a huge data base of business, finance, investment, economy

and all other personal finance related articles. It is not easy to digg

and read each and every article in this blog that I have added from last

three years. Though, I have added an 'Archive' link in the right

sidebar of this blog for readers to select and read the most interested

topic to them.In this section, I am again listing all my articles for the readers to easily scan and select the articles to read and/or book mark this page for feature use. I am sure, no one can digg and read all the articles in this list within a single day or a week. My best advice is to bookmark this page for future references and subscribe this blog to get all the forth coming articles in this blog from the next one.

There are articles on various interesting subjects, links and list post, series articles, videos, interviews and much more can find in this blog. More over the same, each article have links to various related article to the subject. An interesting reader can easily find all the resources that he want to read, is right here in this blog. Have a look and enjoy this effort of simplifying blog search to present all the required resources to readers in a single click!

Banking Articles

- Compound Interest calculator

- Failproof your bank details

- Fight Against Identity Theft

- Floating rate and fixed rate interest

- Guernsey - Offshore Banking Centre 2009

- How banks calculating monthly diminishing interest for outstanding loan amount

- ICICI bank to build customer trust

- Investing in 6 Month Bank CDs - New !!

- Online Bank Account Facilities – What you have to consider?

- SBI start eating customers money

- Save Smart With Multiple Accounts

- What is Cash Reserve Ratio

- What is EMI and how to calculate Equated Monthly Installment

- What is Participatory Notes

Books and Reviews

- 6 Great Tools and Techniques Series Guides for Planning

- Free quicken online-Manage Your Money online

- How to Become Wealthy and Popular

- How to Select a True Investment Guide?

- Illustrated Biography of Warren Buffett

- Money Hacker Book of the Week: Your Money and Your Brain by Jason Zweig

- Money Hacker E-Book - A Handy Guide to Protect Yourself From Recession

- Money Hacker Tweetbook! A Precious Gift to Readers!

- The Buffettology workbook review

- The End of Wall Street - Another Sensation from Roger Lowenstein!

- Top 5 Inspirational Books on Value Investing

- What is a Best Book on Investing

- Widely Accepted Wiley Investment Classics Books Library

Business and Economy Articles

- 3 Kickass Business Ideas to Become Definite Millionaire

- An Interesting Map on US Oil Spill! - New !!

- Are the Days of Easy Credit Gone for Good?

- Astrologers – “Year of Rat” may portend losses in Asian stocks

- Being Wise in the Credit Crunch

- Can you predict the stock market boom?

- Credit Crunch - a deep insight

- Economic Recession and Preparing for a Recession

- Financial Market Turmoil - The Credit Crunch

- Get benefited from NSG waiver on India

- Help for Struggling Businesses

- How To Treat The Recent Market Rally

- How to take our World out of Recession?

- Investments to beat inflation

- Lehman, Merrill and AIG impact in India

- Microsoft offers $44.6B for Yahoo

- Qualified yet Bored? Successful Home Business Ideas for Housewives

- Revisiting Lehman’s Tomb: What Would be the Thoughts for an Investor?

- Simple and Successful Ideas for Small Entrepreneurs

- Sub-Prime What has happened?

- Subprime Flow

- Thoughts On Life After Recession

- US Federal Reserve Cut – An overview and impacts

- Understanding Sub Prime

- What are the Reasons Behind Huge Stock Market Fall

- What factors determine interest rates?

- What is hyperinflation

- Worst company collapses in US

Debt Management Articles

- 7 Legitimate Ways to Get Out of Debt

- 7 Steps to Responsible Borrowing

- Avoiding Common Mortgage Mistakes

- Businesses in Debt – Understanding Company Liquidation

- Calculating Mortgage Closing Costs: Some Facts

- Credit card - Convert an enemy to close friend - A journey through personal experience

- Dangers of debt consolidation

- Debit vs Credit Cards

- Debt - Dangerous or Friendly?

- Did You Know You Could Pay-off Your Debts with an Administration Order!

- Don’t Bury Your Head in the Sand with Debt!

- How to avoid credit card risk

- Is Christmas Debt Really Worth It?

- Is Debt Settlement an Answer to Your Financial Troubles?

- Mortgage Interest Rates Hovering Just Above All-Time Lows

- Mortgages With Credit Challenges Can Be Overcome

- Simplest Ways to Become Debt Free

- What is a Debt Relief Order?

- What is reverse mortgage

Family Finance Articles

- 10 Fabulous Financial Resolutions for New Year 2010

- 5 Must Required Money Practices for Every Person

- 5 practical child savings ideas

- A practical method to teach your kid about the value of money

- Bring Your Kids with Financial Literacy

- Build a perfect portfolio for your Kid

- Buy a new home? Factors to consider intelligently

- Child Investment and Financial Planning Resources

- Child savings and investment requirement

- Convert Your Credit card Habit as a Money Source for Your Child

- Financial Planning for Higher Education

- Financial Planning for Kids in India

- Guide to the Core of Family Financial Planning

- How I Raised Money to Purchase My First Stock

- How I used budgeting to buy shares for my kid

- How to Make Your Kid Smarter

- How to Secure Childs Finance and Investment Portfolio

- How to Teach Your Child about Financial Responsibility

- Money Lesson For Kids

- Money lessons to kid

- My Dream Eco friendly home features

- My Personal Plan for Creating Investment Portfolio for Kid

- Qualified yet Bored? Successful Home Business Ideas for Housewives

- Reclaiming Credit Card Charges – Fair Game?

- Role of Family Members to Family Financial Planning Process - New !!

- Teaching the money saving strategies to kids

- Understand the Six Pillars in Child Financial Planning

Guest Articles

- 10 ways to save money when eating out

- A look into Penny Stocks

- Are the Days of Easy Credit Gone for Good?

- Avoiding Common Mortgage Mistakes

- Being Wise in the Credit Crunch

- Debit vs Credit Cards

- Did You Know You Could Pay-off Your Debts with an Administration Order!

- Don’t Bury Your Head in the Sand with Debt!

- Guernsey - Offshore Banking Centre 2009

- Help for Struggling Businesses

- How Not to Get Conned Out of Your Money

- How To Save The Most On Auto Insurance

- How to Use the Net to Sell Your Gold

- How to take our World out of Recession?

- Is Christmas Debt Really Worth It?

- Make Your Money Go Further in January

- Making More Money Does Not Guarantee Financial Stability

- Mortgage Interest Rates Hovering Just Above All-Time Lows

- Mortgages With Credit Challenges Can Be Overcome

- PPI Claims – What are they?

- Reasons Why a Home Isn't an Investment - New !!

- Save Smart With Multiple Accounts

- Shopping for Annuity Quotes Online

- Should I Take My Pension More Seriously

- What Brazilian Property Market has to Offer

- What is a Debt Relief Order?

- What is an Individual Voluntary Arrangement (IVA)?

India Investment Ideas

- BICII - Best Indian Companies To Invest In - Britannia Industries

- BICII - Best Indian Companies To Invest In - Glaxo Consumer Care

- BICII - Best Indian Companies To Invest In - TMM Post Schedule Calendar

- BICII - Best Indian Company To Invest - Nestle India

- Best Indian Company To Invest - Procter & Gamble India

Insurance Planning Articles

- Benefit of buying a term insurance policy

- Comparing mediclaim policy - the factors to be considered

- Decoding Max NewYork ULIP insurance plan

- Decoding complex insurance product ULIP

- Guidelines to Select Worthy Insurance Policies

- Home Loan Insurance Plan – Requirements and benefits

- How Much Insurance Cover You Take

- How To Save The Most On Auto Insurance

- How ULIPs can make you rich!

- Important Insurance Thoughts for Young Subscribers

- Insurance Claiming – 5 Best practices to make it hassle free

- Invest in ULIP, the double edged sword

- Maximize Wealth Through Intelligent Fund Switching Practice

- Most required qualities for an insurance advisor

- PPI Claims – What are they?

- Protect Self and Family - Dig into the Chances of Insurance

- Self assessment questionnaire for ULIP buyers

- Tapping ULIP investment profit possibilities

- Term Insurance Plan Analysis

- ULIP common points to remember

- What is a ULIP product

- What make a ULIP different from Mutual funds?

- Why ULIP investment is a big failure for some investors

Interview

- CNBC Interview with Warren Buffett on March 09

- Intereview With GetRichSlowly.org

- Interview With Fivecentnickel

- Interview With Moolanomy

- Interview with Jim of Bargaineering

- Interview with The Digerati Life

- Interview with Trent from The Simple Dollar

Investment Articles

- 12 Important Steps to Investing

- 12 golden investment rules each investor should keep in mind

- 15 Investment Failure Reasons

- 3 Activities for Investors to Practice When Market is Peak

- 3 Simple Steps To Invest In A Good Company Or Business

- 30 investing mistakes by investors

- 41 rules for an equity investor

- 5 Great investments instruments for retail investors and practical ideas

- 5 Lessons from Investment Lose

- 5 Stock Investment Mistakes I Always Careful to Avoid

- 5 must consider contrarian stock selection strategies

- 7 Great ideas to accumulate gold through easy steps

- 8 cutting edge investing principles of Philip Fisher

- 9 golden rules of stock investing

- A look into Penny Stocks

- All about Exchange Traded Funds

- All about stock trading and stock investing

- Ayurveda for young investors

- Beginner Investing Ideas

- Beginner investor education

- Beginners Step by Step Guide to Become a Better Investor

- Best practices from Wise Investors

- Beware of company extravagance

- Buffet's first lesson in patiance

- Bull market indicators

- Common mistakes short term investors commits

- Common sense investing strategy

- Competitive Advantages of Investing in Monopoly Businesses

- Contrarian Investment Philosophy - At a glance

- Convert Recession as Your Friend

- Create a Powerful Personal Investment Strategy - A Working Example

- Creating Personal Investment Policies

- Criteria to select an online stock trading or investment account with a stock broker

- Day trading or stock trading explained

- Definition of Investment

- Demat and physical form of securities

- Diamond-The next investment instrument

- Disadvantages of Commodity Business

- Do You Plan to Invest in Stocks? Did You Check this Readiness Checklist?

- Do’s and Don’ts an investor bear in mind

- Exchange Taded Fund – At a glance

- Explaining Long term Investing is Like Explaining Sex to a Virgin

- FPO – Follow-on Public Offering

- Factors leading to investment failure

- Fail proof investing principles of Warren Buffet

- Features of debt instruments

- Four Faces of Investing personalities

- GOLD EXCHANGE TRADED FUNDS

- Golden Nuggets from John Templeton and its hidden meanings

- Golden Rules to Become a Great Investor

- Graham's Guidelines for Ordinary Longterm Investor

- Graham's Mr. Market Allegory

- Growth Stock and Value Stock

- Hidden Intentions Behind Stock Buy and Sell recommendations

- How Could a Beginner Become Super Investor Through Reading

- How Your Investment in Knowledge Convert You as a Successful Investor

- How accounting scandals help an investor

- How share buyback make an investor wealthy

- How they lost their Rolls Royce in Wall Street? A Counsel on 20 Deadly Investment Mistakes

- How to Valuate a Stock like Buying a Business

- How to identify the time to sell a stock

- How to invest in the market

- How to treat an analyst report

- Ideas and Relationship between Mr. Market and Margin of Safety

- Identifying a best managed company with 9 must have qualities

- Invest Like Your marriage - What is it?

- Invest in future top models

- Investing Ideas in a Down Market

- Investing Life Cycle To Wealth

- Investing Success Rules

- Investing THE PETER LYNCH WAY

- Investing THE TEMPLETON WAY

- Investing THE WARREN BUFFETT WAY

- Investing humor, ten reasons why investing is like having sex

- Investing in Art

- Investing in Arts - The Role of Artist

- Investing in real estate

- Investment instruements to grow your money with economy

- Investment loses - what should you do next?

- Investment portfolio mistakes

- Investment portfolio requirements

- Investor and requirement of patience

- Key aspects while investing in equities

- Key aspects while investing in equities

- Know your investment expenses

- Learn investing from Buffett’s advertisement.

- Learn stock analysis from a story

- Major advantages of a diversified portfolio

- Major details on the contract note issued by stock brokers

- Major reasons Behind any Investment Failures

- Most Required Investing intelligence

- My Personal Biography of Investing - Part 1

- My personal biography of investing - Part 2

- One up on wall street by Peter Lych – The investors best friend

- Online Trading Account Selection Criteria

- Portfolio investment models

- Portrait of the successful investor

- Precautions to take before investing in stock markets

- Pro and cons of exchange traded funds

- Real Estate Pre-Launch offer– Things to remember

- Reasons Why Gold is the Most Powerful Investment Today

- Reasons Why a Home Isn't an Investment - New !!

- Rent Agreement Clauses

- Required approach to macro and micro economic factors

- Revisiting Margin of Safety Formula

- Right investing strategy for recession time

- Road to successful investor

- Secondary Market products

- Secret Value Investing Formula - You Never Find in Books

- Selecting a right IPO - Major things to remember

- Simple investment portfolio strategy for persons from different risk profile

- Simplifying Benjamin Graham's famous "Margin of Safety" formula

- Spot coward investors around you

- Stock investment through different channels depends on investors knowledge and risk profile

- Stock research and valuation – important factors to consider

- Story of coward investors

- Strategies to Become an Expert Investor

- Successful investment practices for an equity investor

- Ten Commandments for Investors

- Ten Points: Ben Graham’s Last Will and Testament

- Test to Measure Your Investment Skills and Performance

- The Art and Science of Investing - A Deadly Combination

- The Role of Comparison to Make Successful Decisions

- Think Against Public To Invest

- Time tested principles – Start Investing Early and Invest Regularly

- Tips for Diverse Investing - New !!

- Top 4 Reasons to Invest in Gold Today

- Truth that Investment World Never Tells You

- Two Lessons Honeybees Teach Investors

- Two Trading Accounts with different brokerage firms. Is it legal or illegal?

- Two most simple yet powerful investment steps

- Type Of Businesses To Be Avoided By Value Investors

- Understand investing trap from story of monkeys

- Understand the Hidden Traps in Investment World Through the Story of Monkeys

- Understand the role of production cost

- Understand your risk profile and advisable investment proportion

- Various short term investment options for investors

- Warren Buffet's advice for 2009

- Warren Buffett quotes on common sense investing

- Watch Realtime Stock prices with MS Excel

- Weekly Financial Term - Stock Split

- What Brazilian Property Market has to Offer

- What I Learned From Buffet Investing Strategy

- What I am doing here as an Investor

- What a retail Investor want to do in a fluctuating stock market?

- What are the different kinds of stock issues?

- What is Buffett's Circle of competence?

- What is Return on equity

- What is a Primary Market and Secondary Market?

- What is a contract note

- What is an Index

- What is meant by Face Value of a share or debenture?

- What is stock beta for and how to calculate it?

- What should avoid for short term investing?

- Who Are You As An Investor

- Who is Foreign Institutional Investors (FII's)

- Whos is an Investment Advisor?

- Why Not Invest On Telecom Stocks

- Why an investor should avoid IPO investing

- Why should one invest?

- Why the P/E ratio is irrelevant

- Wisdom from Ben Miller

Life and Success

- 3 Childhood Money Habits I Still Follow

- 5 Magic Personal Qualities behind the Success of Warren Buffett

- A Fasting Approach to Kill a Habit That You Don't Want

- Best Place to Think About Life and Money

- Convert a Bad Habit to Millions…

- Highly Effective Interview Guide Part1

- Highly Effective Interview Guide Part2

- Highly Effective Interview Guide Part3

- How MoneyHacker Feed an Orphan Kid from Reader Comments

- How to Become Beggar at the End of this Year

- Impossible is Just a Word - The Value of Dreams

- Invest from your bad habits

- Plan to Build a New Home? Here is Your Master Check List

- Protecting Yourself from Being Jobless

- Roles of Education to Investment Success

- Step by Step to Stop a Bad Habit and Convert the Savings to Millions

- Thoughts on Life and Wellness

- When I stop my smoking…..

Money Saving Ideas & Money Management Articles

- 10 Interesting Grocery Shopping Lessons Learned from the First Shopping in 2010

- 10 excellant money saving tips

- 10 secrets using at every shopping mall

- 10 ways to save money when eating out

- A Practical Guidance to Become a Christmas Spending Expert

- Be a money saving expert by improving your skills

- Build Wealth from Your Shopping Habit

- Excellent Money Saving Tips at Work

- Highly Practical Money Saving Tips on Groceries

- How I Reduced Electricity Bill to More Than Half Using Simple Practices - New !!

- How Not to Get Conned Out of Your Money

- How to Shop Wisely and Save Money

- How to Spend Money Wisely - 10 Points to Build Intelligent Spending Habits

- How to Use the Net to Sell Your Gold

- How to be a frugal at work

- Insightful Money Saving Tips on Electricity

- Make Money Teaching Online

- Make Your Money Go Further in January

- Money Saving Tips Reality Checks

- Money Saving Tips on Water

- Money mistake series - Top 10 Investing mistakes to avoid

- Practice money management intelligently

- Reality check: Is bloggers money saving tips are practical?

- Save money using energy intelligently

- Season Special: Money Saving Tips for Winter

- Simple yet Superior Money Saving Ideas

- Unique Ideas to Make Money for Christmas from Seasonal Activities

- Woman's Money Saving Tips - 4 Best Money Saving Hobbies

- Woman's Money Saving Tips For Routine Travelers

- Working Tips for Families to Save Money

Mutual Fund Investment Ideas

- Benefits of investing in Mutual Fund

- Case Study: Mutual Fund Investing Mistakes I Made as a Beginner

- Disciplined investment approach for a mutual fund investor

- Equity Exposure through investing in Index Funds

- How to Prevent a Professional Killer Being Your Fund Manager

- Know the efficiency of your mutual fund manager

- Magic of Systematic Investment Plan (SIP)

- Mutual funds vs Fixed deposits

- Options to select mutual fund returns

- Prerequisites for Mutual Fund investments

- Strategies for Intelligent investment in Mutual Funds

- The role of a fund house philosophy

- Top 10 Mutual fund investing mistakes

- Types of returns from Mutual Funds

- ULIP vs Mutual Fund – Which is better to invest?

- Understand the risks associated with mutual fund performance

- Why Debt Funds in your portfolio?

Personal Finance Articles

- 10 Financial mistakes we make

- 15 Financial planning mistakes

- 3 Powerful Factors to Decide a Personal Financial Planning Success

- 3 Required Investment and Financial Planning Qualities

- 5 Financial Life Categories

- 5 Must Required Money Practices for Every Person

- Build a simple effective portfolio with low savings

- Building an Emergency Fund

- Calculating inflation adjusted future expense amount

- Calculating inflation adjusted future expense and maturity value of an investment

- Core Points of Personal Financial Planning

- Creating wealth step by step

- Day 1: Master plan to Protect You from Recession Forever

- Financial Planning Process Chart

- Financial Planning considerations

- Financial planning templates for various age groups

- Financial resolutions for year 2009

- Finding Money Sources for Emergency

- How do you prepare for losing your job

- How to Make Your Life Financially Stable and Successful

- How to Select a Good Financial Advisor

- How to balance a portfolio with magic of maths

- Independent Financial Adviser Selection

- Keys to financial planning

- Learn personal financial planning with soccer - Part 1

- Little Thoughts on Financial Freedom

- Making More Money Does Not Guarantee Financial Stability

- Masterize in Financial Planning through Football - Part 1

- Masterize in Financial Planning through Football - Part 2

- Masterize in Financial Planning through Football - Part 3

- Masterize in Financial Planning through Football - Part 4

- Masterize in Financial Planning through Football - Part 5

- Masterize in Financial Planning through Football - Part 6

- Masterize in Financial Planning through Football - Part 7

- Masterize in Financial Planning through Football - Part 8

- Motivate Self to Generate 3 Way Income

- Opening PPF Account Dilemma With Banks

- Personal Financial Planning thoughts and strategies

- Points To Remember When Managing Financial Resources

- Portfolio Balance Model - A Case Study

- Practical Guidelines to Create Additional Income

- Practical Methods to Raise Funds to Head Off a Crisis

- Set Fail Proof Personal Financial Goals for year 2009

- Setting Up a Savings Plan

- Seven steps to a structured financial plan

- Simple and perfect Wealth Building Strategies

- Step by step financial planning

- The Principles of Passionate Financial Planning - Thomas T. Brown

- Top 10 Qualities required by a good financial advisor

- Top 7 Skill set to Financial Prominence

- Top personal financial planning mistakes 1 – No goal

- Top personal financial planning mistakes 2 – Over diversified portfolio

- Top personal financial planning mistakes 3 – No life coverage

- Top personal financial planning mistakes 4 – No investments

- Top personal financial planning mistakes 5 – Loans and debts

- Top personal financial planning mistakes 6 – Only debt investments

- Ultimate Guide to Budgeting Secrets

- What Prevent One From Being Millionaire

- What is Power of Attorney

- What is your personal wealth? How to calculate that?

- Why Diversification is Important in a Portfolio

Retirement Planning Articles

- 5 Steps to Retirement Planning

- Planning for retirement

- Retirement Planning for Slackers - New !!

- Retirement Strategies

- Shopping for Annuity Quotes Online

- Should I Take My Pension More Seriously

- What is an Individual Voluntary Arrangement (IVA)?

Tax Planning

Money Hacker Videos

- Examples to Measure Advertising Efficiency and Effectiveness

- Featured Video: Top Ten Money Saving Tips

- Importance of Charity for Financial Life

- TMM starts video posts on finance and investing

- Trying the Stock Market without Risking Money

- Video: Investing 101 from Warren Buffett - New !!

- Youtube Personal Finance Videos - New !!

Video: Investing 101 from Warren Buffett

Here is a video which I have embedded from YouTube. This video help

readers and beginner investors to know three most important things

Warren Buffett Looks in a business to buy. You can hear these points

directly from Mary Buffett, famous author of two most admired investment

books on Warren Buffett "The New Buffettology" and "The Tao of Warren Buffett".

Hear this simple yet most powerful points to add value to your

investment decisions. It also covers some of the must required qualities

of a good investor along with a direct voice from Warren Buffett!

I am sure, you will enjoy this small video with very powerful message!

Comments appreciated...

Here is another video which is a tour through Warren Buffet's life and I am sure you will enjoy it a lot!

I am sure, you will enjoy this small video with very powerful message!

Comments appreciated...

Here is another video which is a tour through Warren Buffet's life and I am sure you will enjoy it a lot!

Reasons Why a Home Isn't an Investment

Editor's Note: This is a guest post by Go Banking Rates

By

definition, an investment is "the act of laying out money or capital in

an enterprise or asset with the expectation of profit." So by

definition, is a home really an investment? With mortgage rates at a

historical low and depressed home prices, it really depends on who you

ask.

By

definition, an investment is "the act of laying out money or capital in

an enterprise or asset with the expectation of profit." So by

definition, is a home really an investment? With mortgage rates at a

historical low and depressed home prices, it really depends on who you

ask.

The self-made, multi-millionaire real estate investor who bought in when homes were cheap would answer with an emphatic yes. But times are different now, and many of those same home flippers and amateur investors are declaring bankruptcy while banks are seizing their assets.

In the wake of one of the worst economic catastrophes ever (and caused by overzealous home purchases), people are finally starting to realize that the era of easy money is gone when it comes to housing. While most people still believe a home is a great investment, there are several good reasons why you should reconsider thinking like most people.

By

definition, an investment is "the act of laying out money or capital in

an enterprise or asset with the expectation of profit." So by

definition, is a home really an investment? With mortgage rates at a

historical low and depressed home prices, it really depends on who you

ask.

By

definition, an investment is "the act of laying out money or capital in

an enterprise or asset with the expectation of profit." So by

definition, is a home really an investment? With mortgage rates at a

historical low and depressed home prices, it really depends on who you

ask.The self-made, multi-millionaire real estate investor who bought in when homes were cheap would answer with an emphatic yes. But times are different now, and many of those same home flippers and amateur investors are declaring bankruptcy while banks are seizing their assets.

In the wake of one of the worst economic catastrophes ever (and caused by overzealous home purchases), people are finally starting to realize that the era of easy money is gone when it comes to housing. While most people still believe a home is a great investment, there are several good reasons why you should reconsider thinking like most people.

Youtube Personal Finance Videos

Article written by: Sherin Dev (Read About Me). Follow me in Twitter

I

personally love YouTube a lot to visit and watch videos. It works as a

gold mine for all to get all required information they need. Whether you

are an investment beginner or personal finance beginner or trying to

learn a new language or technology, YouTube is the first and final point

to all required information for you in the form of excellent videos.

I

personally love YouTube a lot to visit and watch videos. It works as a

gold mine for all to get all required information they need. Whether you

are an investment beginner or personal finance beginner or trying to

learn a new language or technology, YouTube is the first and final point

to all required information for you in the form of excellent videos.

Today, I thought I would share some of the best videos from well known personal finance gurus. Here is a collection but not limited to, the same for you to watch:

Suze Orman Collection

1. Suze Orman Paying Off Your Mortgage Early

2. Suze Orman - Career Advice For Young People

3. Suze Orman - Investing During The Financial Crisis

4. Suze Orman on Life Insurance

5. Suze Orman's Debt Consolidation Tips

6. Suze Orman - Attitude On Personal Finance

7. Women & Money by Suze Orman

8. Suze Orman on Cash Value Life Insurance vs. Term Life Insurance

9. Personal Response to Susan Gunelius Women on Business

10. Suze Orman on Personal Finance

I

personally love YouTube a lot to visit and watch videos. It works as a

gold mine for all to get all required information they need. Whether you

are an investment beginner or personal finance beginner or trying to

learn a new language or technology, YouTube is the first and final point

to all required information for you in the form of excellent videos.

I

personally love YouTube a lot to visit and watch videos. It works as a

gold mine for all to get all required information they need. Whether you

are an investment beginner or personal finance beginner or trying to

learn a new language or technology, YouTube is the first and final point

to all required information for you in the form of excellent videos.Today, I thought I would share some of the best videos from well known personal finance gurus. Here is a collection but not limited to, the same for you to watch:

Suze Orman Collection

1. Suze Orman Paying Off Your Mortgage Early

2. Suze Orman - Career Advice For Young People

3. Suze Orman - Investing During The Financial Crisis

4. Suze Orman on Life Insurance

5. Suze Orman's Debt Consolidation Tips

6. Suze Orman - Attitude On Personal Finance

7. Women & Money by Suze Orman

8. Suze Orman on Cash Value Life Insurance vs. Term Life Insurance

9. Personal Response to Susan Gunelius Women on Business

10. Suze Orman on Personal Finance

Retirement Planning for Slackers

Editor's Note: This is a guest article from Alvina Lopez

All

your life, you've probably heard how important it is to secure your

retirement early. You've put it off, made excuses, and now you're closer

to retirement than you are away from it. Your first instinct might be

to panic or resign yourself to working until you drop dead, but it

doesn't have to be that way.

All

your life, you've probably heard how important it is to secure your

retirement early. You've put it off, made excuses, and now you're closer

to retirement than you are away from it. Your first instinct might be

to panic or resign yourself to working until you drop dead, but it

doesn't have to be that way.

With careful planning and smart strategies, you can make retirement work even when you're way behind and close to cashing in. You don't have to depend on Social Security alone. Here are some of the ways you can get back on track.

Know what you need. Sit down

and make a plan for the expenses you will need to cover in your

retirement. Think about what you already have in retirement accounts,

and what you can expect to receive from Social Security. A financial

planner or retirement software can be extremely helpful in this

situation to ensure that nothing is overlooked. With a clear view of

what's needed, you will be better prepared to tackle the mounting task

of retirement.

All

your life, you've probably heard how important it is to secure your

retirement early. You've put it off, made excuses, and now you're closer

to retirement than you are away from it. Your first instinct might be

to panic or resign yourself to working until you drop dead, but it

doesn't have to be that way.

All

your life, you've probably heard how important it is to secure your

retirement early. You've put it off, made excuses, and now you're closer

to retirement than you are away from it. Your first instinct might be

to panic or resign yourself to working until you drop dead, but it

doesn't have to be that way.With careful planning and smart strategies, you can make retirement work even when you're way behind and close to cashing in. You don't have to depend on Social Security alone. Here are some of the ways you can get back on track.

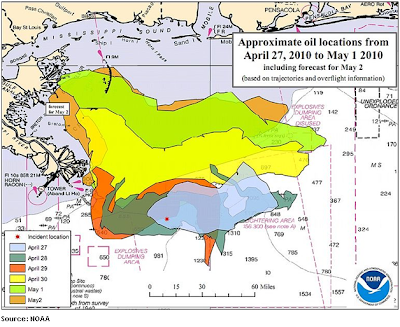

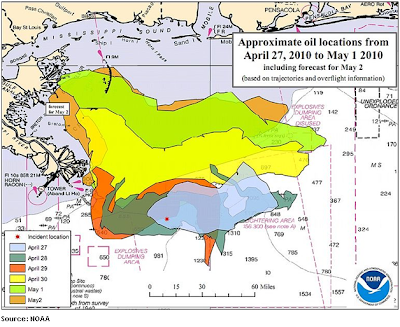

An Interesting Map on US Oil Spill!

Editor's Note: This is a guest article written by SVB from The Digerati Life

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

But, many are also growing concerned about the economic impact that such a disaster poses during an already tough economic climate. Countless entrepreneurs have been interviewed by the likes of CNN, Fox News and other media outlets, telling their stories of lost revenues, lost inventories, and the potential for lost businesses, many of which are finally beginning to see the light in the aftermath of Hurricane Katrina.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.But, many are also growing concerned about the economic impact that such a disaster poses during an already tough economic climate. Countless entrepreneurs have been interviewed by the likes of CNN, Fox News and other media outlets, telling their stories of lost revenues, lost inventories, and the potential for lost businesses, many of which are finally beginning to see the light in the aftermath of Hurricane Katrina.

Investing in 6 Month Bank CDs

Editor's Note: This guest post was written by Go Banking Rates

If you are looking for a quick way to earn a great rate of return on your money, look no further than a 6 month CD from your favorite bank or credit union.

If you are looking for a quick way to earn a great rate of return on your money, look no further than a 6 month CD from your favorite bank or credit union.

For those of you who are unaware, a CD, or certificate of deposit, is a financial deposit product that allows you to invest a sum of money for a predetermined amount of time. In return, you will be paid in interest at a guaranteed interest yield.

6 month CDs are great for people who are short term investors. Since you cannot touch your money for half a year, you should be able to survive on your current income and an emergency fund before investing. If you do not yet have an emergency fund, it is recommended that you build one and pay off all debts prior to investing.

In general, 6 month CDs pay out less in interest than longer term CD rates such as 1 year CDs and 24 month CDs. Some people however, are uncomfortable when they are unable to access their money for long periods of time for any number of reasons.

If you are looking for a quick way to earn a great rate of return on your money, look no further than a 6 month CD from your favorite bank or credit union.

If you are looking for a quick way to earn a great rate of return on your money, look no further than a 6 month CD from your favorite bank or credit union.For those of you who are unaware, a CD, or certificate of deposit, is a financial deposit product that allows you to invest a sum of money for a predetermined amount of time. In return, you will be paid in interest at a guaranteed interest yield.

Why 6 Month CDs?

6 month CDs are great for people who are short term investors. Since you cannot touch your money for half a year, you should be able to survive on your current income and an emergency fund before investing. If you do not yet have an emergency fund, it is recommended that you build one and pay off all debts prior to investing.

In general, 6 month CDs pay out less in interest than longer term CD rates such as 1 year CDs and 24 month CDs. Some people however, are uncomfortable when they are unable to access their money for long periods of time for any number of reasons.

How I Reduced Electricity Bill to More Than Half Using Simple Practices

Article written by Sherin Dev; Follow me in Twitter or Facebook . To get latest news and articles Subscribe for free!

Here

is a commons complaint you may have heard from someone earlier: “My

electricity amount increasing month to month. What the heck is this? I

don’t have any additional appliances in my home and using electricity

just like others. Even though, I am getting huge bills compare with

others? I am not getting any idea on what is wrong”

Here

is a commons complaint you may have heard from someone earlier: “My

electricity amount increasing month to month. What the heck is this? I

don’t have any additional appliances in my home and using electricity

just like others. Even though, I am getting huge bills compare with

others? I am not getting any idea on what is wrong”

Remember, using less appliances or lights doesn’t mean you will get less electricity bills. Even a small appliance, if not using properly, you may get a kick from Electricity Company.

Ahoy!!! There are lots of tips around the web space available on reducing electricity bills to great extends. I agree with some of them which work better. But, most of the tips are either not practical or impossible to follow at all, at least to me. In this context, sharing my own experience of how I reduced my electricity bills to more than half to what I paid some months back would be better to give an idea to work yourself to reduce your bills too. Here are my practices. No worries, I still following these practices and yes, my electricity bills are considerably low.

1. I Love You CFL

I am a green supporter. To comply with green, I have replaced all the ordinary bulbs and tubes in my home with latest CFL/Led lamps. This action helped me to save lots of money for long run. Yes, this activity reduced my electricity bill to a great10% easily.

Here

is a commons complaint you may have heard from someone earlier: “My

electricity amount increasing month to month. What the heck is this? I

don’t have any additional appliances in my home and using electricity

just like others. Even though, I am getting huge bills compare with

others? I am not getting any idea on what is wrong”

Here

is a commons complaint you may have heard from someone earlier: “My

electricity amount increasing month to month. What the heck is this? I

don’t have any additional appliances in my home and using electricity

just like others. Even though, I am getting huge bills compare with

others? I am not getting any idea on what is wrong”Remember, using less appliances or lights doesn’t mean you will get less electricity bills. Even a small appliance, if not using properly, you may get a kick from Electricity Company.

Ahoy!!! There are lots of tips around the web space available on reducing electricity bills to great extends. I agree with some of them which work better. But, most of the tips are either not practical or impossible to follow at all, at least to me. In this context, sharing my own experience of how I reduced my electricity bills to more than half to what I paid some months back would be better to give an idea to work yourself to reduce your bills too. Here are my practices. No worries, I still following these practices and yes, my electricity bills are considerably low.

1. I Love You CFL

I am a green supporter. To comply with green, I have replaced all the ordinary bulbs and tubes in my home with latest CFL/Led lamps. This action helped me to save lots of money for long run. Yes, this activity reduced my electricity bill to a great10% easily.

Tips for Diverse Investing

Editor's Note: This guest post was written by Go Banking Rates

Have

you been thinking about getting in on the investing game, but don't

know exactly what investments you want to make? You may receive tips on

various investment options, but which should you choose?

Have

you been thinking about getting in on the investing game, but don't

know exactly what investments you want to make? You may receive tips on

various investment options, but which should you choose?

Some experts agree that learning to invest requires that you be willing to dabble in a bit of everything to create a diverse portfolio. If you have yet to hear this concept then let's take a closer look into why investing in your future requires diversity.

Whether you're investing in the stock market, or trying to play it safe with Treasury bills, you run the risk of losing money. Of course, the threat of loss will lessen as the level of risk lessens, but any time you allow your money to leave your hands for an extended period of time, you run the risk of losing it (ask the millions of people who lost their 401(k) accounts or lost money after their banks closed).

It is for this reason that financial experts suggest creating a diverse investment portfolio. But what should you add to your investment portfolio? Different investment managers will definitely give you different advice, but here are a few options to consider:

Have

you been thinking about getting in on the investing game, but don't

know exactly what investments you want to make? You may receive tips on

various investment options, but which should you choose?

Have

you been thinking about getting in on the investing game, but don't

know exactly what investments you want to make? You may receive tips on

various investment options, but which should you choose?Some experts agree that learning to invest requires that you be willing to dabble in a bit of everything to create a diverse portfolio. If you have yet to hear this concept then let's take a closer look into why investing in your future requires diversity.

Any Investment Could Lose Money

Whether you're investing in the stock market, or trying to play it safe with Treasury bills, you run the risk of losing money. Of course, the threat of loss will lessen as the level of risk lessens, but any time you allow your money to leave your hands for an extended period of time, you run the risk of losing it (ask the millions of people who lost their 401(k) accounts or lost money after their banks closed).

It is for this reason that financial experts suggest creating a diverse investment portfolio. But what should you add to your investment portfolio? Different investment managers will definitely give you different advice, but here are a few options to consider:

Related articles

How to Learn Investing Strategies

Get College Finance Facts and Information

How CDs Compare to Investments

Review: Deep Value Investing by Jeroen Bos

Improving Credit Score Likely Best Before Major Investments and Life Decisions

The 5 Worst Things You Can Do With Your Money

What You Need to Know Before Opening an ISA

Toddle critical after being hit by van

No comments:

Post a Comment