Caught Your Child Stealing? 5 Ways to Deal with It and Prevent Them from Stealing Again

Stealing

can happen in all levels of society. From a piece of gum at the corner

store to millions of taxpayer dollars on Wall Street, stealing is a

dangerous habit to start and will never lead to positive ends. Make sure

your child knows the real consequences of stealing from an early age

with these five tips:

Stealing

can happen in all levels of society. From a piece of gum at the corner

store to millions of taxpayer dollars on Wall Street, stealing is a

dangerous habit to start and will never lead to positive ends. Make sure

your child knows the real consequences of stealing from an early age

with these five tips:1. Consider Your Child’s Age First

Before you jump to discipline your child, you first have to consider whether or not they knew they were stealing in the first place. If your child is very young, they may not have been aware that taking a piece of candy without paying for it was not right. This child should be dealt with differently than a teenager who steals a shirt from a store in the mall.

2. Return the Stolen Item

The first thing to do is return the stolen item. Bring your child back to the store with the item in tow and ask to speak to the manager. Have your child tell the manager that they took the item, apologize, and give it back. If the item has already been open, used, or eaten, you will need to pay for it.

How Can Forex VPS Help Traders?

Forex

trading has become the best way of making money online and does not

require huge investment in terms of money and time. However, in any

business, success is counted on how much profit you make. Some business

increase their profit margins when their have a huge customer base, but

for Forex traders profits are determined by the tools

and resources that you have access to. They can be either informational

products or software that will assist you in making critical decisions

when trading. For Forex traders, the best tool that they can utilize is a VPS account. VPS accounts have immense benefits to Forex traders due to their widespread availability and easy to use.

Forex

trading has become the best way of making money online and does not

require huge investment in terms of money and time. However, in any

business, success is counted on how much profit you make. Some business

increase their profit margins when their have a huge customer base, but

for Forex traders profits are determined by the tools

and resources that you have access to. They can be either informational

products or software that will assist you in making critical decisions

when trading. For Forex traders, the best tool that they can utilize is a VPS account. VPS accounts have immense benefits to Forex traders due to their widespread availability and easy to use.You might have heard about VPS, but, what does it mean? How will it be of benefit to me as Forex trader?

A VPS hosting account will help you install your expert advisers on a dedicated remote "VPS server." The Forex VPS runs 24/7 without any interruptions and is independent from your own computer. Furthermore, the running of the Forex VPS is done without any effort from the trader as long as it is installed in the trader's PC. It is important to note that, when looking for a company that will host a virtual server make sure that it is constantly running and executing trades via the platform you are using. There are very many benefits that a Forex trader can get when using VPS in Forex trading.

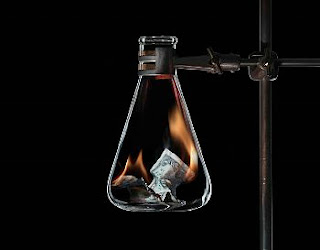

Why Choose to Liquidate Your Business

Instead

of continuing to struggle with a failing company, often it is

worthwhile to consider liquidating and cutting your losses instead of

maintaining a financial drain. Voluntary liquidation isn’t about losing a

business, because you haven’t. Simply, you have closed a company that

wasn’t working, and you have done it in a way that keeps the door open

for when you want to start another one. The following are some of the

reasons why it is beneficial to liquidate your own company before it is

too late:

Instead

of continuing to struggle with a failing company, often it is

worthwhile to consider liquidating and cutting your losses instead of

maintaining a financial drain. Voluntary liquidation isn’t about losing a

business, because you haven’t. Simply, you have closed a company that

wasn’t working, and you have done it in a way that keeps the door open

for when you want to start another one. The following are some of the

reasons why it is beneficial to liquidate your own company before it is

too late:To Avoid a Director Penalty Notice

If you do not recognize the best time to liquidate your business, you could run into problems with the Australian Taxation Office (ATO). If you try to continue steering a sinking ship, the ATO will one day serve you and your company with a director penalty notice, or a garnishee notice, which will then make you personally liable for the company’s taxes. If you simply abandon the company without liquidating it, then you are at risk of not receiving the legal notices, which will also make you responsible for any of the company’s ATO debt. If you choose to liquidate your company voluntarily, then any tax liabilities that the company had will be written off.

Get Your Trip Insured Online, says BerkshireInsurance.com

As

internet penetration rises and the country's netizens become

increasingly comfortable with transacting online, we are seeing a surge

in online retailing in India. Over the past decade, the travel segment

has contributed the most to this growth in Indian e-commerce. From

booking tickets to making hotel reservations or even buying an entire

holiday package, the internet is fast becoming the one stop destination

for the savvy traveler of today. In such a scenario, it then becomes but

natural to provide for one more critical component of any trip – travel

insurance – online as well.

As

internet penetration rises and the country's netizens become

increasingly comfortable with transacting online, we are seeing a surge

in online retailing in India. Over the past decade, the travel segment

has contributed the most to this growth in Indian e-commerce. From

booking tickets to making hotel reservations or even buying an entire

holiday package, the internet is fast becoming the one stop destination

for the savvy traveler of today. In such a scenario, it then becomes but

natural to provide for one more critical component of any trip – travel

insurance – online as well.While planning a trip, whether for business or leisure, whether domestic or foreign, one must get insured against various eventualities like loss of passport, medical expenses in case of illness or injury while travelling, loss or delay of baggage, delay in or cancellation of trip etc. It is most expedient to purchase travel insurance online owing to the host of benefits available over traditional means of purchase, according to BerkshireInsurance.com, which serves as a corporate agent for online retail sales of policies by Bajaj Allianz General Insurance Company Limited.

Annuity Calls for a Better Life Ahead

Are

you worried about witnessing the huge change in your life that is your

retirement? Well, your habit of living a routine life is going to

convert to a freedom of breaking all the routines; however, the biggest

situation to consider here is your income. Yes, with your retirement,

your monthly income comes down to a minimum pension amount, but

responsibilities remain the same. Moreover, you need to focus upon some

special situations, like inflation and health issues. All these turns

into a matter of great tension, if you are not prepared beforehand.

Therefore, finding out a reliable shed like an annuity, a beneficial

retirement plan, is really important to live the life at your ease.

Are

you worried about witnessing the huge change in your life that is your

retirement? Well, your habit of living a routine life is going to

convert to a freedom of breaking all the routines; however, the biggest

situation to consider here is your income. Yes, with your retirement,

your monthly income comes down to a minimum pension amount, but

responsibilities remain the same. Moreover, you need to focus upon some

special situations, like inflation and health issues. All these turns

into a matter of great tension, if you are not prepared beforehand.

Therefore, finding out a reliable shed like an annuity, a beneficial

retirement plan, is really important to live the life at your ease.However, before you start nurturing the tree of annuity to enjoy the golden fruits that are its returns after your retirement, you must know the latest annuity rates available in the market. Yes, it will help you pick up the best plan for ensuring your best safety.

How to know the best annuity rates available?

Knowing the returns offered by the annuity providers is really very important for you to have the assurance of a better life. Well, you can proceed through any of these ways to know the available rates, like:

Ford's New Focus: Small, Low Cost Cars in India

Ford

Motor Company weathered the recent economic storm better than any other

American car manufacturer, and now they are ramping up their

international expansion plans. Ford recently announced its aims to

launch a line of low-cost, small-sized vehicles in India over the next

three years. Their long-term vision is to turn India into a hub for

manufacturing and supply for the entire Asia-Pacific and African region,

and close the gap between Ford and their international rivals. Ford

feels it has been neglecting this region, even though India is Asia's third-largest economy.

They haven't been positioning themselves well in the small car market,

which encompasses 70% of all automotive sales on the crowded streets of

India. Michael Boneham, the president of Ford India recently told

Reuters to expect a major change from Ford, and a focus on the fleet of

small cars India has been clamoring for.

Ford

Motor Company weathered the recent economic storm better than any other

American car manufacturer, and now they are ramping up their

international expansion plans. Ford recently announced its aims to

launch a line of low-cost, small-sized vehicles in India over the next

three years. Their long-term vision is to turn India into a hub for

manufacturing and supply for the entire Asia-Pacific and African region,

and close the gap between Ford and their international rivals. Ford

feels it has been neglecting this region, even though India is Asia's third-largest economy.

They haven't been positioning themselves well in the small car market,

which encompasses 70% of all automotive sales on the crowded streets of

India. Michael Boneham, the president of Ford India recently told

Reuters to expect a major change from Ford, and a focus on the fleet of

small cars India has been clamoring for.Some Tips to Remember While Buying Foreign Currency

When you are planning to opt for buying foreign currency, make sure to deal with detailed knowledge and also great alert.

When you are planning to opt for buying foreign currency, make sure to deal with detailed knowledge and also great alert.Buying foreign currency is gaining high momentum these days with many new investors flocking in the currency market. The reason is simple and it is nothing but the lure of earning high profits in short period of time. But then there are also certain risks associated with the buying of currency and you must be prepared to take that risk. For example, if you are planning to buy Iraqi currency, you should be confident enough about the rate of exchange and other necessary details. You should also recognize the authentic currency notes since there are many such situations where fake notes have been transferred with the authentic notes in the market while dealing and trading.

If you wish for buying foreign currency, the best place for the trade is the internet. When you deal via the internet, you do not need the guidance and help of the online dealers and can trade on your own. But this has to be a very bold choice indeed since the online dealers are experts in their domain and are very well aware of the ups and downs of the present currency market.

4 Things You Need to Know When Investing in Property

Real estate

investment can be a very rewarding and profitable experience. However,

it can lead to certain failure if you are not aware of what you are

doing, or how you should do it. Therefore, you should do all of your

reading before becoming an active investor. If you jump the ship before

you know where you are going, you might not like where you end up at the

end of the journey. These quick tips will help you to getting started

on the right foot, while helping you to minimize any future problems

after you have already invested your hard earned money.

Real estate

investment can be a very rewarding and profitable experience. However,

it can lead to certain failure if you are not aware of what you are

doing, or how you should do it. Therefore, you should do all of your

reading before becoming an active investor. If you jump the ship before

you know where you are going, you might not like where you end up at the

end of the journey. These quick tips will help you to getting started

on the right foot, while helping you to minimize any future problems

after you have already invested your hard earned money.Be Wary Of The Costs Of Investment

As many already know, the market price of the property is not what you will be investing; you will be investing much more than this. You must take into account things such as renovation fees, any taxes you may need to pay, any costs for inspections, and you may even need to invest money for the home to comply with any laws that might be applicable to the area. You should also be aware of interest rates. These will play a role in how much you will invest by the end of the journey. Interest rates are constantly bouncing around, so be sure to go with the option that is best for you.

Is an Ivy League Education Worth the Expense?

The answer to this question is complicated. Most people these days would agree that obtaining a college degree is a must if you want to be competitive in the volatile job market. Heck, even people with multiple diplomas to their name and years of experience in their field are having trouble finding employment in the ongoing recession that has hit the global economy. So students that are currently enrolled in college and steadily tracking towards graduation are understandably nervous about their prospects. And those that have yet to apply to college may be wondering which schools will give them the best opportunity to find gainful employment. With times so uncertain, it's no surprise that many feel that an Ivy League education could be the answer.

But there are a couple of issues to contend with when it comes to upper crust institutions of higher education like Harvard, Yale, Princeton, and so on. For one thing, they are exceedingly difficult to get into. Students that want to gain admission to these prestigious schools must first meet high standards for grades, standardized test scores, extracurricular activities, references, and so on. The exclusivity offered by these institutions demands that the screening process be rigorous; if anyone could get in they wouldn't be nearly as desirable. So before you can even consider these schools you must be, well, scholarly.

Fight Tensions with Equity Release

Do

you want to bid a bye to your retirement tensions? Well, a “yes” as the

answer of this question suggests that you have not yet applied to the

equity release plans for planning your happy retirement. Yes, when you

apply to the equity release companies for releasing a good amount of

money from your house equity, your retirement turns into the best part

of your life, because no financial issues will be able to bother you

ever.

Do

you want to bid a bye to your retirement tensions? Well, a “yes” as the

answer of this question suggests that you have not yet applied to the

equity release plans for planning your happy retirement. Yes, when you

apply to the equity release companies for releasing a good amount of

money from your house equity, your retirement turns into the best part

of your life, because no financial issues will be able to bother you

ever.After retirement, finance is the biggest issue that snatches the good night’s sleep of the elderlies, because of many reasons, like:

• The income of the retirees drops to a minimum pension amount

• The ever increasing financial situation

• The health issues that come along with the old age

Well, all these issues together drag the retirees into great difficulties after their retirement, if they do not have an equity release plan to hold their hands. Yes, this retirement plan ensures a great security for the elderlies, who has less amount of savings, but a big property to live in.

HMRC Coding out ‘Debts’ up to £3,000

As

of April 2012 Her Majesty’s Revenue and Customs (HMRC) are going to be

able to collect debts up to the value of £3,000 by amending the tax code

of individuals in PAYE employment or even getting a UK pension.

As

of April 2012 Her Majesty’s Revenue and Customs (HMRC) are going to be

able to collect debts up to the value of £3,000 by amending the tax code

of individuals in PAYE employment or even getting a UK pension.If you have any income tax debts or any tax credit overpayments, as of next month the HMRC will be able to use this method to collect your outstanding debts.

If you have any tax credits overpayments, which are basically where you’ve been paid too much in tax credits, these will also be taken from your wage or salary.

Save Yourself by Pay Off Student Loans

Did you

take a student loan while you were in college and slowly you have

become a defaulter? Has the period of your payment exceeded? Education

is becoming expensive day by day. Many people desire for higher studies

and for this they apply for educational loans. The worst thing happens

when they fail to repay the loan. It is a massive ignominy on their

credit report and on their career. Young adults suffer a lot when

suddenly the collection agencies start chasing them and they might lose

their house properties, cars if they possess and even fall prey to

joblessness. Student loan default is a grave problem and results in

negative consequences. However, there are repayment options available to

graduates if they default on student loans.

Did you

take a student loan while you were in college and slowly you have

become a defaulter? Has the period of your payment exceeded? Education

is becoming expensive day by day. Many people desire for higher studies

and for this they apply for educational loans. The worst thing happens

when they fail to repay the loan. It is a massive ignominy on their

credit report and on their career. Young adults suffer a lot when

suddenly the collection agencies start chasing them and they might lose

their house properties, cars if they possess and even fall prey to

joblessness. Student loan default is a grave problem and results in

negative consequences. However, there are repayment options available to

graduates if they default on student loans.Let me share something with you. My friend once took an educational loan while he was pursuing his post graduate studies in management. He was doing his MBA from abroad. However, he became a defaulter of the student loan. The collection agencies disturbed him to such an extent that he even had to lose his job. He was working in a bank and the debt collector filed a suit against him. Gradually, he was filed with a court case, as a result of which he lost his job.

Merchant Accounts Explained

A merchant

account is primarily a bank account serviced by a merchant account

provider in order for a business to accept and process credit card

transactions. The merchant account provider deducts the funds from the

customer's credit or debit card and then transferring the money into the

business holder's account. Generally, there is also an independent

processing company involved responsible for processing each credit card

transaction on behalf of the bank.

A merchant

account is primarily a bank account serviced by a merchant account

provider in order for a business to accept and process credit card

transactions. The merchant account provider deducts the funds from the

customer's credit or debit card and then transferring the money into the

business holder's account. Generally, there is also an independent

processing company involved responsible for processing each credit card

transaction on behalf of the bank.In order for a business to be able to accept a credit or debit card transaction, they must have a merchant account. The majority of merchant account providers require a business to possess a valid business checking account, have good standing credit and be U.S. based. Most providers also require a personal credit check for the business owner and most accounts involve lengthy and exhaustive paperwork due to the high risk of credit card sales. Although it is possible for just about any business, small or large, to obtain an account, the higher the risk, the higher the fees and rates charged. There are non-personal accounts for non-companies and some international providers accept merchant accounts for individuals who are not United States citizens.

Risks of CFD trading

When

entering a market you should always get insights of the reasons causing

this market to move in one or another direction. With CFD Trading you

can take a position almost on every market in the world, but one of the

greatest risks is to bet on something you don’t fully understand.

Moreover, you should be familiar with the specifics of those financial

products in general.

When

entering a market you should always get insights of the reasons causing

this market to move in one or another direction. With CFD Trading you

can take a position almost on every market in the world, but one of the

greatest risks is to bet on something you don’t fully understand.

Moreover, you should be familiar with the specifics of those financial

products in general.CFDs follow the price of a share or other asset as there is some difference which covers your broker’s costs. Usually share prices follow the country index price as spiky movement are possible resulting from major news related to that particular stock. In those circumstances you can hardly be sure what will happen with your position. If you are short on a CFD with underlying instrument which went down due to company bankrupt, your broker might take certain measures to protect its position with you. That is why you should always be aware of those terms in order to not get surprised at the time that happens.

Anyway, before entering the current market you should carefully research and seek independent advice if needed. Design your strategy, specify you enter and exit points and make sure you follow them. The major forces that move your CFD price must be identified and tracked at all times. In general the US markets have always been a major market mover so you should follow them as well.

Want Term Life Insurance, But Worried About Getting Your Money’s Worth?

Many

consumers who are considering whether to buy term life insurance are

concerned about getting their money’s worth on a policy. There are so

many different types of life insurance – term life insurance, whole

life, universal life and more – that it can be a little intimidating.

Many

consumers who are considering whether to buy term life insurance are

concerned about getting their money’s worth on a policy. There are so

many different types of life insurance – term life insurance, whole

life, universal life and more – that it can be a little intimidating.Consumers who are looking to buy term life insurance or another form of income- replacement protection may have concerns about what they are getting for their money and if they are getting the best deal. Especially in today’s tougher economic times, when millions of American families are watching their spending more than ever, who wants to spend their hard-earned money on products or services that are not a good value?

Deciding to buy a term life insurance policy can be a sound financial decision that helps protect your family’s financial future for years to come. A term life insurance policy may be reliable protection for your loved ones in the event you die.

For example, term life insurance proceeds can be used by your surviving beneficiaries to cover living expenses such as a mortgage, college tuitions, or to pay other bills and help a family maintain the standard of living they have enjoyed.

Managing the Cost of A Divorce

There

is no escaping the fact that for many divorcing couples the process of

officially ending a marriage can be extremely costly. Though separations

can be ruinous in both an emotional and financial context, many couples

retain hope of life after divorce, which is why even in the most

embittered of times it is crucial that they are encouraged to work

together to achieve a relatively amicable split.

There

is no escaping the fact that for many divorcing couples the process of

officially ending a marriage can be extremely costly. Though separations

can be ruinous in both an emotional and financial context, many couples

retain hope of life after divorce, which is why even in the most

embittered of times it is crucial that they are encouraged to work

together to achieve a relatively amicable split.The cost of a divorce tends to correlate with the depth of disagreement in a relationship. If a husband and wife argue over everything, there is a good chance that neither will want to give ground to the other during divorce proceedings. Personal assets, financial affairs and children are among the most common causes of dispute for divorcing couples. If a compromise cannot be reached, the matter will usually end up in court.

Divorce Courts

Around ten per cent of married couples in England and Wales go to court to settle divorce proceedings. The percentage is relatively low because court hearings are expensive; many couples realize that there are better ways to resolve their differences than by airing them before a judge.

What to Do If You Can't Pay Back Your Student Loans

From Editor: This is an article written by Evan Fischer for MoneyHacker

As

unemployment rates continue to hover around double-digits, and more and

more people are underemployed or under-compensated, many former college

students are finding it difficult to stay current on their loan

payments. Defaulting on your student loans is a very bad idea. The

detriment to your credit score can be severe, and the government can

find ways to get their money from you regardless. Luckily there are

options for those that find themselves unable to pay back their student

loans. What's most important is that you take the time to learn all the

various options available to you before you're faced with not being able

to pay them back. Here's a quick look at some of the ways that you can

handle this tricky situation.

As

unemployment rates continue to hover around double-digits, and more and

more people are underemployed or under-compensated, many former college

students are finding it difficult to stay current on their loan

payments. Defaulting on your student loans is a very bad idea. The

detriment to your credit score can be severe, and the government can

find ways to get their money from you regardless. Luckily there are

options for those that find themselves unable to pay back their student

loans. What's most important is that you take the time to learn all the

various options available to you before you're faced with not being able

to pay them back. Here's a quick look at some of the ways that you can

handle this tricky situation.

Deferments

There are several situations where you may be able to receive a deferment on your payments. This will allow you to halt payment of your student loans for a specific amount of time. There are particular qualifications, such as economic hardship, unemployment, or if you're returning to school, that determine whether you qualify. But better yet, many of the deferments will stop interest from accruing while also giving you a break from paying the principal. Make sure you understand what types of loans you have, and whether the loan is with a private company or the federal government, before you apply.

As

unemployment rates continue to hover around double-digits, and more and

more people are underemployed or under-compensated, many former college

students are finding it difficult to stay current on their loan

payments. Defaulting on your student loans is a very bad idea. The

detriment to your credit score can be severe, and the government can

find ways to get their money from you regardless. Luckily there are

options for those that find themselves unable to pay back their student

loans. What's most important is that you take the time to learn all the

various options available to you before you're faced with not being able

to pay them back. Here's a quick look at some of the ways that you can

handle this tricky situation.

As

unemployment rates continue to hover around double-digits, and more and

more people are underemployed or under-compensated, many former college

students are finding it difficult to stay current on their loan

payments. Defaulting on your student loans is a very bad idea. The

detriment to your credit score can be severe, and the government can

find ways to get their money from you regardless. Luckily there are

options for those that find themselves unable to pay back their student

loans. What's most important is that you take the time to learn all the

various options available to you before you're faced with not being able

to pay them back. Here's a quick look at some of the ways that you can

handle this tricky situation.Deferments

There are several situations where you may be able to receive a deferment on your payments. This will allow you to halt payment of your student loans for a specific amount of time. There are particular qualifications, such as economic hardship, unemployment, or if you're returning to school, that determine whether you qualify. But better yet, many of the deferments will stop interest from accruing while also giving you a break from paying the principal. Make sure you understand what types of loans you have, and whether the loan is with a private company or the federal government, before you apply.

Banks to Contact Victims of PPI

Between

4 and 12 million customers could soon be receiving letters from their

banks about the mis-sold Payment Protection Insurance (PPI) that they

were sold.

Between

4 and 12 million customers could soon be receiving letters from their

banks about the mis-sold Payment Protection Insurance (PPI) that they

were sold.The banks claim that they ‘systematically mis-sold’ PPI to a number of their customers and the Financial Services Authority (FSA) have now ordered the banks to write the letters in plain English and that they should let the customers know that they may have been mis-sold PPI, how they can go about trying to reclaim it and that there’s no need for the customer to use a claims management company to reclaim what they are owed.

All of these letters are said to be being sent out the customers in stages so as not to miss anyone out and to be a little more precise in ensuring everyone receives a letter.

It has also recently been revealed that an astonishing £1.9bn has been paid out in 2011 due to the mis-selling of PPI. According to reports though, there could still be a quite astronomical amount of £6bn to still be paid out to customers that have been mis-sold the insurance in previous years.

How To Save Money While Relocating?

Relocation is

quite a challenging task that involves a lot of expenditure. You can

always curtail some of the unnecessary expenses by a cautious planning.

The different ways of reducing the expenses involved in relocation are:

Relocation is

quite a challenging task that involves a lot of expenditure. You can

always curtail some of the unnecessary expenses by a cautious planning.

The different ways of reducing the expenses involved in relocation are:Preparing A Moving Budget

Preparing a moving budget before relocating is a good way to cut down the unnecessary expenses. Planning the total budget amount in advance can be greatly helpful in reducing costs of relocation. Mostly, people overlook this aspect and end up paying huge taxes. It is better to prepare a moving budget than to end up paying for unanticipated costs.

Plan The Move

Planning the relocation in advance is a good way of lessening the costs of relocation. An organized and planned approach helps in understanding the steps involved in the move. This helps in deciding what work is to be done, and how the costs can be reduced. An important part of planning the move is to discuss the costs of relocating in advance with the professionals you hire. This shall save you from the eleventh hour extravagance.

Discharging Tax Debts Through Bankruptcy

Paying

taxes is basically a fact of life for the majority of Americans, but

sometimes, tax debt can grow to a level where it is very difficult to

repay. When your debt starts to take over your financial situation,

filing for bankruptcy may be the only option that you have left to take

control again. While filing for bankruptcy can get you out of some

debts, getting out of tax debt can be difficult.

Paying

taxes is basically a fact of life for the majority of Americans, but

sometimes, tax debt can grow to a level where it is very difficult to

repay. When your debt starts to take over your financial situation,

filing for bankruptcy may be the only option that you have left to take

control again. While filing for bankruptcy can get you out of some

debts, getting out of tax debt can be difficult.Tax Debt and Bankruptcy

As a general rule, it's tough to get tax debt relief through bankruptcy. Only certain types of taxes can be discharged through Chapter 7 bankruptcy. If you file for Chapter 13 bankruptcy, your tax debt will not be discharged as your debts will be entered into a repayment plan that is set up by the court.

Only income taxes can be discharged through bankruptcy protection. If the debt comes from capital gains, payroll tax, or any other type of tax, it cannot be discharged through bankruptcy.

4 Ways to Say Thank You in The Workplace

Thank you

is an expression that a person shares with another person letting them

know that they appreciate something that they have done. It’s most

likely that you have a fellow co-worker that has helped you in some way,

whether it was with a business or personal matter. When you are work

there is a time and place for everything, especially a thank you. A

thank you can get take you far and here are a few ways to show that you

appreciate them:

Thank you

is an expression that a person shares with another person letting them

know that they appreciate something that they have done. It’s most

likely that you have a fellow co-worker that has helped you in some way,

whether it was with a business or personal matter. When you are work

there is a time and place for everything, especially a thank you. A

thank you can get take you far and here are a few ways to show that you

appreciate them:Written:

You can do it the old fashioned way that your mother taught you, hand write a thank you note on an actual card. Even though a handwritten thank you card is more personable, sending short and friendly thank you email is just as acceptable, especially this day in age.

Verbally:

Thank them in person using your words. When you thank them, tell them what you are thankful for and how it was beneficial and why you appreciate it. You can do this either in a meeting, at the water cooler or at your lunch break. Don’t forget to make eye contact and smile.

How Much Money Should You Have in An Emergency Fund?

While

growing up, a lot of us had moms that used to tell us to save a couple

of dollars for a rainy day. Back then, if we listened, that was probably

"piggy bank cash" that we put towards a new pair of sneakers or pair of

jeans.

While

growing up, a lot of us had moms that used to tell us to save a couple

of dollars for a rainy day. Back then, if we listened, that was probably

"piggy bank cash" that we put towards a new pair of sneakers or pair of

jeans.In adult terminology, saving that kind of money would probably now be called an emergency fund, and rather than use that money for getting things that we want, it's more for taking care of some of our unexpected needs. Although stashing away some of our income for any potential unforeseen incidents like an extensive car repair or even the loss of a job makes perfect sense, unfortunately, a lot of us still do not have one because we're not sure how to begin or how much we'll need.

Coping with Money Stress

Worrying

about money is something nearly everybody experiences in their

lifetime. In successive surveys, money is always the number one worry

for people in America. People often believe that making more money will

bring about less stress and more happiness. However, research suggests

this is not the case, and financial stress still affects most people, no

matter how great somebody’s income. The more we earn, the more we tend

to spend, and the more we tend to borrow, so even if you have a very

high income, worrying how to pay the mortgage and pay off debts can

still cause stress.

Worrying

about money is something nearly everybody experiences in their

lifetime. In successive surveys, money is always the number one worry

for people in America. People often believe that making more money will

bring about less stress and more happiness. However, research suggests

this is not the case, and financial stress still affects most people, no

matter how great somebody’s income. The more we earn, the more we tend

to spend, and the more we tend to borrow, so even if you have a very

high income, worrying how to pay the mortgage and pay off debts can

still cause stress.For those struggling financially, money worries can overshadow nearly everything else in life. Quite often, people let money worries fester, often burying their head in the sand rather than trying to get themselves free of debt, or finding coping strategies to reduce the impact of financial stress. Money stress affects us all no matter how well off we may appear to some, so learning how to cope with money stress is important for everybody.

Relocation Special: Preparing Furniture for Storage

During

the relocation, we need to give special attention to the furniture of

the house. Most of us opt for an ideal storage unit during the transit.

This helps to set the new home in a better way. We may also require time

to decide whether the furniture goes with the look of the new house. We

can follow the given steps to prepare furniture in a better way for

storage.

During

the relocation, we need to give special attention to the furniture of

the house. Most of us opt for an ideal storage unit during the transit.

This helps to set the new home in a better way. We may also require time

to decide whether the furniture goes with the look of the new house. We

can follow the given steps to prepare furniture in a better way for

storage.Inspection Of The Storage Unit

It is important to carefully inspect the storage unit before moving the furniture. It is important to ascertain that the unit is spacious enough to store all our furniture. It is advisable to opt for a temperature-controlled or climate-controlled storage unit to ensure better safety from moisture and avoid leakage. All furniture storage units provide us with shelves and racks. We must make proper use of all these facilities.

Cleaning The Furniture

It is mandatory to keep the furniture free from dust and clean them thoroughly because dust particles attract moisture which can cause dust stains. Dusting of furniture helps evade the problem of white ants and insects.

What to Do If You have Run Out of Money

If you’ve

found yourself in a really stressful financial situation and you’ve run

out of money to pay bills or other basic necessities: there are people

who can help. There are also steps you can take to make budgeting easier

for yourself, so try not to panic too much. If you follow the advice

laid out here you will soon find yourself in a better situation in no

time.

If you’ve

found yourself in a really stressful financial situation and you’ve run

out of money to pay bills or other basic necessities: there are people

who can help. There are also steps you can take to make budgeting easier

for yourself, so try not to panic too much. If you follow the advice

laid out here you will soon find yourself in a better situation in no

time.1. Talk to friends and family

Firstly, where possible, don’t struggle with this burden alone. Let your friends or family know about your situation – whether it is that you can no longer pay your rent, or that you cannot make your credit card or other loan repayments, or maybe you are overseas and cannot afford an airfare home.

They might not be able to lend you any money – and nor would you expect them to – but they can at least talk you through the situation and provide you with emotional support, or a place to stay if needed.

Related articles

Sponsored: Get a head start on head lice this back-to-school season - Visit ExpertAdviceOnLice.com

Britain's best cash Isa withdrawn after one week

Nationwide 'misleading customers' over cash Isa transfers

What You Need to Know Before Opening an ISA

Royal Mail shares applicants have Isa allowance 'stolen'

No comments:

Post a Comment