Do's and Dont's in the Stock Market - Let’s Introduce Do’s and Dont's of Investing

Editor's Note: This is a guest post from Ramalingam of Holistic Investment Planners

Most

of us have our own perception of investment based on our experiences,

but also tend to be confused with the opinions given by others. Knowing

the do’s and don’ts of the stock market would help us turn really as a

smart investor.

Most

of us have our own perception of investment based on our experiences,

but also tend to be confused with the opinions given by others. Knowing

the do’s and don’ts of the stock market would help us turn really as a

smart investor.

The do’s and don’ts in the stock market are:

slow, steady, and boring wins the race:

It is best not to panic over information about stocks on the media. Being slow and steady with looking at the activities that your money is to be used for would ensure that you invest in ventures that are good, useful and profitable.

Most

of us have our own perception of investment based on our experiences,

but also tend to be confused with the opinions given by others. Knowing

the do’s and don’ts of the stock market would help us turn really as a

smart investor.

Most

of us have our own perception of investment based on our experiences,

but also tend to be confused with the opinions given by others. Knowing

the do’s and don’ts of the stock market would help us turn really as a

smart investor.The do’s and don’ts in the stock market are:

slow, steady, and boring wins the race:

It is best not to panic over information about stocks on the media. Being slow and steady with looking at the activities that your money is to be used for would ensure that you invest in ventures that are good, useful and profitable.

Managed Share Investments - Much Better Than Doing It Yourself

Editor's Note: This is a Guest Post from Sachin

Even

the most successful professional share traders will tell you that

managing a share portfolio in real time trading can be a truly tough,

grinding experience. All professional share traders will also tell you

without exception that they’ve taken losses, too. For private investors,

losses can accumulate, all too quickly, and in large bites. If you want

to invest in share trading, managed share investments are definitely

the safer option.

Even

the most successful professional share traders will tell you that

managing a share portfolio in real time trading can be a truly tough,

grinding experience. All professional share traders will also tell you

without exception that they’ve taken losses, too. For private investors,

losses can accumulate, all too quickly, and in large bites. If you want

to invest in share trading, managed share investments are definitely

the safer option.

What’s Really Wrong with DIY Share Trading

The fact is that share trading really isn’t as simple as it looks. Day traders, who literally have to work with daily share price margins, manage portfolios of live stocks which must be monitored closely. This is a very time-consuming, almost obsessive process, and it’s nerve wracking to say the least. On some days, margins are microscopic. You wouldn’t get out of bed, much less risk good money, on such low margins. Good days do happen, but so do days when staying in bed would definitely be a better option.

Even

the most successful professional share traders will tell you that

managing a share portfolio in real time trading can be a truly tough,

grinding experience. All professional share traders will also tell you

without exception that they’ve taken losses, too. For private investors,

losses can accumulate, all too quickly, and in large bites. If you want

to invest in share trading, managed share investments are definitely

the safer option.

Even

the most successful professional share traders will tell you that

managing a share portfolio in real time trading can be a truly tough,

grinding experience. All professional share traders will also tell you

without exception that they’ve taken losses, too. For private investors,

losses can accumulate, all too quickly, and in large bites. If you want

to invest in share trading, managed share investments are definitely

the safer option.What’s Really Wrong with DIY Share Trading

The fact is that share trading really isn’t as simple as it looks. Day traders, who literally have to work with daily share price margins, manage portfolios of live stocks which must be monitored closely. This is a very time-consuming, almost obsessive process, and it’s nerve wracking to say the least. On some days, margins are microscopic. You wouldn’t get out of bed, much less risk good money, on such low margins. Good days do happen, but so do days when staying in bed would definitely be a better option.

Importance of Nomination

About Sherin; My Facebook and Twitter

If

you ever filled application form for opening a bank account, fixed

deposit, trading account or even subscribed mutual funds, you eyes might

have stuck in a section specifically given to fill the nominee details.

Generally, most people would avoid the column because of any

unavailability of the information have asked in the section.

If

you ever filled application form for opening a bank account, fixed

deposit, trading account or even subscribed mutual funds, you eyes might

have stuck in a section specifically given to fill the nominee details.

Generally, most people would avoid the column because of any

unavailability of the information have asked in the section.

This is the nomination section and which is powerful enough to decide who can withdraw your money or investments in case of your death. It is highly recommended by the financial planners to make your nomination intact when dealing with money subjects like investments.

So, what is the importance of making a nomination? Each one should ensure that have nominated a person who will be entrusted with your funds in case of your death. If you have not made any nominations, it will be cumbersome for your legal heirs to take control of your money or investments.

If

you ever filled application form for opening a bank account, fixed

deposit, trading account or even subscribed mutual funds, you eyes might

have stuck in a section specifically given to fill the nominee details.

Generally, most people would avoid the column because of any

unavailability of the information have asked in the section.

If

you ever filled application form for opening a bank account, fixed

deposit, trading account or even subscribed mutual funds, you eyes might

have stuck in a section specifically given to fill the nominee details.

Generally, most people would avoid the column because of any

unavailability of the information have asked in the section.This is the nomination section and which is powerful enough to decide who can withdraw your money or investments in case of your death. It is highly recommended by the financial planners to make your nomination intact when dealing with money subjects like investments.

So, what is the importance of making a nomination? Each one should ensure that have nominated a person who will be entrusted with your funds in case of your death. If you have not made any nominations, it will be cumbersome for your legal heirs to take control of your money or investments.

Advantages of Living on a Budget

About Sherin; My Facebook and Twitter

This

article greatly deals with the definite advantages of having a budget

to live with, a subject that have covered rarely in this blog. I’m asked

quite a bit about what the benefits of creating a personal budget are.

One of the reasons to this article is, I have found most of the people

not have any budget and run out of money at the end of each month. Such

people do not have any control over their money and such situation later

put them to trouble like huge debts,

uncontrollable expenses, no savings and running out of money when

necessities approaches. Getting aware on the advantages of personal or

family budgeting would help to live within and get right control over

our income and expenses.

This

article greatly deals with the definite advantages of having a budget

to live with, a subject that have covered rarely in this blog. I’m asked

quite a bit about what the benefits of creating a personal budget are.

One of the reasons to this article is, I have found most of the people

not have any budget and run out of money at the end of each month. Such

people do not have any control over their money and such situation later

put them to trouble like huge debts,

uncontrollable expenses, no savings and running out of money when

necessities approaches. Getting aware on the advantages of personal or

family budgeting would help to live within and get right control over

our income and expenses.

As an introduction, budgeting considers as the first step to the financial planning. It also considers as the initial step to various financial goals like become debt free, make investments for future goals, retirements planning etc. Budgeting is not limited to any individual, but anyone, whether it is an individual, family, group or organization, who wants to get control over their finance, should practice and enjoy the power.

This

article greatly deals with the definite advantages of having a budget

to live with, a subject that have covered rarely in this blog. I’m asked

quite a bit about what the benefits of creating a personal budget are.

One of the reasons to this article is, I have found most of the people

not have any budget and run out of money at the end of each month. Such

people do not have any control over their money and such situation later

put them to trouble like huge debts,

uncontrollable expenses, no savings and running out of money when

necessities approaches. Getting aware on the advantages of personal or

family budgeting would help to live within and get right control over

our income and expenses.

This

article greatly deals with the definite advantages of having a budget

to live with, a subject that have covered rarely in this blog. I’m asked

quite a bit about what the benefits of creating a personal budget are.

One of the reasons to this article is, I have found most of the people

not have any budget and run out of money at the end of each month. Such

people do not have any control over their money and such situation later

put them to trouble like huge debts,

uncontrollable expenses, no savings and running out of money when

necessities approaches. Getting aware on the advantages of personal or

family budgeting would help to live within and get right control over

our income and expenses.As an introduction, budgeting considers as the first step to the financial planning. It also considers as the initial step to various financial goals like become debt free, make investments for future goals, retirements planning etc. Budgeting is not limited to any individual, but anyone, whether it is an individual, family, group or organization, who wants to get control over their finance, should practice and enjoy the power.

Apple White iPhone

Apple today announced that the white iPhone 4

will be available beginning tomorrow. White iPhone 4 models will be

available from Apple’s online store, at Apple’s retail stores, AT&T

and Verizon Wireless stores and select Apple Authorized Resellers.

Apple today announced that the white iPhone 4

will be available beginning tomorrow. White iPhone 4 models will be

available from Apple’s online store, at Apple’s retail stores, AT&T

and Verizon Wireless stores and select Apple Authorized Resellers.“The white iPhone 4 has finally arrived and it’s beautiful,” said Philip Schiller, Apple’s senior vice president of Worldwide Product Marketing. “We appreciate everyone who has waited patiently while we’ve worked to get every detail right.”

iPhone 4 is the most innovative phone in the world, featuring Apple’s stunning Retina display, the highest resolution display ever built into a phone resulting in super crisp text, images and video, and FaceTime, which makes video calling a reality.

Efficient Ways to Save Money on Daily Travel

About Sherin; My Facebook and Twitter

Though I have written many money saving tips

articles in this blog, some of them deals with saving money on

transport in a great extend. However, this specific article can consider

as most relevant to the subject considering the recent fuel price hike

and the expectation of same behavior in the future too..

Though I have written many money saving tips

articles in this blog, some of them deals with saving money on

transport in a great extend. However, this specific article can consider

as most relevant to the subject considering the recent fuel price hike

and the expectation of same behavior in the future too..

These ideas greatly help you to save lots of money on transportation using some intelligent and practical ideas. You may found each of them in various places and my effort is to group them under an umbrella of an article named ‘Efficient Ways to Save Money on Daily Travel’ . Hope you will find it useful and share your great opinion and more ideas.

This article greatly deals with the tips to save money on daily travel. It would be a good reference point to those who travels daily from office to business and thinking how to save money on this. Have a look:

Though I have written many money saving tips

articles in this blog, some of them deals with saving money on

transport in a great extend. However, this specific article can consider

as most relevant to the subject considering the recent fuel price hike

and the expectation of same behavior in the future too..

Though I have written many money saving tips

articles in this blog, some of them deals with saving money on

transport in a great extend. However, this specific article can consider

as most relevant to the subject considering the recent fuel price hike

and the expectation of same behavior in the future too..These ideas greatly help you to save lots of money on transportation using some intelligent and practical ideas. You may found each of them in various places and my effort is to group them under an umbrella of an article named ‘Efficient Ways to Save Money on Daily Travel’ . Hope you will find it useful and share your great opinion and more ideas.

This article greatly deals with the tips to save money on daily travel. It would be a good reference point to those who travels daily from office to business and thinking how to save money on this. Have a look:

City or Suburb; Where to build your dream house?

About Sherin; My Facebook and Twitter

One

of the most difficult questions each of us have to answer when planning

to buy a house. Is it into a City or in a Suburb? Which would be

better? Most of the time an answer gets influenced by the present status

and living standards. Those who are from the middle class always in

confusion to get a right answer to this question. This little article

will clear your doubts on this.

One

of the most difficult questions each of us have to answer when planning

to buy a house. Is it into a City or in a Suburb? Which would be

better? Most of the time an answer gets influenced by the present status

and living standards. Those who are from the middle class always in

confusion to get a right answer to this question. This little article

will clear your doubts on this.

Buying a house can be considered as a onetime huge investment for the middle class people. In that context, any move should be taken carefully with proper planning. Have an honest discussion with your family members to understand their preferences and identify the advantages and disadvantages of both locations. Be open and realistic. Such discussions would later come with good solution to make your next move to buy house. Consider asking the opinions and experiences from people from different ages who presently lives in city and suburbs. This would highly helpful to reach to a right conclusion.

One

of the most difficult questions each of us have to answer when planning

to buy a house. Is it into a City or in a Suburb? Which would be

better? Most of the time an answer gets influenced by the present status

and living standards. Those who are from the middle class always in

confusion to get a right answer to this question. This little article

will clear your doubts on this.

One

of the most difficult questions each of us have to answer when planning

to buy a house. Is it into a City or in a Suburb? Which would be

better? Most of the time an answer gets influenced by the present status

and living standards. Those who are from the middle class always in

confusion to get a right answer to this question. This little article

will clear your doubts on this.Buying a house can be considered as a onetime huge investment for the middle class people. In that context, any move should be taken carefully with proper planning. Have an honest discussion with your family members to understand their preferences and identify the advantages and disadvantages of both locations. Be open and realistic. Such discussions would later come with good solution to make your next move to buy house. Consider asking the opinions and experiences from people from different ages who presently lives in city and suburbs. This would highly helpful to reach to a right conclusion.

An Essential Library for Investors

About Sherin; My Facebook and Twitter

BEING

a successful investor is not an easy task. Common sense and money

management intelligence plays major role to bring ultimate success. One

essential step to become a successful investor is, getting right

guidance through reading right books. But, what should one read? There

are plenty of books available and selection of the best from it is of

course, a difficult task. However, if one know what exactly to select

and read, would help to go with right books that provide right wisdom.

There would not be any spoon feeding solution to be the next Warren

Buffett or Benjamin Graham. All of us need to know what to select and

read.

BEING

a successful investor is not an easy task. Common sense and money

management intelligence plays major role to bring ultimate success. One

essential step to become a successful investor is, getting right

guidance through reading right books. But, what should one read? There

are plenty of books available and selection of the best from it is of

course, a difficult task. However, if one know what exactly to select

and read, would help to go with right books that provide right wisdom.

There would not be any spoon feeding solution to be the next Warren

Buffett or Benjamin Graham. All of us need to know what to select and

read.

Reading books of Buffett's or Graham's theory and practices itself doesn't make or promise any investor to become rich. Adaptability and practical use of right guidance from successful books would help investors to develop own investment framework, which considers as the big supportive factor behind each successful investors in the world. Yes, each successful investor developed their own investment framework or strategies, which was fail proof, and they stick with it to the maximum to work for them to bring enormous success later.

BEING

a successful investor is not an easy task. Common sense and money

management intelligence plays major role to bring ultimate success. One

essential step to become a successful investor is, getting right

guidance through reading right books. But, what should one read? There

are plenty of books available and selection of the best from it is of

course, a difficult task. However, if one know what exactly to select

and read, would help to go with right books that provide right wisdom.

There would not be any spoon feeding solution to be the next Warren

Buffett or Benjamin Graham. All of us need to know what to select and

read.

BEING

a successful investor is not an easy task. Common sense and money

management intelligence plays major role to bring ultimate success. One

essential step to become a successful investor is, getting right

guidance through reading right books. But, what should one read? There

are plenty of books available and selection of the best from it is of

course, a difficult task. However, if one know what exactly to select

and read, would help to go with right books that provide right wisdom.

There would not be any spoon feeding solution to be the next Warren

Buffett or Benjamin Graham. All of us need to know what to select and

read.Reading books of Buffett's or Graham's theory and practices itself doesn't make or promise any investor to become rich. Adaptability and practical use of right guidance from successful books would help investors to develop own investment framework, which considers as the big supportive factor behind each successful investors in the world. Yes, each successful investor developed their own investment framework or strategies, which was fail proof, and they stick with it to the maximum to work for them to bring enormous success later.

Apple Sues Samsung over Galaxy Phones

In

a patent suit filed Friday, Apple claims that Samsung’s line of Galaxy

tablets and phones willfully infringe on its own patents. Apple is

seeking injunctions as well as actual and punitive damages.

In

a patent suit filed Friday, Apple claims that Samsung’s line of Galaxy

tablets and phones willfully infringe on its own patents. Apple is

seeking injunctions as well as actual and punitive damages.Samsung’s Galaxy Tab, which runs on Android, was released late last year. Apple claims the tab infringes on iPad patents and that the Galaxy S looks and feels a little too similar to the iPhone.

Samsung is one of the fastest growing smartphone makers and has also emerged as Apple's strongest competitor in the booming tablet market with models in three sizes, although it remains a distant second in the space.

Its Galaxy products use Google Inc's Android operating system, which directly competes with Apple's mobile software, the lawsuit said. However, Apple's claims against Samsung focus on Galaxy's design features, such as the look of its screen icons.

Amazon Introduces Print-On-Demand Program for Books

Amazon.co.jp

today announced a new Print-on-Demand (POD) program for Books, which

dramatically expands the selection of titles available to customers and

offers publishers a cost-effective way to make the broadest possible

range of their authors' titles available.

Amazon.co.jp

today announced a new Print-on-Demand (POD) program for Books, which

dramatically expands the selection of titles available to customers and

offers publishers a cost-effective way to make the broadest possible

range of their authors' titles available.Using POD technology, Amazon.co.jp can rapidly print and ship a single book in response to a customer's order. Titles in the program will always be in-stock, allowing customers to benefit from Amazon.co.jp's shipping offers such as Amazon Prime and Same Day Delivery. There are currently over 600,000 titles available for printing from Amazon.co.jp.

10 Things About Business People Won't Tell You

These

are links but once after reading the article from the given source, you

will certainly come back and thank me. Because these are some well

written articles in Smartmoney by various, well experienced writers who

deals with '10 things' people won't tell you. It is arranged to

understand easily and get knowledge on various areas you deals in daily

life. These articles provide a deep insight on understand and avoid the

traps used by various people to their customers by hiding some of the

secrets, that may affect their business if they reveals to public.

These

are links but once after reading the article from the given source, you

will certainly come back and thank me. Because these are some well

written articles in Smartmoney by various, well experienced writers who

deals with '10 things' people won't tell you. It is arranged to

understand easily and get knowledge on various areas you deals in daily

life. These articles provide a deep insight on understand and avoid the

traps used by various people to their customers by hiding some of the

secrets, that may affect their business if they reveals to public.It can be anything. If people don't tell something to you, meant they are hiding something in their business and the customers would be a victim to that. Understand that 'things' related to various areas. This would bring you an aware customer to avoid traps and money when dealing with some of this businesses.

iPad 2 For Travelers - Explore The Features

In National Geographic site, Mary Anne Potts

have been posted this fantastic article. This is completely deals with

the second generation iPad released by Apple last month and its features

and how it helpful while traveling.

In National Geographic site, Mary Anne Potts

have been posted this fantastic article. This is completely deals with

the second generation iPad released by Apple last month and its features

and how it helpful while traveling.It opens a window to the new features of iPad and tells how and why it is a suitable mate while traveling. this article covers its size, camera efficiency, battery and applications that help us to bring new iPad anywhere needed.

One of the important innovation in this iPad is its supported travel applications. With the addition of the new gyroscope and cameras, and the existing GPS, the world of travel apps is about to take off.

Got a Business plan? Earn $1,000 in 60 Seconds

An

interesting, recurring, competition by Rice University known as Rice

Business Plan Competition were given a minute to deliver the best

business pitch they could muster to a panel of judges.

An

interesting, recurring, competition by Rice University known as Rice

Business Plan Competition were given a minute to deliver the best

business pitch they could muster to a panel of judges.42 Teams from the world's top graduate programs announced. At least one team competing in Rice University's Business Plan Competition made $1,000 Thursday night in 60 seconds!

Investing in Smaller Emerging Markets

An article in SmartMoney Magazine by Anna Prior

explores the possibilities to Investing in Smaller Emerging Markets

opens a new window to right investors. This is found one of the best

article provide some insight to the next investment opportunity.

An article in SmartMoney Magazine by Anna Prior

explores the possibilities to Investing in Smaller Emerging Markets

opens a new window to right investors. This is found one of the best

article provide some insight to the next investment opportunity.It's a stat that could lead many investors to do a double take: The stock market of Sri Lanka soared 91 percent last year. But it's true. While all the attention, and most of the money, keeps going to the so-called BRIC countries (Brazil, Russia, India and China), they were trounced by a country many think of only when there's a bad cyclone or a civil war. And Sri Lanka, whose economy grew 8 percent last year, isn't alone in offering another option to investors looking for emerging markets.

Indeed, as China looks to slow down parts of its economy, strategists are turning to other parts of the world for growth. They don't have to look very hard. Countries in both hemispheres have seen their economies surge along with their stock markets. Part of this strong performance can be attributed to a surge in demand worldwide for the commodities found in some of these nations. And part of it is simply a result of the global economic recovery.

How to Control Unnecessary Spending - Are you up for these 3 Financial Challenges?

Editor's Note: This is a guest post from Ramalingam of Holistic Investment Planners

The safest way to double your money is to fold it over once and put it in your pocket. ~ Kin Hubbard

The safest way to double your money is to fold it over once and put it in your pocket. ~ Kin Hubbard

Kin Hubbard is right in saying that if we do not spend money unnecessarily we would be able to save money and double it. However most of us like to spend and would find it difficult to not spend at all. We feel that it could stress us further.

Accepting the3 financial challenges could help you in controlling unnecessary spending. Once you control and avoid unnecessary spending you can save more and invest more. So you can achieve your financial goals easier and earlier.

Here are the challenges:

A Day Away from spending

The challenge of not spending for a day could be difficult, but could help save and render some important life lessons. It is true as most of us have regular daily expenses on coffee, tea, lunch, and snack at regular intervals and fuel to travel to and from work.

The safest way to double your money is to fold it over once and put it in your pocket. ~ Kin Hubbard

The safest way to double your money is to fold it over once and put it in your pocket. ~ Kin HubbardKin Hubbard is right in saying that if we do not spend money unnecessarily we would be able to save money and double it. However most of us like to spend and would find it difficult to not spend at all. We feel that it could stress us further.

Accepting the3 financial challenges could help you in controlling unnecessary spending. Once you control and avoid unnecessary spending you can save more and invest more. So you can achieve your financial goals easier and earlier.

Here are the challenges:

A Day Away from spending

The challenge of not spending for a day could be difficult, but could help save and render some important life lessons. It is true as most of us have regular daily expenses on coffee, tea, lunch, and snack at regular intervals and fuel to travel to and from work.

Where to Invest Money in High Interest

Editor' Note: This is a guest post by Ronen Vikki

Investing

money may be a best choice once you earn a good amount at the return.

Looking for a high yielding investment means you are waiting for a high

interest on your invested amount. There are only two major consequences

that one can face with; one is to win a hand full of profit or to lose

the whole on hand within a fraction of seconds. This happening depends

utterly on the situation that plays with the investor’s action, decision

made and the investment scenario on time. We can see several risky

situations that one must deal with to make money over investment.

Investing

money may be a best choice once you earn a good amount at the return.

Looking for a high yielding investment means you are waiting for a high

interest on your invested amount. There are only two major consequences

that one can face with; one is to win a hand full of profit or to lose

the whole on hand within a fraction of seconds. This happening depends

utterly on the situation that plays with the investor’s action, decision

made and the investment scenario on time. We can see several risky

situations that one must deal with to make money over investment.

Ways to invest on high interest

There are several ways that one can choose from the existing choice of making money. Stock market, real estate and foreign exchange marketing are few of them that tend to earn more interest. Among the three investment factors, forex trading or foreign exchange has earned more people’s interest in short time as they provide with wide range of opportunities as it is the world’s largest finance marketing trade which deals with roughly many trillions of dollars under trade.

Investing

money may be a best choice once you earn a good amount at the return.

Looking for a high yielding investment means you are waiting for a high

interest on your invested amount. There are only two major consequences

that one can face with; one is to win a hand full of profit or to lose

the whole on hand within a fraction of seconds. This happening depends

utterly on the situation that plays with the investor’s action, decision

made and the investment scenario on time. We can see several risky

situations that one must deal with to make money over investment.

Investing

money may be a best choice once you earn a good amount at the return.

Looking for a high yielding investment means you are waiting for a high

interest on your invested amount. There are only two major consequences

that one can face with; one is to win a hand full of profit or to lose

the whole on hand within a fraction of seconds. This happening depends

utterly on the situation that plays with the investor’s action, decision

made and the investment scenario on time. We can see several risky

situations that one must deal with to make money over investment.Ways to invest on high interest

There are several ways that one can choose from the existing choice of making money. Stock market, real estate and foreign exchange marketing are few of them that tend to earn more interest. Among the three investment factors, forex trading or foreign exchange has earned more people’s interest in short time as they provide with wide range of opportunities as it is the world’s largest finance marketing trade which deals with roughly many trillions of dollars under trade.

Tips for Investing in a Roth IRA

Editor's Note: This is a guest post from Bailey Harris of Insurancequotes.org

A

Roth Individual Retirement Account (IRA) is a type of investment

account for people who are saving for retirement. Roth IRAs can be

indispensable savings tools. If you follow the rules and invest wisely,

your money can grow tax-free. Following are some tips for investing in a

Roth IRA.

A

Roth Individual Retirement Account (IRA) is a type of investment

account for people who are saving for retirement. Roth IRAs can be

indispensable savings tools. If you follow the rules and invest wisely,

your money can grow tax-free. Following are some tips for investing in a

Roth IRA.

Make Sure You Are Eligible

Not everyone is eligible to contribute to a Roth IRA. Eligibility requirements stipulate that you must have earned income that exceeds or is equal to the amount contributed. In other words, you must earn income from a job and not invest any more than you earn. Limits are also placed on your adjustable gross income. If you are single, your AGI must be below $122,000. If you are married and filing jointly, you and your spouse's combined AGI must be below $179,000. AGIs must be below $10,000 if you are married and filing separately.

A

Roth Individual Retirement Account (IRA) is a type of investment

account for people who are saving for retirement. Roth IRAs can be

indispensable savings tools. If you follow the rules and invest wisely,

your money can grow tax-free. Following are some tips for investing in a

Roth IRA.

A

Roth Individual Retirement Account (IRA) is a type of investment

account for people who are saving for retirement. Roth IRAs can be

indispensable savings tools. If you follow the rules and invest wisely,

your money can grow tax-free. Following are some tips for investing in a

Roth IRA.Make Sure You Are Eligible

Not everyone is eligible to contribute to a Roth IRA. Eligibility requirements stipulate that you must have earned income that exceeds or is equal to the amount contributed. In other words, you must earn income from a job and not invest any more than you earn. Limits are also placed on your adjustable gross income. If you are single, your AGI must be below $122,000. If you are married and filing jointly, you and your spouse's combined AGI must be below $179,000. AGIs must be below $10,000 if you are married and filing separately.

Investing In Japan After The Earthquake - Where Investors Stand??

About Sherin; My Twitter; My Facebook Page

An

article by Dave Kansas in a famous online publication discussing five

points which explains why investors stop worrying about Japan.

Uncertainties are still there and there are not much improvement after

the worst earthquake/tsunami and nuclear disaster. News flashed around

the world rumoring Japan would be the next Chernobyl but nothing

happened. During this situation, why investors are still not worrying

about Japan?

An

article by Dave Kansas in a famous online publication discussing five

points which explains why investors stop worrying about Japan.

Uncertainties are still there and there are not much improvement after

the worst earthquake/tsunami and nuclear disaster. News flashed around

the world rumoring Japan would be the next Chernobyl but nothing

happened. During this situation, why investors are still not worrying

about Japan?

Global investors, especially in the U.S., have moved from fretting about Japan to deciding that there's really not too much to worry about. While the Nikkei 225 slid 1.7% last night, the U.S. market is looking more resilient. The Dow Jones Industrial Average has managed to regain the level reached ahead of the Japanese disaster. Similar rebounds have occurred in Europe and elsewhere in Asia.

An

article by Dave Kansas in a famous online publication discussing five

points which explains why investors stop worrying about Japan.

Uncertainties are still there and there are not much improvement after

the worst earthquake/tsunami and nuclear disaster. News flashed around

the world rumoring Japan would be the next Chernobyl but nothing

happened. During this situation, why investors are still not worrying

about Japan?

An

article by Dave Kansas in a famous online publication discussing five

points which explains why investors stop worrying about Japan.

Uncertainties are still there and there are not much improvement after

the worst earthquake/tsunami and nuclear disaster. News flashed around

the world rumoring Japan would be the next Chernobyl but nothing

happened. During this situation, why investors are still not worrying

about Japan?Global investors, especially in the U.S., have moved from fretting about Japan to deciding that there's really not too much to worry about. While the Nikkei 225 slid 1.7% last night, the U.S. market is looking more resilient. The Dow Jones Industrial Average has managed to regain the level reached ahead of the Japanese disaster. Similar rebounds have occurred in Europe and elsewhere in Asia.

Nokia Uncovers the E6 and X7 Smartphones

Nokia,

the world's largest phone maker by volume, unveiled on Tuesday two new

smartphone models running on a new version of its Symbian software

platform.

Nokia,

the world's largest phone maker by volume, unveiled on Tuesday two new

smartphone models running on a new version of its Symbian software

platform.The new models, the E6 and the X7, will go on sale for 340 euros ($491.6) and 380 euros respectively excluding subsidies and taxes, later this quarter.

Both the E6 and the X7 are touch-enabled Symbian^3 handsets, but the X7 is a slate with a 4” touchscreen, while the E6 is a bar with a portrait QWERTY and 2.46” VGA touchscreen. Here's what the Nokia E6 product manager had to say about the new phone.

The Nokia E6 combines glass and stainless steel in a sleek 115.5 x 59 10.5 mm body and has a taste for BlackBerry blood. It packs quad-band 2G and five-band 3G – a true globe trotter. 3G is enhanced with 10.2Mbps HSDPA and 2Mbps HSUPA.

6 Proven Money Habits to Practice

An article by Sherin Dev; Follow me in Twitter or Visit myFacebook Page

Are

you serious to manage your money in a better, structured way? Here are 6

proven money habits for you to practice. These are very simple but the

result would be fantastic.

Are

you serious to manage your money in a better, structured way? Here are 6

proven money habits for you to practice. These are very simple but the

result would be fantastic.

Plan Budget

Having a budget in place is beautiful. Living in a budget is excellent! It would help keep track of your exact income and expenditures thus helpful to manage money in a better way. Budgeting considers as a best tool to clamp down unnecessary spending and expenditures to a great amount.

Pay bills in time

Nothing is free. If you pay bills in time, you are safe from penalties thus losing money too. If a person have number of bills at the end each month to pay and never pay in time, counting the penalties itself would reach to a considerable amount, that may sufficient to pay one or more of his bills later!

Are

you serious to manage your money in a better, structured way? Here are 6

proven money habits for you to practice. These are very simple but the

result would be fantastic.

Are

you serious to manage your money in a better, structured way? Here are 6

proven money habits for you to practice. These are very simple but the

result would be fantastic.Plan Budget

Having a budget in place is beautiful. Living in a budget is excellent! It would help keep track of your exact income and expenditures thus helpful to manage money in a better way. Budgeting considers as a best tool to clamp down unnecessary spending and expenditures to a great amount.

Pay bills in time

Nothing is free. If you pay bills in time, you are safe from penalties thus losing money too. If a person have number of bills at the end each month to pay and never pay in time, counting the penalties itself would reach to a considerable amount, that may sufficient to pay one or more of his bills later!

Best Ways to Invest Money for Secure Long Term Investments

Editor' Note: This is a guest post by Ronen Vikki

If

you are a parent, some of the primary things to put up a good corpus

for your kid’s future include planning for an unambiguous time frame and

corpus requirement, contributing systematically and regularly, being

clear about the returns expected from each of the options and the tax

repercussions over a long term. Considering all the above, there are

various instruments that can be looked at in the current circumstances.

Let us have a glance at some of the best long term investment options

for your kids.

If

you are a parent, some of the primary things to put up a good corpus

for your kid’s future include planning for an unambiguous time frame and

corpus requirement, contributing systematically and regularly, being

clear about the returns expected from each of the options and the tax

repercussions over a long term. Considering all the above, there are

various instruments that can be looked at in the current circumstances.

Let us have a glance at some of the best long term investment options

for your kids.

Get a Savings Account

If you are wondering how to invest money for your kids, you should know that one of the first things to do is open a savings account.

If

you are a parent, some of the primary things to put up a good corpus

for your kid’s future include planning for an unambiguous time frame and

corpus requirement, contributing systematically and regularly, being

clear about the returns expected from each of the options and the tax

repercussions over a long term. Considering all the above, there are

various instruments that can be looked at in the current circumstances.

Let us have a glance at some of the best long term investment options

for your kids.

If

you are a parent, some of the primary things to put up a good corpus

for your kid’s future include planning for an unambiguous time frame and

corpus requirement, contributing systematically and regularly, being

clear about the returns expected from each of the options and the tax

repercussions over a long term. Considering all the above, there are

various instruments that can be looked at in the current circumstances.

Let us have a glance at some of the best long term investment options

for your kids.Get a Savings Account

If you are wondering how to invest money for your kids, you should know that one of the first things to do is open a savings account.

Get Amazon Kindle for $25 Less

Amazon

is cutting the entry price of the Kindle by $25 -- but it'll cost

readers in the form of on-screen ads which they can vote on as

"attractive" or not.

Amazon

is cutting the entry price of the Kindle by $25 -- but it'll cost

readers in the form of on-screen ads which they can vote on as

"attractive" or not.The Seattle-based online retail and e-reader giant announced its lower-priced Kindle, dubbed Kindle with Special Offers, on Monday.

The ad-running reader will sell for $114 and start shipping May 3. The regular Kindle, free of advertisement, sells for $139 or $189 with free 3G wireless service.

Ads will display on the Kindle with Special Offers only in a strip across the bottom of the home screen or as a screen saver when the device isn't in use, and thus never interrupt reading, Amazon Chief Executive Jeff Bezos said in a statement.

Can You go to Graduate School for Free?

Editor's Note: This is a guest post by Brian Jenkins of BrainTrack

You've

decided to go to graduate school. Now how do you pay for it? You can

take out loans, but plenty of fellowships, grants, and teaching and

research assistantships are available. Let's take a look at ways to go

to graduate school for free.

You've

decided to go to graduate school. Now how do you pay for it? You can

take out loans, but plenty of fellowships, grants, and teaching and

research assistantships are available. Let's take a look at ways to go

to graduate school for free.

Most graduate school awards are based on qualifications. Good grades, superior exam scores, and excellent letters of recommendation are important. Kalman Chany, author of Paying for College Without Going Broke, said, "Grad schools give awards based more on merit than need.

Doctoral Candidates

The more the faculty at a particular schools wants a candidate, the more money that candidate will receive. If a school really wants someone, the degree will probably be free. Also, doctoral candidates have a better chance of receiving awards than master's degree candidates."

You've

decided to go to graduate school. Now how do you pay for it? You can

take out loans, but plenty of fellowships, grants, and teaching and

research assistantships are available. Let's take a look at ways to go

to graduate school for free.

You've

decided to go to graduate school. Now how do you pay for it? You can

take out loans, but plenty of fellowships, grants, and teaching and

research assistantships are available. Let's take a look at ways to go

to graduate school for free.Most graduate school awards are based on qualifications. Good grades, superior exam scores, and excellent letters of recommendation are important. Kalman Chany, author of Paying for College Without Going Broke, said, "Grad schools give awards based more on merit than need.

Doctoral Candidates

The more the faculty at a particular schools wants a candidate, the more money that candidate will receive. If a school really wants someone, the degree will probably be free. Also, doctoral candidates have a better chance of receiving awards than master's degree candidates."

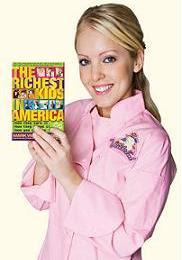

The Richest Kids In America: How They Earn It, How They Spend It, How You Can Too

Get ready to meet

some amazing entrepreneurial superstars who are living their dreams and

making a big difference doing it. They’ve shared their stories to

inspire you, teach you, and show you that your own opportunities are

endless. How did they discover their passion? What were their first

steps to building their business? Who supported them along the way? Why

do they all choose to give back to their community? In this book you’ll

learn the key principles that catapulted each of these incredible young

entrepreneurs to success and how these same principles will lead you to a

life of ultimate fulfillment.

Get ready to meet

some amazing entrepreneurial superstars who are living their dreams and

making a big difference doing it. They’ve shared their stories to

inspire you, teach you, and show you that your own opportunities are

endless. How did they discover their passion? What were their first

steps to building their business? Who supported them along the way? Why

do they all choose to give back to their community? In this book you’ll

learn the key principles that catapulted each of these incredible young

entrepreneurs to success and how these same principles will lead you to a

life of ultimate fulfillment."The Richest Kids in America" tells the story of many young kids who took business into their own hands to earn a great deal of money, more than others make in their entire lives before the young age of eighteen. Covering how they found out what they wanted to do, how to get started when one can't even drive, finding support, and how youthful business leads to youthful optimism and philanthropy, "The Richest Kids in America" is an inspiring story to any young reader who has big dreams of their own.

No comments:

Post a Comment