| Flo (Progressive Insurance) (Photo credit: Wikipedia) |

Easy Tips to Save on Your Heating Bill

This is a guest article from Jocelyn Anne

Down by Two

Down by Two

Whenever you walk over to that thermostat, think “Down by 2” and turn the thermostat down by two degrees. If you’re used to room temperature at 72º, then aim for 70º. You might be a little bit uncomfortable for the first few days, but your body will adjust very quickly. In the meantime, just put a couple extra layers on. Add some heavy duty wool socks to your normal wear, make sure you’ve got shoes on your feet and you might not even notice the difference!

Use Room Heaters

Central heating systems are often the most expensive way to heat a home, not to mention that they often heat multiple rooms unnecessarily. Instead of heating an entire home including rooms you may not even be using at all (guest bedroom?), use room heaters that allow you to heat just one room that you’re currently in. This is ideal for sleeping at night when you can turn off the central heat and heat just the bedroom. If you’ll be working out of a home office, same idea. Hanging out with the kids downstairs all day? You got it!

Down by Two

Down by TwoWhenever you walk over to that thermostat, think “Down by 2” and turn the thermostat down by two degrees. If you’re used to room temperature at 72º, then aim for 70º. You might be a little bit uncomfortable for the first few days, but your body will adjust very quickly. In the meantime, just put a couple extra layers on. Add some heavy duty wool socks to your normal wear, make sure you’ve got shoes on your feet and you might not even notice the difference!

Use Room Heaters

Central heating systems are often the most expensive way to heat a home, not to mention that they often heat multiple rooms unnecessarily. Instead of heating an entire home including rooms you may not even be using at all (guest bedroom?), use room heaters that allow you to heat just one room that you’re currently in. This is ideal for sleeping at night when you can turn off the central heat and heat just the bedroom. If you’ll be working out of a home office, same idea. Hanging out with the kids downstairs all day? You got it!

Insuring Against an Unthinkable Diagnosis

This is a guest article from Sachin

It

is impossible to know what awaits us so how can you try and protect

yourself financially in case of a serious illness or accident. Trauma

insurance is one option that will give you some peace of mind.

It

is impossible to know what awaits us so how can you try and protect

yourself financially in case of a serious illness or accident. Trauma

insurance is one option that will give you some peace of mind.

Trauma insurance can protect you in the case of an extreme accident or illness. Unlike life insurance, this type of coverage is about covering the medical expenses that come with being seriously or critically ill. Serious illness may be something most of us prefer not to think about but it may be worthwhile protecting you and your family.

While many of us think about getting home insurance or contents insurance it is easy to forget to insure yourself against the unthinkable.

It

is impossible to know what awaits us so how can you try and protect

yourself financially in case of a serious illness or accident. Trauma

insurance is one option that will give you some peace of mind.

It

is impossible to know what awaits us so how can you try and protect

yourself financially in case of a serious illness or accident. Trauma

insurance is one option that will give you some peace of mind.Trauma insurance can protect you in the case of an extreme accident or illness. Unlike life insurance, this type of coverage is about covering the medical expenses that come with being seriously or critically ill. Serious illness may be something most of us prefer not to think about but it may be worthwhile protecting you and your family.

While many of us think about getting home insurance or contents insurance it is easy to forget to insure yourself against the unthinkable.

Should You Upgrade or Replace Your Computer?

This is a guest post by Marcos Garza

Your

computer, be it a desktop or laptop, has an average lifespan of three

to five years. With money being tight for everyone, you need to

determine if you really need to replace your computer or if an upgrade

will suffice. Since many people are not as computer savvy as they would

like to be, the average computer user quickly becomes overwhelmed when

it comes to determining whether to replace or upgrade their current

computer.

Your

computer, be it a desktop or laptop, has an average lifespan of three

to five years. With money being tight for everyone, you need to

determine if you really need to replace your computer or if an upgrade

will suffice. Since many people are not as computer savvy as they would

like to be, the average computer user quickly becomes overwhelmed when

it comes to determining whether to replace or upgrade their current

computer.

This is where you need to sit back and ask yourself some important questions in order to determine if you should simply upgrade your existing computer or take the plunge and replace your computer. To make an informed decision, ask yourself the following questions:

# Does my current computer still work well and run the programs I need it to run or have my needs dramatically changed?

Your

computer, be it a desktop or laptop, has an average lifespan of three

to five years. With money being tight for everyone, you need to

determine if you really need to replace your computer or if an upgrade

will suffice. Since many people are not as computer savvy as they would

like to be, the average computer user quickly becomes overwhelmed when

it comes to determining whether to replace or upgrade their current

computer.

Your

computer, be it a desktop or laptop, has an average lifespan of three

to five years. With money being tight for everyone, you need to

determine if you really need to replace your computer or if an upgrade

will suffice. Since many people are not as computer savvy as they would

like to be, the average computer user quickly becomes overwhelmed when

it comes to determining whether to replace or upgrade their current

computer.This is where you need to sit back and ask yourself some important questions in order to determine if you should simply upgrade your existing computer or take the plunge and replace your computer. To make an informed decision, ask yourself the following questions:

# Does my current computer still work well and run the programs I need it to run or have my needs dramatically changed?

Watch Out for Debt Settlement Scams

This is a guest article from Bob Underwood

Finance scandals have a pretty long history. The latest scandal to hit the stand is debt settlement scams.

Finance scandals have a pretty long history. The latest scandal to hit the stand is debt settlement scams.

The economic scenario in the post-recession U.S is quite scary. Consumer debt has reached $2.43 trillion, as per statistics from the Federal Reserve. A lot of people are struggling to pay off their unsecured debts. In such a scenario, shady debt settlement companies are surfacing to exploit the unsuspecting debt-stricken consumers.

How can unscrupulous debt settlement companies deceive you?

They will promise you that they will wipe out all your debts. The internet is inundated with advertisements from fraud debt settlement companies. Their offers might seem to be lucrative and mind blowing, but would actually put you in deeper financial trouble.

Finance scandals have a pretty long history. The latest scandal to hit the stand is debt settlement scams.

Finance scandals have a pretty long history. The latest scandal to hit the stand is debt settlement scams.The economic scenario in the post-recession U.S is quite scary. Consumer debt has reached $2.43 trillion, as per statistics from the Federal Reserve. A lot of people are struggling to pay off their unsecured debts. In such a scenario, shady debt settlement companies are surfacing to exploit the unsuspecting debt-stricken consumers.

How can unscrupulous debt settlement companies deceive you?

They will promise you that they will wipe out all your debts. The internet is inundated with advertisements from fraud debt settlement companies. Their offers might seem to be lucrative and mind blowing, but would actually put you in deeper financial trouble.

Top Personal Finance Resources for Beginners and Experienced

If

you are searching for some best, free resources to learn personal

finance and all the topics related to the same, here is a list of sites

which have tons of article and self education materials to be familiar

with personal finance and other related topics. Have a look:

If

you are searching for some best, free resources to learn personal

finance and all the topics related to the same, here is a list of sites

which have tons of article and self education materials to be familiar

with personal finance and other related topics. Have a look:1. About.com

About.com known as the best place in the net to learn about anything. It has a dedicated section for personal finance which give all the information by arranging it in a well manner. Have a visit. It just not have some information but it is an encyclopedia for personal finance. Whatever you want to know about personal finance, available there in About.com

2. The Motley Fool

Fool.com is a treasure with information on personal finance and investing. It has a well structured personal finance page to educate readers where huge number of well written articles on on saving and spending, credit and debit, home and real estate, death and tax etc... available.

Quick Guide to the First Home Owner Grant

From Editor: This is a guest article by Sachin

Confused

about the first home owner grant? Wondering whether you’re eligible?

Use this quick guide to cut through the jargon and find out what the

grant is all about.

Confused

about the first home owner grant? Wondering whether you’re eligible?

Use this quick guide to cut through the jargon and find out what the

grant is all about.

The First Home Owner Grant (‘FHOG’) was first introduced by the Federal government in 1 July 2000 to offset the effect of GST on home purchases. While it’s a national scheme, it’s administered and funded by the states and territories. While it may not be able to be used for investment property in Sydney it is still a great way to add to your first deposit. In this article we take a closer look at the grant, its eligibility criteria, and specific state/territory requirements

What Is It?

The FHOG is a one-off grant of up to $7000 available to first time home owners who meet the stated eligibility criteria. The grant can be used for any aspect of the purchase, including the deposit amount. As such, the grant can be very useful for covering aspects of the purchase, including relatively smaller items like conveyancing fees.

Confused

about the first home owner grant? Wondering whether you’re eligible?

Use this quick guide to cut through the jargon and find out what the

grant is all about.

Confused

about the first home owner grant? Wondering whether you’re eligible?

Use this quick guide to cut through the jargon and find out what the

grant is all about.The First Home Owner Grant (‘FHOG’) was first introduced by the Federal government in 1 July 2000 to offset the effect of GST on home purchases. While it’s a national scheme, it’s administered and funded by the states and territories. While it may not be able to be used for investment property in Sydney it is still a great way to add to your first deposit. In this article we take a closer look at the grant, its eligibility criteria, and specific state/territory requirements

What Is It?

The FHOG is a one-off grant of up to $7000 available to first time home owners who meet the stated eligibility criteria. The grant can be used for any aspect of the purchase, including the deposit amount. As such, the grant can be very useful for covering aspects of the purchase, including relatively smaller items like conveyancing fees.

Managing an Investment

From Editor: This is a guest article by Andrew Black

Do

you have savings? It is not enough that you keep it in your bank

account. While it is true that it would grow through the interest

imposed, it is just logical that bank deposit interest rates simply are

too small. Why not attain the full potential of your money by investing it properly and effectively? Managing an investment is not as risky and as difficult as you may think.

Do

you have savings? It is not enough that you keep it in your bank

account. While it is true that it would grow through the interest

imposed, it is just logical that bank deposit interest rates simply are

too small. Why not attain the full potential of your money by investing it properly and effectively? Managing an investment is not as risky and as difficult as you may think.

If you decide to just keep your savings in your bank account, it may grow by about 4% to 6% per year. If the current inflation rate is from 6% to 8%, you should realize that your bank savings account would lose value over time. It is much more ideal if your savings could grow by more than 9% annually. You have no idea just how much it could possibly grow if you put it somewhere else.

Your savings could grow by as much as double in just a short period if you would invest it well. Managing an investment is a skill or expertise you should learn. Thus, you have to be familiar in investment management. There are four basic steps to the process.

Do

you have savings? It is not enough that you keep it in your bank

account. While it is true that it would grow through the interest

imposed, it is just logical that bank deposit interest rates simply are

too small. Why not attain the full potential of your money by investing it properly and effectively? Managing an investment is not as risky and as difficult as you may think.

Do

you have savings? It is not enough that you keep it in your bank

account. While it is true that it would grow through the interest

imposed, it is just logical that bank deposit interest rates simply are

too small. Why not attain the full potential of your money by investing it properly and effectively? Managing an investment is not as risky and as difficult as you may think.If you decide to just keep your savings in your bank account, it may grow by about 4% to 6% per year. If the current inflation rate is from 6% to 8%, you should realize that your bank savings account would lose value over time. It is much more ideal if your savings could grow by more than 9% annually. You have no idea just how much it could possibly grow if you put it somewhere else.

Your savings could grow by as much as double in just a short period if you would invest it well. Managing an investment is a skill or expertise you should learn. Thus, you have to be familiar in investment management. There are four basic steps to the process.

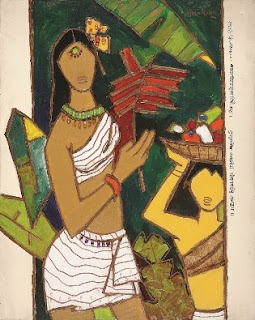

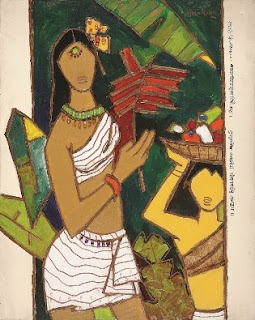

India Art Collective announces India’s First Online Art Fair

Burgundy Art Pvt. Ltd. provides access to the best of Indian art through this pioneering initiative. This would certainly help art investors and art collectors worldwide.

14th September 2011, Mumbai: Burgundy Art Pvt. Ltd. today proudly announced the debut of India’s first online art fair, India Art Collective (IAC).

This initiative aims to showcase the best art India has to offer and

explore the unlimited potential of the online medium. India Art

Collective is a collaborative effort of all galleries to join hands and

collectively participate through a first of its kind, exclusive online

art fair – India Art Collective.

14th September 2011, Mumbai: Burgundy Art Pvt. Ltd. today proudly announced the debut of India’s first online art fair, India Art Collective (IAC).

This initiative aims to showcase the best art India has to offer and

explore the unlimited potential of the online medium. India Art

Collective is a collaborative effort of all galleries to join hands and

collectively participate through a first of its kind, exclusive online

art fair – India Art Collective.

With the rapid growth of the online space, an initiative like India Art Collective becomes imperative. Given the omnipresence of the medium, it will help diffuse geographical boundaries and facilitate convenient collecting of art at transparent price points, besides increasing awareness and access to a wealth of art in the country.

14th September 2011, Mumbai: Burgundy Art Pvt. Ltd. today proudly announced the debut of India’s first online art fair, India Art Collective (IAC).

This initiative aims to showcase the best art India has to offer and

explore the unlimited potential of the online medium. India Art

Collective is a collaborative effort of all galleries to join hands and

collectively participate through a first of its kind, exclusive online

art fair – India Art Collective.

14th September 2011, Mumbai: Burgundy Art Pvt. Ltd. today proudly announced the debut of India’s first online art fair, India Art Collective (IAC).

This initiative aims to showcase the best art India has to offer and

explore the unlimited potential of the online medium. India Art

Collective is a collaborative effort of all galleries to join hands and

collectively participate through a first of its kind, exclusive online

art fair – India Art Collective.With the rapid growth of the online space, an initiative like India Art Collective becomes imperative. Given the omnipresence of the medium, it will help diffuse geographical boundaries and facilitate convenient collecting of art at transparent price points, besides increasing awareness and access to a wealth of art in the country.

False Myths About Life Insurance

From the Editor: This is a guest article by Denise Mancini

In

spite of people having access to so much information in the

Internet-savvy age we live in, some people still have misconceptions

about life insurance. Here are a few myths you might have unknowingly

subscribed to:

In

spite of people having access to so much information in the

Internet-savvy age we live in, some people still have misconceptions

about life insurance. Here are a few myths you might have unknowingly

subscribed to:

Myth 1: You can’t get life insurance if you are not in the best of health.

False. There are life insurance companies that specialize in life insurance policies for those with unsatisfactory health conditions or lifestyles. You may not get the cheapest life insurance rates, but these companies will work with you in order to accommodate your needs. If you’re health is seriously affected making you ineligible for any type of life insurance policy, there are life insurance companies that offer no-medical exam life insurance offering a maximum coverage of up to $300,000.

Myth 2: A stay-at-home-spouse doesn’t need life insurance

False. A stay-at-home-spouse makes a tremendous financial contribution to the family income, though these services are often unaccounted. Think about how many services you would need to employ if your stay-at-home spouse were absent.

In

spite of people having access to so much information in the

Internet-savvy age we live in, some people still have misconceptions

about life insurance. Here are a few myths you might have unknowingly

subscribed to:

In

spite of people having access to so much information in the

Internet-savvy age we live in, some people still have misconceptions

about life insurance. Here are a few myths you might have unknowingly

subscribed to:Myth 1: You can’t get life insurance if you are not in the best of health.

False. There are life insurance companies that specialize in life insurance policies for those with unsatisfactory health conditions or lifestyles. You may not get the cheapest life insurance rates, but these companies will work with you in order to accommodate your needs. If you’re health is seriously affected making you ineligible for any type of life insurance policy, there are life insurance companies that offer no-medical exam life insurance offering a maximum coverage of up to $300,000.

Myth 2: A stay-at-home-spouse doesn’t need life insurance

False. A stay-at-home-spouse makes a tremendous financial contribution to the family income, though these services are often unaccounted. Think about how many services you would need to employ if your stay-at-home spouse were absent.

Advice on Dealing with Debt

From Editor's Desk: This is a guest article by Sam Butterworth

Unfortunately living in debt

is not uncommon these days and this problem is rather widespread. Debt

is no new phenomenon though and throughout history people have exceeded

their means and had to borrow a few extra shekels or shillings. Today

credit is more available than ever with credit cards, store cards and

retail repayments schemes all easily available to most people.

Unfortunately living in debt

is not uncommon these days and this problem is rather widespread. Debt

is no new phenomenon though and throughout history people have exceeded

their means and had to borrow a few extra shekels or shillings. Today

credit is more available than ever with credit cards, store cards and

retail repayments schemes all easily available to most people.

You may well have used these means of securing funds or making purchases before, and of course you will be aware that at some point your creditors will want you to make repayments. This is where some people find themselves in trouble.

What are the major causes of debt?

The ease of access to credit today is one of the main causes of debt, or at least the biggest factor that allows people to get themselves into debt. Credit is usually taken to make large purchases such as cars or to contribute to buying a house, or perhaps to pay for a holiday. The intention is usually to repay these funds as soon as possible, but sometimes this doesn’t happen and debt can mount.

Unfortunately living in debt

is not uncommon these days and this problem is rather widespread. Debt

is no new phenomenon though and throughout history people have exceeded

their means and had to borrow a few extra shekels or shillings. Today

credit is more available than ever with credit cards, store cards and

retail repayments schemes all easily available to most people.

Unfortunately living in debt

is not uncommon these days and this problem is rather widespread. Debt

is no new phenomenon though and throughout history people have exceeded

their means and had to borrow a few extra shekels or shillings. Today

credit is more available than ever with credit cards, store cards and

retail repayments schemes all easily available to most people.You may well have used these means of securing funds or making purchases before, and of course you will be aware that at some point your creditors will want you to make repayments. This is where some people find themselves in trouble.

What are the major causes of debt?

The ease of access to credit today is one of the main causes of debt, or at least the biggest factor that allows people to get themselves into debt. Credit is usually taken to make large purchases such as cars or to contribute to buying a house, or perhaps to pay for a holiday. The intention is usually to repay these funds as soon as possible, but sometimes this doesn’t happen and debt can mount.

Credit Card Providers Innovate As Consumer Attitudes Change

From Editor's Desk : This is a guest article by Mike Brains

In these times of austerity and high inflation,

the average consumer has had to cut back in many areas, including the

use of credit cards. Card interest rates are at a 10-year high as

providers battle to protect margins amidst defaults and write-offs and

people are more debt-averse than ever before.

In these times of austerity and high inflation,

the average consumer has had to cut back in many areas, including the

use of credit cards. Card interest rates are at a 10-year high as

providers battle to protect margins amidst defaults and write-offs and

people are more debt-averse than ever before.

In such a harsh climate it’s no surprise that overall use of credit cards has decreased according research by Mintel. Their survey of over 1000 adults has revealed that more people than ever before are avoiding large balances on their credit cards by clearing debts as soon as possible. Gone are the days of cheap credit and less than perfect financial management, the modern credit card holder is responsible and conscious of debt commitments.

The Mintel research revealed that almost two thirds of credit card holders are clearing their outstanding balance on a monthly basis. Even more remarkable, almost a fifth of all participants said they have tried to reduce their credit card usage in the previous two years.

In these times of austerity and high inflation,

the average consumer has had to cut back in many areas, including the

use of credit cards. Card interest rates are at a 10-year high as

providers battle to protect margins amidst defaults and write-offs and

people are more debt-averse than ever before.

In these times of austerity and high inflation,

the average consumer has had to cut back in many areas, including the

use of credit cards. Card interest rates are at a 10-year high as

providers battle to protect margins amidst defaults and write-offs and

people are more debt-averse than ever before.In such a harsh climate it’s no surprise that overall use of credit cards has decreased according research by Mintel. Their survey of over 1000 adults has revealed that more people than ever before are avoiding large balances on their credit cards by clearing debts as soon as possible. Gone are the days of cheap credit and less than perfect financial management, the modern credit card holder is responsible and conscious of debt commitments.

The Mintel research revealed that almost two thirds of credit card holders are clearing their outstanding balance on a monthly basis. Even more remarkable, almost a fifth of all participants said they have tried to reduce their credit card usage in the previous two years.

Death Proof Your Finances

From Editor's Desk: This is a guest article by Chris Spann

Do you have kids?

Do you have kids?

If the answer to this is yes, then you’ll know exactly how much that as a parent, you’d do anything to keep them safe and not wanting. Whatever the circumstances, you want your kids to do as well as they possibly can whether you’re there or not.

So, that begs the question: If the worst were to happen to you (Or whoever the main earner is in your household), what would your family do? A serious illness (Or worse) can really take its toll on a family, both from a personal point of view and a financial one as well. After all, if the household’s main breadwinner is suddenly no longer bringing money in, what can the family do to get by?

Do you have kids?

Do you have kids?If the answer to this is yes, then you’ll know exactly how much that as a parent, you’d do anything to keep them safe and not wanting. Whatever the circumstances, you want your kids to do as well as they possibly can whether you’re there or not.

So, that begs the question: If the worst were to happen to you (Or whoever the main earner is in your household), what would your family do? A serious illness (Or worse) can really take its toll on a family, both from a personal point of view and a financial one as well. After all, if the household’s main breadwinner is suddenly no longer bringing money in, what can the family do to get by?

Sony's New 'Tablet S' Ready to Launch

Sony,

whose brand and reputation for design have long resonated with

consumers, is trying something different. On Friday, it is launching a

handsome tablet, called the Sony Tablet S, with an unusual, asymmetrical design and some software tweaks and content services it hopes can set it apart from the pack.

Sony,

whose brand and reputation for design have long resonated with

consumers, is trying something different. On Friday, it is launching a

handsome tablet, called the Sony Tablet S, with an unusual, asymmetrical design and some software tweaks and content services it hopes can set it apart from the pack.Like dozens of other tablets, Sony's new entry uses Google's Android operating system. And it costs the same as the Wi-Fi-only iPads—$500 for a 16 gigabyte model and $600 for a 32 gigabyte model. The Tablet S has no cellular-data option. It's also late to the game, and had significantly weaker battery life than the iPad 2.

Penn Schoen Berland Bolsters its Senior Counselor Team

New Delhi, INDIA

– September 12, 2011. Penn Schoen Berland (PSB), a global research

based communications strategy and reputation management advisory

announced today that senior industry veterans Mr. Ajay Khanna, former

CEO of Electronics Arts in India; Mr. Ranga Iyer, former Managing

Director of Wyeth Limited & Mr. Ravi Aurora, former Director of

Concept Communication will join the team as ‘Senior Counselors’ at their

South Asia office to offer deep industry insights to the clients of

PSB.

New Delhi, INDIA

– September 12, 2011. Penn Schoen Berland (PSB), a global research

based communications strategy and reputation management advisory

announced today that senior industry veterans Mr. Ajay Khanna, former

CEO of Electronics Arts in India; Mr. Ranga Iyer, former Managing

Director of Wyeth Limited & Mr. Ravi Aurora, former Director of

Concept Communication will join the team as ‘Senior Counselors’ at their

South Asia office to offer deep industry insights to the clients of

PSB.Welcoming them to the team, Ashwani Singla, Managing Director and Chief Executive, Penn Schoen Berland, South Asia, said, “Understanding the business of our clients and their big challenges is crucial to delivering actionable insights that help our clients gain a competitive edge. The deep sector expertise of our Sr. Counselors and capabilities of PSB will make for a compelling combination to our clients”

Back to School Personal Finance Tips for College Kids

Editor's Desk: This is a guest article from Bobby Dee, a personal finance blogger

For

a freshman starting out in college is a crazy time in a young adult's

life. Most college freshman is going to experience some dramatic

changes. Ever hear of the "Freshman 15"? It's the excess 15 lbs that a

freshman gains in their first year of college, and that's not the only

change a first year college student will experience. For many first year

students college is their first taste of personal and financial freedom, some 18 year olds handle it well, others don't handle it so well.

For

a freshman starting out in college is a crazy time in a young adult's

life. Most college freshman is going to experience some dramatic

changes. Ever hear of the "Freshman 15"? It's the excess 15 lbs that a

freshman gains in their first year of college, and that's not the only

change a first year college student will experience. For many first year

students college is their first taste of personal and financial freedom, some 18 year olds handle it well, others don't handle it so well.

Getting out from under the watchful eye of good ol' mom and dad is an awesome milestone for a young person, but with new found freedom comes new found problems. Many individuals can become stressed out with having to balance academics, a social life and finances. It's good to start a young person out on the right foot with their personal finances, and it's important for students to establish good personal finance and spending habits early, that way they are not stuck with a bunch of credit card debt when they graduate. It's hard enough dealing with your student loan debt when you're out of college but dealing with credit card debt or any other financial problems you might have run into while in college can be an unnecessary challenge.

For

a freshman starting out in college is a crazy time in a young adult's

life. Most college freshman is going to experience some dramatic

changes. Ever hear of the "Freshman 15"? It's the excess 15 lbs that a

freshman gains in their first year of college, and that's not the only

change a first year college student will experience. For many first year

students college is their first taste of personal and financial freedom, some 18 year olds handle it well, others don't handle it so well.

For

a freshman starting out in college is a crazy time in a young adult's

life. Most college freshman is going to experience some dramatic

changes. Ever hear of the "Freshman 15"? It's the excess 15 lbs that a

freshman gains in their first year of college, and that's not the only

change a first year college student will experience. For many first year

students college is their first taste of personal and financial freedom, some 18 year olds handle it well, others don't handle it so well.Getting out from under the watchful eye of good ol' mom and dad is an awesome milestone for a young person, but with new found freedom comes new found problems. Many individuals can become stressed out with having to balance academics, a social life and finances. It's good to start a young person out on the right foot with their personal finances, and it's important for students to establish good personal finance and spending habits early, that way they are not stuck with a bunch of credit card debt when they graduate. It's hard enough dealing with your student loan debt when you're out of college but dealing with credit card debt or any other financial problems you might have run into while in college can be an unnecessary challenge.

How to Reduce Small Business Insurance

Editor's Desk: This is a guest post by Ryan Sandberg

New

small businesses need to closely compare the business insurance quotes

pertaining to all the segments of insurance, from general liability to

worker’s compensation and employment practices insurance. But it is safe

to say that sticking to one insurance company for all your business

needs would save much needed time, money, resources, and hassles. And

what new business wants to deal with the hassles of running their

business when they're living on hot dogs and macaroni and cheese instead

of those five dollar lattes? While the business insurance premium works

to protect any business from specific operational losses depending on

coverage type, some insurance companies do not offer every type of business insurance.

New

small businesses need to closely compare the business insurance quotes

pertaining to all the segments of insurance, from general liability to

worker’s compensation and employment practices insurance. But it is safe

to say that sticking to one insurance company for all your business

needs would save much needed time, money, resources, and hassles. And

what new business wants to deal with the hassles of running their

business when they're living on hot dogs and macaroni and cheese instead

of those five dollar lattes? While the business insurance premium works

to protect any business from specific operational losses depending on

coverage type, some insurance companies do not offer every type of business insurance.

When choosing to stick with one company, it is imperative that each small business select the types of business coverage they need most immediately. Even in withstanding the smallest budgets, small businesses should find the company that can take care of their immediate insurance needs at a competitive price.

New

small businesses need to closely compare the business insurance quotes

pertaining to all the segments of insurance, from general liability to

worker’s compensation and employment practices insurance. But it is safe

to say that sticking to one insurance company for all your business

needs would save much needed time, money, resources, and hassles. And

what new business wants to deal with the hassles of running their

business when they're living on hot dogs and macaroni and cheese instead

of those five dollar lattes? While the business insurance premium works

to protect any business from specific operational losses depending on

coverage type, some insurance companies do not offer every type of business insurance.

New

small businesses need to closely compare the business insurance quotes

pertaining to all the segments of insurance, from general liability to

worker’s compensation and employment practices insurance. But it is safe

to say that sticking to one insurance company for all your business

needs would save much needed time, money, resources, and hassles. And

what new business wants to deal with the hassles of running their

business when they're living on hot dogs and macaroni and cheese instead

of those five dollar lattes? While the business insurance premium works

to protect any business from specific operational losses depending on

coverage type, some insurance companies do not offer every type of business insurance.When choosing to stick with one company, it is imperative that each small business select the types of business coverage they need most immediately. Even in withstanding the smallest budgets, small businesses should find the company that can take care of their immediate insurance needs at a competitive price.

Easily Improve Your Customer Retention Rates & Grow Your Business

From Editor: This is a guest article from Eric Graves

It

is more important than ever to have the capability to, not only reach

new customers, but retain the clients that have already experienced your

services. High retention equals growth of your company which,

ultimately, is your number one goal. You might ask yourself how you can

encourage clients to resist the competition and remain loyal to you.

It all begins with extra, personalized attention, superior product

performance and exceptional customer service.

It

is more important than ever to have the capability to, not only reach

new customers, but retain the clients that have already experienced your

services. High retention equals growth of your company which,

ultimately, is your number one goal. You might ask yourself how you can

encourage clients to resist the competition and remain loyal to you.

It all begins with extra, personalized attention, superior product

performance and exceptional customer service.

People want to feel important and if you can get your company to connect with your customers on a personal level, you will find them returning to you. How do you do this? There are a number of ways but it all starts from the first introduction.

It

is more important than ever to have the capability to, not only reach

new customers, but retain the clients that have already experienced your

services. High retention equals growth of your company which,

ultimately, is your number one goal. You might ask yourself how you can

encourage clients to resist the competition and remain loyal to you.

It all begins with extra, personalized attention, superior product

performance and exceptional customer service.

It

is more important than ever to have the capability to, not only reach

new customers, but retain the clients that have already experienced your

services. High retention equals growth of your company which,

ultimately, is your number one goal. You might ask yourself how you can

encourage clients to resist the competition and remain loyal to you.

It all begins with extra, personalized attention, superior product

performance and exceptional customer service.People want to feel important and if you can get your company to connect with your customers on a personal level, you will find them returning to you. How do you do this? There are a number of ways but it all starts from the first introduction.

Get a Head Start: 5 Simple Ways College Students can Build Creditworthiness

From Editor: This is a guest article from Stella Walker of credit score guide

With

classes in full swing, most college students are now naturally

preoccupied studying for tests and making new friends. While those two

areas are extremely important aspects to tend to, one area they

shouldn't neglect is their finances—and no, we're not just talking about

budgeting. Throughout their college career students need to diligently

work to build their credit. The concept of earning credit might not

seem all that important now, but it will play a major role once a

student earns his or her diploma—it affects everything from deposit

rates for renting an apartment, to acquiring business loans, to even

making major purchases like a new vehicle. That said, below are some

small venues students can pursue in order to slowly start to build their credit while in college.

With

classes in full swing, most college students are now naturally

preoccupied studying for tests and making new friends. While those two

areas are extremely important aspects to tend to, one area they

shouldn't neglect is their finances—and no, we're not just talking about

budgeting. Throughout their college career students need to diligently

work to build their credit. The concept of earning credit might not

seem all that important now, but it will play a major role once a

student earns his or her diploma—it affects everything from deposit

rates for renting an apartment, to acquiring business loans, to even

making major purchases like a new vehicle. That said, below are some

small venues students can pursue in order to slowly start to build their credit while in college.

1. Open a Checking and Savings Account. Opening a bank account is the utter most basic thing you can do to start building credit. The act of opening an account won't give you credit exactly, but the way you manage your account (i.e. you always deposit money and you never overdraft or bounce checks) just might. This is because the simple act of being responsible with your money will help you appear "trustworthy" and "stable" in your bank's eyes. "Trustworthy" people are the ones who are offered credit cards—and credit cards can help you build your credit substantially, which leads us to option 2.

With

classes in full swing, most college students are now naturally

preoccupied studying for tests and making new friends. While those two

areas are extremely important aspects to tend to, one area they

shouldn't neglect is their finances—and no, we're not just talking about

budgeting. Throughout their college career students need to diligently

work to build their credit. The concept of earning credit might not

seem all that important now, but it will play a major role once a

student earns his or her diploma—it affects everything from deposit

rates for renting an apartment, to acquiring business loans, to even

making major purchases like a new vehicle. That said, below are some

small venues students can pursue in order to slowly start to build their credit while in college.

With

classes in full swing, most college students are now naturally

preoccupied studying for tests and making new friends. While those two

areas are extremely important aspects to tend to, one area they

shouldn't neglect is their finances—and no, we're not just talking about

budgeting. Throughout their college career students need to diligently

work to build their credit. The concept of earning credit might not

seem all that important now, but it will play a major role once a

student earns his or her diploma—it affects everything from deposit

rates for renting an apartment, to acquiring business loans, to even

making major purchases like a new vehicle. That said, below are some

small venues students can pursue in order to slowly start to build their credit while in college.1. Open a Checking and Savings Account. Opening a bank account is the utter most basic thing you can do to start building credit. The act of opening an account won't give you credit exactly, but the way you manage your account (i.e. you always deposit money and you never overdraft or bounce checks) just might. This is because the simple act of being responsible with your money will help you appear "trustworthy" and "stable" in your bank's eyes. "Trustworthy" people are the ones who are offered credit cards—and credit cards can help you build your credit substantially, which leads us to option 2.

No comments:

Post a Comment