Sherin Dev,

Professional Investor and editor of MoneyHacker. Started on 2007,

MoneyHacker posting vital lessons in wealth creation, protection and

lots of personal finance topics.. More about Sherin...

- ISA

- Are you making the most of your ISA allowance? Halifax offers two types of ISA - cash ISAs and stocks & shares ISAs.

- Cash ISA

- Savings

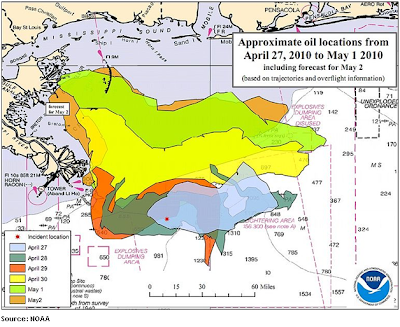

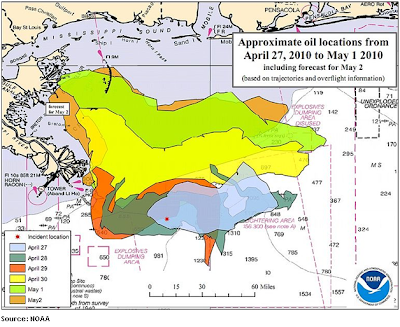

An Interesting Map on US Oil Spill!

Editor's Note: This is a guest article written by SVB from The Digerati Life

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

But, many are also growing concerned about the economic impact that such a disaster poses during an already tough economic climate. Countless entrepreneurs have been interviewed by the likes of CNN, Fox News and other media outlets, telling their stories of lost revenues, lost inventories, and the potential for lost businesses, many of which are finally beginning to see the light in the aftermath of Hurricane Katrina.

Not only does this disaster have the potential to crush the surf side economies of Texas, Louisiana, Alabama and Mississippi, but also to reach into the pockets of each and every one of us. Plans for domestic offshore drilling in Alaska, who was next in line for federal funding, will now be halted, further solidifying our dependence on foreign oil imports. Not only that, but the price of Alaskan crude managed to jump from $2.70 per barrel to $83.97. Now, what do you think this will do to the average price of gas where you live, especially in the face of higher summer demand? And what about food prices, heating oil, and so forth? Feels like déjà vu all over again.

At last count, the estimated cost of cleanup is going to cost somewhere in the neighborhood of several billion dollars. Of course, everyone’s looking to BP to cover the cost, but what happens if they can’t or won’t? Does that mean that we simply leave the oil where it is? Not even close. The federal government will foot the bill, and as we’ve all seen during the financial bailout, it’s not the government that foots the bill…it’s us. Sadly, there is no loan product that we can issue that will allow Mother Nature to repay the cost of cleanup, with interest. This one’s solely on our shoulders. Of course, this will mean higher taxes, more aggressive tax collecting policies and tons of grief from the federal government to “pay our fair share”.

I am beginning to wonder where the oversight was on this one. As a card carrying member of the Murphy’s Law club, I completely understand that no matter what precautions we take in life, sometimes stuff just happens. Things are not always under our control and we are reminded of this year after year. But, in hind sight (which is always 20/20, by the way) whose decision was it to NOT use that little $500,000 thingy that maybe could’ve stopped this whole thing before it ever happened? Somewhere, someone is still slapping himself in the forehead with his palm and shaking his head miserably, probably somewhere in the unemployment office, wondering why he didn’t consider spending just a little bit more and ensuring the safety of his rig. He was probably already way over budget (which is a no-no in this day and age) no matter what shape the economy is in, and so he had to figure out how to cut costs.

When are we going to learn that faster and cheaper do not always result in better? When is it going to become unacceptable to sacrifice safety and responsibility for a higher profit margin? As much as we’d like to blame BP, we have all played a little part in this disaster, by allowing companies to gamble the safety of their workers, the environment and even the public in exchange for larger profits. Think this is an isolated incident? Think again. Remember the West Virginia mining disaster earlier in April 2010?

The problem is that we as a society has allowed this to happen. We turn the other cheek, choosing to work, patronize, and even elect supporters of this type of behavior into office time and time again and are then outraged when things like this happen. The truth is that we have the power to prevent these types of accidents from happening. We need to take a new approach and force companies to change the way they do business by placing safety and personal responsibility first.

The Digerati Life is a personal finance site that offers tips and resources on credit card use and prudent debt management. Check out the site’s reviews of balance transfer credit cards and 0% APR credit cards. Subscribe to The Digerati Life RSS.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.

We

are all well aware of the impact that the oil spill in the Gulf of

Mexico is having on the environment and its potential to cause even more

damage, especially since it comes on the heels of Earth Day 2010.

Hundreds of thousands of fish, birds, and other aquatic lives will be

lost, the soil will be spoiled and unable to support vital plant growth

and the waters will be toxic for both for many years to come.But, many are also growing concerned about the economic impact that such a disaster poses during an already tough economic climate. Countless entrepreneurs have been interviewed by the likes of CNN, Fox News and other media outlets, telling their stories of lost revenues, lost inventories, and the potential for lost businesses, many of which are finally beginning to see the light in the aftermath of Hurricane Katrina.

Not only does this disaster have the potential to crush the surf side economies of Texas, Louisiana, Alabama and Mississippi, but also to reach into the pockets of each and every one of us. Plans for domestic offshore drilling in Alaska, who was next in line for federal funding, will now be halted, further solidifying our dependence on foreign oil imports. Not only that, but the price of Alaskan crude managed to jump from $2.70 per barrel to $83.97. Now, what do you think this will do to the average price of gas where you live, especially in the face of higher summer demand? And what about food prices, heating oil, and so forth? Feels like déjà vu all over again.

At last count, the estimated cost of cleanup is going to cost somewhere in the neighborhood of several billion dollars. Of course, everyone’s looking to BP to cover the cost, but what happens if they can’t or won’t? Does that mean that we simply leave the oil where it is? Not even close. The federal government will foot the bill, and as we’ve all seen during the financial bailout, it’s not the government that foots the bill…it’s us. Sadly, there is no loan product that we can issue that will allow Mother Nature to repay the cost of cleanup, with interest. This one’s solely on our shoulders. Of course, this will mean higher taxes, more aggressive tax collecting policies and tons of grief from the federal government to “pay our fair share”.

I am beginning to wonder where the oversight was on this one. As a card carrying member of the Murphy’s Law club, I completely understand that no matter what precautions we take in life, sometimes stuff just happens. Things are not always under our control and we are reminded of this year after year. But, in hind sight (which is always 20/20, by the way) whose decision was it to NOT use that little $500,000 thingy that maybe could’ve stopped this whole thing before it ever happened? Somewhere, someone is still slapping himself in the forehead with his palm and shaking his head miserably, probably somewhere in the unemployment office, wondering why he didn’t consider spending just a little bit more and ensuring the safety of his rig. He was probably already way over budget (which is a no-no in this day and age) no matter what shape the economy is in, and so he had to figure out how to cut costs.

When are we going to learn that faster and cheaper do not always result in better? When is it going to become unacceptable to sacrifice safety and responsibility for a higher profit margin? As much as we’d like to blame BP, we have all played a little part in this disaster, by allowing companies to gamble the safety of their workers, the environment and even the public in exchange for larger profits. Think this is an isolated incident? Think again. Remember the West Virginia mining disaster earlier in April 2010?

The problem is that we as a society has allowed this to happen. We turn the other cheek, choosing to work, patronize, and even elect supporters of this type of behavior into office time and time again and are then outraged when things like this happen. The truth is that we have the power to prevent these types of accidents from happening. We need to take a new approach and force companies to change the way they do business by placing safety and personal responsibility first.

The Digerati Life is a personal finance site that offers tips and resources on credit card use and prudent debt management. Check out the site’s reviews of balance transfer credit cards and 0% APR credit cards. Subscribe to The Digerati Life RSS.

Labels:

Business and Economy

2 Creative Comments are Rare Specious. Try One::