- ISA

- Are you making the most of your ISA allowance? Halifax offers two types of ISA - cash ISAs and stocks & shares ISAs.

- Cash ISA

- Savings

Do

you think any commercial movie can influence young business students or

entrepreneurs to build their level of knowledge or skills? If you not,

you are wrong. There are such wonderful movies which can motivate anyone

in the sense of business success or pass some wonderful ideas. Here is

a list of 10 movies in this kind that anyone rolled out from business

schools or entered as new in business school must watch.

Do

you think any commercial movie can influence young business students or

entrepreneurs to build their level of knowledge or skills? If you not,

you are wrong. There are such wonderful movies which can motivate anyone

in the sense of business success or pass some wonderful ideas. Here is

a list of 10 movies in this kind that anyone rolled out from business

schools or entered as new in business school must watch. 1. Gung Ho (1986)

1. Gung Ho (1986)Directed by Ron Howard and starring by Michael Keaton and Gedde Watanabe, Gung Ho was made when Japan start showing the world about how to make better products.A Japanese auto company is persuaded to take over an abandoned factory--and abandoned U.S. workforce, in a small rust-belt town in Middle America. Alas, this wonderful idea for a culture-clash comedy goes pretty much to waste in Gung Ho. There's a trumped-up crisis in every reel, and a great deal of double talk about whether the Japanese are workaholic freaks or the new, true inheritors of the old American get-up-and-go. This movie recommended by Joseph Thomas, Dean of Johnson Graduate School of Management.

Next Sensation - No Higher Honor: A Memoir of Condoleezza Rice

From

one of the world’s most admired women, this is former National Security

Advisor and Secretary of State Condoleezza Rice’s compelling story of

eight years serving at the highest levels of government. In her

position as America’s chief diplomat, Rice traveled almost continuously

around the globe, seeking common ground among sometimes bitter enemies,

forging agreement on divisive issues, and compiling a remarkable record

of achievement.

From

one of the world’s most admired women, this is former National Security

Advisor and Secretary of State Condoleezza Rice’s compelling story of

eight years serving at the highest levels of government. In her

position as America’s chief diplomat, Rice traveled almost continuously

around the globe, seeking common ground among sometimes bitter enemies,

forging agreement on divisive issues, and compiling a remarkable record

of achievement.A native of Birmingham, Alabama who overcame the racism of the Civil Rights era to become a brilliant academic and expert on foreign affairs, Rice distinguished herself as an advisor to George W. Bush during the 2000 presidential campaign. Once Bush was elected, she served as his chief adviser on national-security issues – a job whose duties included harmonizing the relationship between the Secretaries of State and Defense. It was a role that deepened her bond with the President and ultimately made her one of his closest confidantes.

Effective Advertisement Ideas for Small Business Owners

Present

days, lots of people comes to start small business by foreseeing its

potential revenue generation capabilities. Those who have real interest

and time to build small business have lots of opportunities to succeed.

One of the unavoidable factor to any small business is the effective

advertisements to pass the message to public and potential customers to

establish the business.

Present

days, lots of people comes to start small business by foreseeing its

potential revenue generation capabilities. Those who have real interest

and time to build small business have lots of opportunities to succeed.

One of the unavoidable factor to any small business is the effective

advertisements to pass the message to public and potential customers to

establish the business.There are various methods to advertise a business. Television ads, news papers and signboards are the preferred methods among it. However, it would be merely difficult for a small business owner to spend huge money to launch advertisement campaigns through costly medias or signboards. In order to meet this difficulty, small business owners should find less cost but highly effective methods to advertise there business or products. Here are some very simple yet powerful solutions to advertise your small business with little money.

5 Things Your Credit Card Company Doesn’t Want You to Know

Editor's note: This is a guest post from Evan Fischer

Credit card

companies are notorious for their fine print, which can often leave you

paying outrageous interest rates and fees that you haven’t anticipated.

Sure, they’ll promise you the moon with low introductory rates and

rewards programs, but when push comes to shove they’re looking to take

your money in any way they can. This means interest hikes and fees for

everything from overages to late or missed payments to black mark on your credit report (that have nothing to do with your credit card account). Here are a few things your creditors don’t want you to know.

Credit card

companies are notorious for their fine print, which can often leave you

paying outrageous interest rates and fees that you haven’t anticipated.

Sure, they’ll promise you the moon with low introductory rates and

rewards programs, but when push comes to shove they’re looking to take

your money in any way they can. This means interest hikes and fees for

everything from overages to late or missed payments to black mark on your credit report (that have nothing to do with your credit card account). Here are a few things your creditors don’t want you to know.

1. The CARD Act protects you. The Credit Card Accountability Responsibility and Disclosure Act is aimed at protecting consumers from some of the unfair practices that creditors have used in the past. According to this act, creditors must inform you of any changes to your account a minimum of 45 days prior to implementing the changes. Further, changes can be applied only to future charges (not retroactively). Don’t let them tell you any different.

Credit card

companies are notorious for their fine print, which can often leave you

paying outrageous interest rates and fees that you haven’t anticipated.

Sure, they’ll promise you the moon with low introductory rates and

rewards programs, but when push comes to shove they’re looking to take

your money in any way they can. This means interest hikes and fees for

everything from overages to late or missed payments to black mark on your credit report (that have nothing to do with your credit card account). Here are a few things your creditors don’t want you to know.

Credit card

companies are notorious for their fine print, which can often leave you

paying outrageous interest rates and fees that you haven’t anticipated.

Sure, they’ll promise you the moon with low introductory rates and

rewards programs, but when push comes to shove they’re looking to take

your money in any way they can. This means interest hikes and fees for

everything from overages to late or missed payments to black mark on your credit report (that have nothing to do with your credit card account). Here are a few things your creditors don’t want you to know.1. The CARD Act protects you. The Credit Card Accountability Responsibility and Disclosure Act is aimed at protecting consumers from some of the unfair practices that creditors have used in the past. According to this act, creditors must inform you of any changes to your account a minimum of 45 days prior to implementing the changes. Further, changes can be applied only to future charges (not retroactively). Don’t let them tell you any different.

How a 529 Plan Affects Financial Aid

From Editor: This is a guest post from Pat Singer

Saving

for your child’s higher education can be difficult. Even if you make

enough to safely stash some away for their college years, it’s hard to

decide on a savings plan. A lot of people opt for a 529 savings plan

because of the tax advantages. However, there could be repercussions,

because having a 529 savings plan could possibly affect your child’s

chances of getting financial aid. Following are a few tips on how a 529

plan affects financial aid.

Saving

for your child’s higher education can be difficult. Even if you make

enough to safely stash some away for their college years, it’s hard to

decide on a savings plan. A lot of people opt for a 529 savings plan

because of the tax advantages. However, there could be repercussions,

because having a 529 savings plan could possibly affect your child’s

chances of getting financial aid. Following are a few tips on how a 529

plan affects financial aid.

What Is a 529 Savings Plan?

Basically a 529 savings plan is a way to put money away for a college education. The plan is generally managed by a state government or a college or university. A 529 savings plan is available in all 50 states. One benefit of a 529 plan is that you don’t have to go to school in the state in which you paid into the plan. There are two basic types of 529 plans.

Saving

for your child’s higher education can be difficult. Even if you make

enough to safely stash some away for their college years, it’s hard to

decide on a savings plan. A lot of people opt for a 529 savings plan

because of the tax advantages. However, there could be repercussions,

because having a 529 savings plan could possibly affect your child’s

chances of getting financial aid. Following are a few tips on how a 529

plan affects financial aid.

Saving

for your child’s higher education can be difficult. Even if you make

enough to safely stash some away for their college years, it’s hard to

decide on a savings plan. A lot of people opt for a 529 savings plan

because of the tax advantages. However, there could be repercussions,

because having a 529 savings plan could possibly affect your child’s

chances of getting financial aid. Following are a few tips on how a 529

plan affects financial aid.What Is a 529 Savings Plan?

Basically a 529 savings plan is a way to put money away for a college education. The plan is generally managed by a state government or a college or university. A 529 savings plan is available in all 50 states. One benefit of a 529 plan is that you don’t have to go to school in the state in which you paid into the plan. There are two basic types of 529 plans.

4 Steps to Investing in Property

From Editor: This is a guest post by Sachin

When

looking for an investment property in Sydney there is a vast amount of

options which you could take. This short guide will look at some of the

methods which you can follow to judge the value of a property and make

the right investment.

When

looking for an investment property in Sydney there is a vast amount of

options which you could take. This short guide will look at some of the

methods which you can follow to judge the value of a property and make

the right investment.When looking for an investment property in Sydney there is a vast amount of options which you could take. Sydney is a vast and sprawling city with many diverse areas and a multitude of types of property. This short guide will look at some of the methods which you can follow to judge the value of a property and make the right investment.

Citi Diamond Preferred Card - A Friend For Unhealthy Wallets

This review removed due to dispute with flexoffers.com

Five Important Investments for New Home Owners

From Editor: This is a guest post by Ryan Sandberg

Purchasing

a new home is an important and exciting step in everyone's life. You

have finally moved beyond living with your parents, a group of

roommates, or in a cramped studio apartment and are ready to take on the

responsibilities of an adult. Owning your own home is not as simple as

just paying your monthly mortgage bill and mowing the lawn. Many other

factors go into home ownership that are not covered by high schools and

colleges. Here are five of the most important investments you can make

for a new home:

Purchasing

a new home is an important and exciting step in everyone's life. You

have finally moved beyond living with your parents, a group of

roommates, or in a cramped studio apartment and are ready to take on the

responsibilities of an adult. Owning your own home is not as simple as

just paying your monthly mortgage bill and mowing the lawn. Many other

factors go into home ownership that are not covered by high schools and

colleges. Here are five of the most important investments you can make

for a new home:

Purchasing

a new home is an important and exciting step in everyone's life. You

have finally moved beyond living with your parents, a group of

roommates, or in a cramped studio apartment and are ready to take on the

responsibilities of an adult. Owning your own home is not as simple as

just paying your monthly mortgage bill and mowing the lawn. Many other

factors go into home ownership that are not covered by high schools and

colleges. Here are five of the most important investments you can make

for a new home:

Purchasing

a new home is an important and exciting step in everyone's life. You

have finally moved beyond living with your parents, a group of

roommates, or in a cramped studio apartment and are ready to take on the

responsibilities of an adult. Owning your own home is not as simple as

just paying your monthly mortgage bill and mowing the lawn. Many other

factors go into home ownership that are not covered by high schools and

colleges. Here are five of the most important investments you can make

for a new home:Ways to Save Money on Your Rental Car

From Editor: This is a guest post by Beth Montgomery

When

you’re on a relaxing vacation, the last thing you want to worry about

is your rental car expense. The fact is many people don’t understand

which fees are and which fees are not necessary, so the rental car

company ends up charging them for services that they do not need. To

avoid some of the hassle that can go along with renting a car, here are a

few tips to help you get out of the rental car office and on your way.

When

you’re on a relaxing vacation, the last thing you want to worry about

is your rental car expense. The fact is many people don’t understand

which fees are and which fees are not necessary, so the rental car

company ends up charging them for services that they do not need. To

avoid some of the hassle that can go along with renting a car, here are a

few tips to help you get out of the rental car office and on your way.

Before you commit

Before you start searching for a place to rent your car, think about what you will need in this car. What size will you need? How many days are absolutely necessary? How much are you willing to spend? Asking yourself these questions will help you avoid making a decision too quickly. If you aren’t careful, you could end up choosing the most expensive alternative and regret your decision.

When

you’re on a relaxing vacation, the last thing you want to worry about

is your rental car expense. The fact is many people don’t understand

which fees are and which fees are not necessary, so the rental car

company ends up charging them for services that they do not need. To

avoid some of the hassle that can go along with renting a car, here are a

few tips to help you get out of the rental car office and on your way.

When

you’re on a relaxing vacation, the last thing you want to worry about

is your rental car expense. The fact is many people don’t understand

which fees are and which fees are not necessary, so the rental car

company ends up charging them for services that they do not need. To

avoid some of the hassle that can go along with renting a car, here are a

few tips to help you get out of the rental car office and on your way.Before you commit

Before you start searching for a place to rent your car, think about what you will need in this car. What size will you need? How many days are absolutely necessary? How much are you willing to spend? Asking yourself these questions will help you avoid making a decision too quickly. If you aren’t careful, you could end up choosing the most expensive alternative and regret your decision.

Understanding Credit Scores Isn’t That Hard

From Editor: This is a guest post from SmartCredit.com

You just need to understand the percentages

You just need to understand the percentages

Prior to making a big purchase, such as buying a house, you should obtain and understand your credit score. You should also make sure to understand how your score plays an important role in the process of obtaining a loan.

Simply put, your credit score is a number that lenders use to determine risk – specifically, they use it to decide not just if to loan you the money you seek, but also to determine whether you will repay the loan. A high credit score means you are less of a risk, while a lower score reflects the opposite.

Credit scores are determined by taking data from your credit reports and, after running it through some software, getting a number. You should be aware that there will likely be variances in your scores for each credit bureau, since they all have their own criteria in determining your scores.

You just need to understand the percentages

You just need to understand the percentages Prior to making a big purchase, such as buying a house, you should obtain and understand your credit score. You should also make sure to understand how your score plays an important role in the process of obtaining a loan.

Simply put, your credit score is a number that lenders use to determine risk – specifically, they use it to decide not just if to loan you the money you seek, but also to determine whether you will repay the loan. A high credit score means you are less of a risk, while a lower score reflects the opposite.

Credit scores are determined by taking data from your credit reports and, after running it through some software, getting a number. You should be aware that there will likely be variances in your scores for each credit bureau, since they all have their own criteria in determining your scores.

Top 5 Twitters That Every Trader Needs to Follow

From Editor: This is a guest post from Itay Drory

Every one

is quite well acquainted with the word Twitter, though the sad part

here is that people are not generally acquainted with what it is used

for or what does it do. Twitter, the phenom thingy, we all have heard

about is the 36th most visited internet site as per the census conducted

in the year 2006 and is continuously climbing faster and faster.

Experts suggest that Twitter will hit the top 10 most visited websites

by this year. That is the absolute reason for a sane human to sign up

there, for free, and be entertained with the humongous traffic over the

site. What ever you are using Twitter for, it is the best source for

both casual and official use. Students here can make new friends and

socialize more, while professionals or working class have everything

they seek on Twitter.

Every one

is quite well acquainted with the word Twitter, though the sad part

here is that people are not generally acquainted with what it is used

for or what does it do. Twitter, the phenom thingy, we all have heard

about is the 36th most visited internet site as per the census conducted

in the year 2006 and is continuously climbing faster and faster.

Experts suggest that Twitter will hit the top 10 most visited websites

by this year. That is the absolute reason for a sane human to sign up

there, for free, and be entertained with the humongous traffic over the

site. What ever you are using Twitter for, it is the best source for

both casual and official use. Students here can make new friends and

socialize more, while professionals or working class have everything

they seek on Twitter.

Twitter is not a typical social media website where people stay in touch and have fun with their friends and family, rather it is a micro-blogging service provider that allows its members, especially traders, to read and send other users’ posts or updates which are known as tweets. These tweets are the text-based updates or posts of a predefined character length that is up to 140.

Every one

is quite well acquainted with the word Twitter, though the sad part

here is that people are not generally acquainted with what it is used

for or what does it do. Twitter, the phenom thingy, we all have heard

about is the 36th most visited internet site as per the census conducted

in the year 2006 and is continuously climbing faster and faster.

Experts suggest that Twitter will hit the top 10 most visited websites

by this year. That is the absolute reason for a sane human to sign up

there, for free, and be entertained with the humongous traffic over the

site. What ever you are using Twitter for, it is the best source for

both casual and official use. Students here can make new friends and

socialize more, while professionals or working class have everything

they seek on Twitter.

Every one

is quite well acquainted with the word Twitter, though the sad part

here is that people are not generally acquainted with what it is used

for or what does it do. Twitter, the phenom thingy, we all have heard

about is the 36th most visited internet site as per the census conducted

in the year 2006 and is continuously climbing faster and faster.

Experts suggest that Twitter will hit the top 10 most visited websites

by this year. That is the absolute reason for a sane human to sign up

there, for free, and be entertained with the humongous traffic over the

site. What ever you are using Twitter for, it is the best source for

both casual and official use. Students here can make new friends and

socialize more, while professionals or working class have everything

they seek on Twitter.Twitter is not a typical social media website where people stay in touch and have fun with their friends and family, rather it is a micro-blogging service provider that allows its members, especially traders, to read and send other users’ posts or updates which are known as tweets. These tweets are the text-based updates or posts of a predefined character length that is up to 140.

Account Now Gold Visa Prepaid Card - An Ideal Solution to Control Your Money

This article deleted due to dispute with Flexoffers.com..

Balance Transfer Fees: The Sting in the Tail of 0% Deals

This is a guest article from credit card comparison site, UK

Over the past few years, 0% balance transfer fees have been the credit card industry’s goose that lays the golden eggs.

Over the past few years, 0% balance transfer fees have been the credit card industry’s goose that lays the golden eggs.

The offer both builds a better reputation for credit card providers among consumers – a credit card which actually helps people with high-interest debts! – and it’s popular among providers for the same reason any credit card deal is… because it makes them plenty of money.

Yes, he deals are by no means the kindness that they appear to be.

High rates of credit card debt after the 0% deal after notoriously common, either because cardholders have failed to pay off the balance transfer or because they just go on to run up another debt, but the most obvious, yet least understood, portion of 0% balance transfer credit cards’ profit margins are balance transfer fees.

Over the past few years, 0% balance transfer fees have been the credit card industry’s goose that lays the golden eggs.

Over the past few years, 0% balance transfer fees have been the credit card industry’s goose that lays the golden eggs.The offer both builds a better reputation for credit card providers among consumers – a credit card which actually helps people with high-interest debts! – and it’s popular among providers for the same reason any credit card deal is… because it makes them plenty of money.

Yes, he deals are by no means the kindness that they appear to be.

High rates of credit card debt after the 0% deal after notoriously common, either because cardholders have failed to pay off the balance transfer or because they just go on to run up another debt, but the most obvious, yet least understood, portion of 0% balance transfer credit cards’ profit margins are balance transfer fees.

4 Tips To Finding Real Estate Hot Spots

From Editor: This is a guest post from Sachin

You’re thinking of buying a property but not sure where to look. Here’s a guide to finding the best real estate hot spots.

You’re thinking of buying a property but not sure where to look. Here’s a guide to finding the best real estate hot spots.

You’re in the market for a solid property investment but are unsure about which area to buy into. It’s always difficult to keep tabs on the changing property landscape so here are some tips on how to determine the real estate hot spots.

Tip 1 - Know How To Read The Trends

Luckily with the internet there’s more information on property sales and trends than ever before. Even financial sections of newspapers carry detailed breakdowns of property hotspots and which suburbs are performing well and which are struggling. But be careful how you analyse the data. One tip is to look at how the suburb has performed not just over the last year but the last ten years. This will give you a much better indication of whether it’s truly on the rise or if this is just a sudden spike or an abnormality.

You’re thinking of buying a property but not sure where to look. Here’s a guide to finding the best real estate hot spots.

You’re thinking of buying a property but not sure where to look. Here’s a guide to finding the best real estate hot spots.You’re in the market for a solid property investment but are unsure about which area to buy into. It’s always difficult to keep tabs on the changing property landscape so here are some tips on how to determine the real estate hot spots.

Tip 1 - Know How To Read The Trends

Luckily with the internet there’s more information on property sales and trends than ever before. Even financial sections of newspapers carry detailed breakdowns of property hotspots and which suburbs are performing well and which are struggling. But be careful how you analyse the data. One tip is to look at how the suburb has performed not just over the last year but the last ten years. This will give you a much better indication of whether it’s truly on the rise or if this is just a sudden spike or an abnormality.

Credit Cards & Teenagers: How to Make Sure Things Stay in Control?

From Editor: This is a guest post from Alban Smith

You

are not the only one worried about how to maintain control over the

health of your teen’s credit as in February 2010 President Barak Obama

the Credit Card Accountability,

Responsibility and Disclosure Act which makes it harder for credit card

companies to prey on teenagers and suck them into using a credit card

they can’t afford or control.

You

are not the only one worried about how to maintain control over the

health of your teen’s credit as in February 2010 President Barak Obama

the Credit Card Accountability,

Responsibility and Disclosure Act which makes it harder for credit card

companies to prey on teenagers and suck them into using a credit card

they can’t afford or control.

However, while the new laws state that a teen must have a job or a co-signer, it is still not impossible for your teen to get and use a credit card, so should you be the one helping them as co-signer, or should you take the law into your own hands and just say no?

You

are not the only one worried about how to maintain control over the

health of your teen’s credit as in February 2010 President Barak Obama

the Credit Card Accountability,

Responsibility and Disclosure Act which makes it harder for credit card

companies to prey on teenagers and suck them into using a credit card

they can’t afford or control.

You

are not the only one worried about how to maintain control over the

health of your teen’s credit as in February 2010 President Barak Obama

the Credit Card Accountability,

Responsibility and Disclosure Act which makes it harder for credit card

companies to prey on teenagers and suck them into using a credit card

they can’t afford or control.However, while the new laws state that a teen must have a job or a co-signer, it is still not impossible for your teen to get and use a credit card, so should you be the one helping them as co-signer, or should you take the law into your own hands and just say no?

Should I Try to Pay Off Old Debt?

Editor's note: This is a guest post from SmartCredit.com

The process can be frustrating – but it’s worth it in the end

The process can be frustrating – but it’s worth it in the end

Lots of people have questions regarding credit scores – and few people really understand how this all-important number is calculated or how it works.

One of the most commonly asked questions is this: Will paying off an old or bad debt raise your credit score?

When you have a charge off or a negative mark on your credit report, it will remain them for seven years. This means that when you pay a debt in full, the mark will not be removed from your credit report. This is incredibly frustrating when you are trying to clean up your report.

But just because it is frustrating doesn’t mean you shouldn’t try to pay off your debts. It’s better that you do pay them in full whenever possible. Potential creditors will want to see that for the debts listed on your credit report, there is “paid in full” next to the charge off or negative mark. It shows you took responsibility for the debt.

The process can be frustrating – but it’s worth it in the end

The process can be frustrating – but it’s worth it in the end Lots of people have questions regarding credit scores – and few people really understand how this all-important number is calculated or how it works.

One of the most commonly asked questions is this: Will paying off an old or bad debt raise your credit score?

When you have a charge off or a negative mark on your credit report, it will remain them for seven years. This means that when you pay a debt in full, the mark will not be removed from your credit report. This is incredibly frustrating when you are trying to clean up your report.

But just because it is frustrating doesn’t mean you shouldn’t try to pay off your debts. It’s better that you do pay them in full whenever possible. Potential creditors will want to see that for the debts listed on your credit report, there is “paid in full” next to the charge off or negative mark. It shows you took responsibility for the debt.

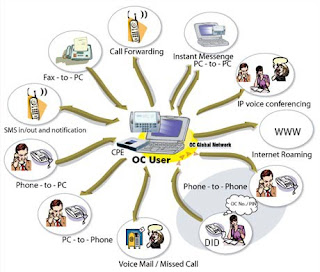

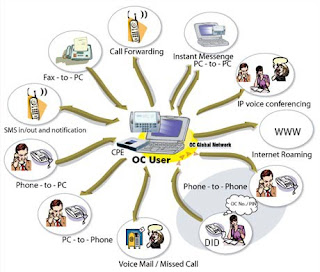

Save Money on Your Communication Needs

From Editor: This is a guest post by Noreen Ruth

Keeping

in touch with family and friends has never been easier. With

innovations in communication technology coming fast and furious,

opportunities for more people to have cell phones and access to online

social networks and services has opened up. But with all those available

options, many people find it a daunting task to choose the ones that

meet their needs. Don’t let the fear of new technology keep you from

communicating whenever and wherever you are and save money at the same

time.

Keeping

in touch with family and friends has never been easier. With

innovations in communication technology coming fast and furious,

opportunities for more people to have cell phones and access to online

social networks and services has opened up. But with all those available

options, many people find it a daunting task to choose the ones that

meet their needs. Don’t let the fear of new technology keep you from

communicating whenever and wherever you are and save money at the same

time.

Bundled Services

If you currently have cable, phone and Internet services, one easy way to cut on the cost of all three is by signing up for a bundled package. When you purchase multiple services from one company, your loyalty will be rewarded with lower rates. In addition, you’ll keep bill paying to a minimum with one statement and payment each month.

Keeping

in touch with family and friends has never been easier. With

innovations in communication technology coming fast and furious,

opportunities for more people to have cell phones and access to online

social networks and services has opened up. But with all those available

options, many people find it a daunting task to choose the ones that

meet their needs. Don’t let the fear of new technology keep you from

communicating whenever and wherever you are and save money at the same

time.

Keeping

in touch with family and friends has never been easier. With

innovations in communication technology coming fast and furious,

opportunities for more people to have cell phones and access to online

social networks and services has opened up. But with all those available

options, many people find it a daunting task to choose the ones that

meet their needs. Don’t let the fear of new technology keep you from

communicating whenever and wherever you are and save money at the same

time.Bundled Services

If you currently have cable, phone and Internet services, one easy way to cut on the cost of all three is by signing up for a bundled package. When you purchase multiple services from one company, your loyalty will be rewarded with lower rates. In addition, you’ll keep bill paying to a minimum with one statement and payment each month.

3 Ways Your Credit Score Impacts Your Life

This is a guest post from Zach of moneyedup.com

During

tough economic times, some people find themselves in a situation where

their credit can be adversely affected based on difficult financial

decisions. It may be a decision to delay payment on a credit card, or

fall behind on a mortgage payment, or allow a doctor bill to go into

collections. While it may be unavoidable, it is important to maintain a

long view of your credit standing, because a low credit score can impact

much more than your ability to obtain credit. In the long run that

could be the least of your worries. There are three ways your credit

score impacts your life: Borrowing costs, employment, and insurance.

During

tough economic times, some people find themselves in a situation where

their credit can be adversely affected based on difficult financial

decisions. It may be a decision to delay payment on a credit card, or

fall behind on a mortgage payment, or allow a doctor bill to go into

collections. While it may be unavoidable, it is important to maintain a

long view of your credit standing, because a low credit score can impact

much more than your ability to obtain credit. In the long run that

could be the least of your worries. There are three ways your credit

score impacts your life: Borrowing costs, employment, and insurance.

Higher Borrowing Costs

Most people are aware that, if they fall within a lower credit score range, they are going to have more difficulty obtaining credit on favorable terms on long term loans. The greater concern should be for the cost of your existing credit. If you existing credit cards, or variable line of credit, you could find your rates increasing once your creditors see that their risk has increased.

During

tough economic times, some people find themselves in a situation where

their credit can be adversely affected based on difficult financial

decisions. It may be a decision to delay payment on a credit card, or

fall behind on a mortgage payment, or allow a doctor bill to go into

collections. While it may be unavoidable, it is important to maintain a

long view of your credit standing, because a low credit score can impact

much more than your ability to obtain credit. In the long run that

could be the least of your worries. There are three ways your credit

score impacts your life: Borrowing costs, employment, and insurance.

During

tough economic times, some people find themselves in a situation where

their credit can be adversely affected based on difficult financial

decisions. It may be a decision to delay payment on a credit card, or

fall behind on a mortgage payment, or allow a doctor bill to go into

collections. While it may be unavoidable, it is important to maintain a

long view of your credit standing, because a low credit score can impact

much more than your ability to obtain credit. In the long run that

could be the least of your worries. There are three ways your credit

score impacts your life: Borrowing costs, employment, and insurance.Higher Borrowing Costs

Most people are aware that, if they fall within a lower credit score range, they are going to have more difficulty obtaining credit on favorable terms on long term loans. The greater concern should be for the cost of your existing credit. If you existing credit cards, or variable line of credit, you could find your rates increasing once your creditors see that their risk has increased.

Making Sense of Property Market Trends

From Editor: This is a guest post by Sachin

Looks at property market trends and how to evaluate real market moves. Discusses the investment advantages of buying off the plan

Looks at property market trends and how to evaluate real market moves. Discusses the investment advantages of buying off the plan

Property market information varies from excellent, accurate news to types of information which barely deserve to be called gossip. When you’re looking at buying an investment property, the last things you need are non-information, rumors, hearsay and speculation without confirmation. It is possible to get some sense out of the property market trends, but it’s not by listening to second-hand information- It’s by research and checking your facts.

Looks at property market trends and how to evaluate real market moves. Discusses the investment advantages of buying off the plan

Looks at property market trends and how to evaluate real market moves. Discusses the investment advantages of buying off the planProperty market information varies from excellent, accurate news to types of information which barely deserve to be called gossip. When you’re looking at buying an investment property, the last things you need are non-information, rumors, hearsay and speculation without confirmation. It is possible to get some sense out of the property market trends, but it’s not by listening to second-hand information- It’s by research and checking your facts.

A Complete and Comprehensive Checklist for Buying Term Life Insurance

This is a guest post from Ramalingam of Holistic Investment Planners

Buying

insurance for protection and wealth creation has always been a very

complicated task involving careful analyzes. The analysis involves the

amount of coverage, reason for coverage and the term/time that the cover

is required. Term policies taken for a specified period of time like 5,

10, 15, 20, or even 30 years helps to look after family’s financial

commitments like education and marriage of our children and the day to

day expenses for a reasonable standard of living.

Buying

insurance for protection and wealth creation has always been a very

complicated task involving careful analyzes. The analysis involves the

amount of coverage, reason for coverage and the term/time that the cover

is required. Term policies taken for a specified period of time like 5,

10, 15, 20, or even 30 years helps to look after family’s financial

commitments like education and marriage of our children and the day to

day expenses for a reasonable standard of living.

Term insurance policies that resemble motor/house insurance are not subject to the law of indemnity as damage due to human life cannot be measured. Taken for a specified period when financial obligations have to be met, no money is generally paid back if death does not occur in the period.

Buying

insurance for protection and wealth creation has always been a very

complicated task involving careful analyzes. The analysis involves the

amount of coverage, reason for coverage and the term/time that the cover

is required. Term policies taken for a specified period of time like 5,

10, 15, 20, or even 30 years helps to look after family’s financial

commitments like education and marriage of our children and the day to

day expenses for a reasonable standard of living.

Buying

insurance for protection and wealth creation has always been a very

complicated task involving careful analyzes. The analysis involves the

amount of coverage, reason for coverage and the term/time that the cover

is required. Term policies taken for a specified period of time like 5,

10, 15, 20, or even 30 years helps to look after family’s financial

commitments like education and marriage of our children and the day to

day expenses for a reasonable standard of living.Term insurance policies that resemble motor/house insurance are not subject to the law of indemnity as damage due to human life cannot be measured. Taken for a specified period when financial obligations have to be met, no money is generally paid back if death does not occur in the period.

With Car Rental 8 you can get the best car hire at over 50,000 locations across the globe.

ReplyDelete