From the Editor: This is a guest article by Aaron Garcia

While

I think most of us have become painfully aware through the media, or

through personal experience of the changing weather patterns, of things

like global warming and melting polar ice caps, we have probably never

regarded ourselves as being able to do something about it. That is the

terrain of politicians, governments and national decision makers.

While

I think most of us have become painfully aware through the media, or

through personal experience of the changing weather patterns, of things

like global warming and melting polar ice caps, we have probably never

regarded ourselves as being able to do something about it. That is the

terrain of politicians, governments and national decision makers.

Not so. Each of us, by making some simple changes in our lifestyle choices and our awareness of our environment, can make an impact. Just think, in a population as big as ours, what that cumulative impact for good could be.

Where do I begin? Well, besides the initiatives at home with things like the recycling of waste products, you could look at your transport choices. I know we travel long distances in the US and the freedom to use our own vehicles is great, but the impact on the environment of the carbon emissions from our personal vehicles is vast.

While

I think most of us have become painfully aware through the media, or

through personal experience of the changing weather patterns, of things

like global warming and melting polar ice caps, we have probably never

regarded ourselves as being able to do something about it. That is the

terrain of politicians, governments and national decision makers.

While

I think most of us have become painfully aware through the media, or

through personal experience of the changing weather patterns, of things

like global warming and melting polar ice caps, we have probably never

regarded ourselves as being able to do something about it. That is the

terrain of politicians, governments and national decision makers.Not so. Each of us, by making some simple changes in our lifestyle choices and our awareness of our environment, can make an impact. Just think, in a population as big as ours, what that cumulative impact for good could be.

Where do I begin? Well, besides the initiatives at home with things like the recycling of waste products, you could look at your transport choices. I know we travel long distances in the US and the freedom to use our own vehicles is great, but the impact on the environment of the carbon emissions from our personal vehicles is vast.

Do You Really Need Dental Insurance?

From Editor: This is a guest article contributed by Richard Keane

The

monthly budget of many individuals and families is already overcrowded

with bills and things to pay for. The thrust of many people is how to

prune down their budget

and reduce the number of things that they have to pay for. People are

thus going through their expenses to find services and products that

they could do without. Against this backdrop, one question that many ask

is, do I really need dental insurance?

The

monthly budget of many individuals and families is already overcrowded

with bills and things to pay for. The thrust of many people is how to

prune down their budget

and reduce the number of things that they have to pay for. People are

thus going through their expenses to find services and products that

they could do without. Against this backdrop, one question that many ask

is, do I really need dental insurance?

At first glance, you may be tempted to answer a quick no, the reason being seemingly quite simple. Why put up with paying monthly premiums for dental cover, when you take such good care of your teeth and have no cavities or toothache? Well, each person will have to answer that question in light with their own circumstances. At present, about 30% of Americans do not have any form of dental insurance cover. That translates to about 100 million Americans that do not have dental cover. You may be quick to ask yourself, if they can stay without dental insurance, why can’t I do the same too?

The

monthly budget of many individuals and families is already overcrowded

with bills and things to pay for. The thrust of many people is how to

prune down their budget

and reduce the number of things that they have to pay for. People are

thus going through their expenses to find services and products that

they could do without. Against this backdrop, one question that many ask

is, do I really need dental insurance?

The

monthly budget of many individuals and families is already overcrowded

with bills and things to pay for. The thrust of many people is how to

prune down their budget

and reduce the number of things that they have to pay for. People are

thus going through their expenses to find services and products that

they could do without. Against this backdrop, one question that many ask

is, do I really need dental insurance?At first glance, you may be tempted to answer a quick no, the reason being seemingly quite simple. Why put up with paying monthly premiums for dental cover, when you take such good care of your teeth and have no cavities or toothache? Well, each person will have to answer that question in light with their own circumstances. At present, about 30% of Americans do not have any form of dental insurance cover. That translates to about 100 million Americans that do not have dental cover. You may be quick to ask yourself, if they can stay without dental insurance, why can’t I do the same too?

Annoucing the Lauch of New Focused Blog - moneywithmoney.NET !

I am happy to announce the launch of my new blog named "www.moneywithmoney.net"

a joint initiative with my wife. This launch has decided to today,

August 29, the date of my birth day, and I an very happy to introduce

this new blog to all our visitors.

Unlike investinternals.com, moneywithmoney.net

is more focused to it main subject: Money. It would cover all

possibilities of making and managing money with numerous tips to save

money. It also introduce all the resources to readers to get control

over their money in a well structured and highly efficient way.

Unlike investinternals.com, moneywithmoney.net

is more focused to it main subject: Money. It would cover all

possibilities of making and managing money with numerous tips to save

money. It also introduce all the resources to readers to get control

over their money in a well structured and highly efficient way.

My hearty welcome to all of you to have a look at this new blog. It is our pleasure if you could SUBSCRIBE this blog as first 100 to realize its decided quality of articles coming soon. All the first 100 email subscribers would receive a surprising gift from us as a launching offer of moneywithmoney.net.

Visit today to subscribe to the knowledge rich contents today..

Thanks in advance.... Sherin Dev and Jyothi Sherin

Unlike investinternals.com, moneywithmoney.net

is more focused to it main subject: Money. It would cover all

possibilities of making and managing money with numerous tips to save

money. It also introduce all the resources to readers to get control

over their money in a well structured and highly efficient way.

Unlike investinternals.com, moneywithmoney.net

is more focused to it main subject: Money. It would cover all

possibilities of making and managing money with numerous tips to save

money. It also introduce all the resources to readers to get control

over their money in a well structured and highly efficient way.

My hearty welcome to all of you to have a look at this new blog. It is our pleasure if you could SUBSCRIBE this blog as first 100 to realize its decided quality of articles coming soon. All the first 100 email subscribers would receive a surprising gift from us as a launching offer of moneywithmoney.net.

Visit today to subscribe to the knowledge rich contents today..

Thanks in advance.... Sherin Dev and Jyothi Sherin

Top of the Range Property Investment- New Apartments and Buying off the Plan

From the Editor: This guest article offered by Sachin

This

article would give you good insight on upper range property investments

and the advantages of buying investment properties off the plan

This

article would give you good insight on upper range property investments

and the advantages of buying investment properties off the plan

If you’re looking at buying an investment property in the top end of the market, buying an investment property off the plan is the best option. The investment values of the upper range of the market are very different in their dynamics from the mainstream property market. This is a fussy, highly discriminating market and it can be extremely demanding. The demand is for quality. Buyers and renters alike want value, and can afford to pay for it.

Top of the range property investment, an overview

There are several typical characteristics of a good upmarket investment property. These are also the basic expectations of this end of the market, and it’s important to understand the values and priorities attached to them.

This

article would give you good insight on upper range property investments

and the advantages of buying investment properties off the plan

This

article would give you good insight on upper range property investments

and the advantages of buying investment properties off the planIf you’re looking at buying an investment property in the top end of the market, buying an investment property off the plan is the best option. The investment values of the upper range of the market are very different in their dynamics from the mainstream property market. This is a fussy, highly discriminating market and it can be extremely demanding. The demand is for quality. Buyers and renters alike want value, and can afford to pay for it.

Top of the range property investment, an overview

There are several typical characteristics of a good upmarket investment property. These are also the basic expectations of this end of the market, and it’s important to understand the values and priorities attached to them.

64% of Americans Don’t Have a $1000 Emergency Fund

Editor's note: This information provide by Ben Joven

The NFCC (National Foundation for Credit Counseling)

released a July online poll that revealed the sordid financial state

of the American consumer. The online poll uncovered that 64% of

Americans do not have $1000 in their savings account for an emergency

expense. The 64% of Americans that do not have enough cash on hand for

an emergency, stated that they would have to rely on other resources in

order to cover an unexpected expense such as a medical emergency, or an

unanticipated car repair.

The NFCC (National Foundation for Credit Counseling)

released a July online poll that revealed the sordid financial state

of the American consumer. The online poll uncovered that 64% of

Americans do not have $1000 in their savings account for an emergency

expense. The 64% of Americans that do not have enough cash on hand for

an emergency, stated that they would have to rely on other resources in

order to cover an unexpected expense such as a medical emergency, or an

unanticipated car repair.

Only 36% of Americans said that they would be able to tap into their savings account for an unexpected emergency expense. The rest of the 64% polled stated other means of coming up with the emergency expense, here are few interesting figures that the NFCC’s profile revealed:

The NFCC (National Foundation for Credit Counseling)

released a July online poll that revealed the sordid financial state

of the American consumer. The online poll uncovered that 64% of

Americans do not have $1000 in their savings account for an emergency

expense. The 64% of Americans that do not have enough cash on hand for

an emergency, stated that they would have to rely on other resources in

order to cover an unexpected expense such as a medical emergency, or an

unanticipated car repair.

The NFCC (National Foundation for Credit Counseling)

released a July online poll that revealed the sordid financial state

of the American consumer. The online poll uncovered that 64% of

Americans do not have $1000 in their savings account for an emergency

expense. The 64% of Americans that do not have enough cash on hand for

an emergency, stated that they would have to rely on other resources in

order to cover an unexpected expense such as a medical emergency, or an

unanticipated car repair.Only 36% of Americans said that they would be able to tap into their savings account for an unexpected emergency expense. The rest of the 64% polled stated other means of coming up with the emergency expense, here are few interesting figures that the NFCC’s profile revealed:

Tips for First Time Home Buyers

Editor's note: This is a guest post from Darrell Rigley

Now

that you are ready to buy your first home, where do you start- How do

you make sure that you are getting a good deal on your home and that you

haven-t missed anything when choosing the home and making the deal.

Now

that you are ready to buy your first home, where do you start- How do

you make sure that you are getting a good deal on your home and that you

haven-t missed anything when choosing the home and making the deal.

Here is a checklist to get you started:

1. Run your credit report and fix any problems found

2. Shop around for your mortgage in order to get the best rate available

3. Get pre-approved for your mortgage - This will tell you how much home you can afford and show potential sellers that you are serious

4. Crunch the numbers - Determine how much each $1000 in price affects your monthly payment

5. Determine your comfort zone - This most likely will be less than you are approved for

Now

that you are ready to buy your first home, where do you start- How do

you make sure that you are getting a good deal on your home and that you

haven-t missed anything when choosing the home and making the deal.

Now

that you are ready to buy your first home, where do you start- How do

you make sure that you are getting a good deal on your home and that you

haven-t missed anything when choosing the home and making the deal.Here is a checklist to get you started:

1. Run your credit report and fix any problems found

2. Shop around for your mortgage in order to get the best rate available

3. Get pre-approved for your mortgage - This will tell you how much home you can afford and show potential sellers that you are serious

4. Crunch the numbers - Determine how much each $1000 in price affects your monthly payment

5. Determine your comfort zone - This most likely will be less than you are approved for

Invest Like A Billionaire !

Editor's note: This is a guest post from Zach Ramsay

Almost

anyone can make money in a booming economy, but only smart investors

can say the same when the economy, and the stock market, heads south. If

you haven’t been completely satisfied with the performance of your

portfolio recently, learn how to invest like a billionaire by copying

the moves of one of these financial geniuses:

Almost

anyone can make money in a booming economy, but only smart investors

can say the same when the economy, and the stock market, heads south. If

you haven’t been completely satisfied with the performance of your

portfolio recently, learn how to invest like a billionaire by copying

the moves of one of these financial geniuses:

Warren Buffet

Born in 1930 to a former stockbroker, Warren Buffet showed a talent for all things financial at a very young age. By the time he turned six, young Warren was making a small profit by selling soft drinks to his friends. Today, this investment icon is worth more than $50 billion. If you’d like to become a student of Buffettology, keep these tips in mind:

Almost

anyone can make money in a booming economy, but only smart investors

can say the same when the economy, and the stock market, heads south. If

you haven’t been completely satisfied with the performance of your

portfolio recently, learn how to invest like a billionaire by copying

the moves of one of these financial geniuses:

Almost

anyone can make money in a booming economy, but only smart investors

can say the same when the economy, and the stock market, heads south. If

you haven’t been completely satisfied with the performance of your

portfolio recently, learn how to invest like a billionaire by copying

the moves of one of these financial geniuses:Warren Buffet

Born in 1930 to a former stockbroker, Warren Buffet showed a talent for all things financial at a very young age. By the time he turned six, young Warren was making a small profit by selling soft drinks to his friends. Today, this investment icon is worth more than $50 billion. If you’d like to become a student of Buffettology, keep these tips in mind:

Business Credit Cards Can Be Bad For Business

Editor’s Note: This is a guest post from Odysseas Papadimitriou of Card Hub

As

the age-old saying goes, you’ve got to spend money to make money. It

therefore goes to reason that to make the most money possible, you’ve

got to spend wisely. For most small businesses, a key aspect of this is

choosing the right credit card, both for funding purposes and everyday

purchases. But how should one go about selecting a business credit

card? Interestingly, according to a pair of small business credit card

studies from Card Hub, this process isn’t nearly as straightforward as

you might think.

As

the age-old saying goes, you’ve got to spend money to make money. It

therefore goes to reason that to make the most money possible, you’ve

got to spend wisely. For most small businesses, a key aspect of this is

choosing the right credit card, both for funding purposes and everyday

purchases. But how should one go about selecting a business credit

card? Interestingly, according to a pair of small business credit card

studies from Card Hub, this process isn’t nearly as straightforward as

you might think.

These studies – which gathered information about the policies and practices of the 10 largest credit card issuers in the United States – not only revealed that American Express, Bank of America, Capital One, Chase, Citi, Discover, HSBC and U.S. Bank all hold individual consumers liable for so-called business credit card use, but also unearthed the fact that all of the major issuers who were transparent enough to participate in the studies report “business credit card” information to users’ individual credit reports.

As

the age-old saying goes, you’ve got to spend money to make money. It

therefore goes to reason that to make the most money possible, you’ve

got to spend wisely. For most small businesses, a key aspect of this is

choosing the right credit card, both for funding purposes and everyday

purchases. But how should one go about selecting a business credit

card? Interestingly, according to a pair of small business credit card

studies from Card Hub, this process isn’t nearly as straightforward as

you might think.

As

the age-old saying goes, you’ve got to spend money to make money. It

therefore goes to reason that to make the most money possible, you’ve

got to spend wisely. For most small businesses, a key aspect of this is

choosing the right credit card, both for funding purposes and everyday

purchases. But how should one go about selecting a business credit

card? Interestingly, according to a pair of small business credit card

studies from Card Hub, this process isn’t nearly as straightforward as

you might think.These studies – which gathered information about the policies and practices of the 10 largest credit card issuers in the United States – not only revealed that American Express, Bank of America, Capital One, Chase, Citi, Discover, HSBC and U.S. Bank all hold individual consumers liable for so-called business credit card use, but also unearthed the fact that all of the major issuers who were transparent enough to participate in the studies report “business credit card” information to users’ individual credit reports.

Safety in Numbers ? Why Charter Bus Transportation is So Safe

From Editor: This guest post submitted by Aaron Garcia

Did

you know that the US Government has published statistics which indicate

that buses and coaches are the safest mode of road transport? (0.4

fatalities per 100 million vehicle miles, compared to cars where the

rate is 3.5 times higher.

Did

you know that the US Government has published statistics which indicate

that buses and coaches are the safest mode of road transport? (0.4

fatalities per 100 million vehicle miles, compared to cars where the

rate is 3.5 times higher.

Even though they share the roads with other users, it has been determined that they have the safety level of trains. These findings are borne out by those from countries such as Australia and Germany, which indicate a lower accident fatality rate in buses than in any other form of land transport.

But most buses don't have safety belts for passengers. How can they still be safe??

It's all a matter of how they are built. All the seats on a bus are much higher than any you would find in a car or even an SUV. This means that passengers are seated higher than the point of any conceivable impact. Besides this, motor coach seats are compartmentalized, which means that each seat is like a padded roll cage and will offer the protection needed by passengers in the event of a collision.

Did

you know that the US Government has published statistics which indicate

that buses and coaches are the safest mode of road transport? (0.4

fatalities per 100 million vehicle miles, compared to cars where the

rate is 3.5 times higher.

Did

you know that the US Government has published statistics which indicate

that buses and coaches are the safest mode of road transport? (0.4

fatalities per 100 million vehicle miles, compared to cars where the

rate is 3.5 times higher.Even though they share the roads with other users, it has been determined that they have the safety level of trains. These findings are borne out by those from countries such as Australia and Germany, which indicate a lower accident fatality rate in buses than in any other form of land transport.

But most buses don't have safety belts for passengers. How can they still be safe??

It's all a matter of how they are built. All the seats on a bus are much higher than any you would find in a car or even an SUV. This means that passengers are seated higher than the point of any conceivable impact. Besides this, motor coach seats are compartmentalized, which means that each seat is like a padded roll cage and will offer the protection needed by passengers in the event of a collision.

Getting the Most as a Student

From Editor's Desk: This guest article contributed by Katei Cranford College

can be one of the most rewarding parts of a lifetime. But it can also

be stressful, expensive, and all-consuming. Plus finances are rarely on

the academic roster for those not pursuing a business-oriented degree.

In order to get the most out of education, it's essential students seek

out the opportunities available to only them. Below are a few things

students should “get” before they graduate.

College

can be one of the most rewarding parts of a lifetime. But it can also

be stressful, expensive, and all-consuming. Plus finances are rarely on

the academic roster for those not pursuing a business-oriented degree.

In order to get the most out of education, it's essential students seek

out the opportunities available to only them. Below are a few things

students should “get” before they graduate.

Get a job - or at least an internship.

Classes and homework eat up most hours of the day, but a small part-time position can supplement income in big ways. Working while in school helps to overcome the hurdle of lacking actual “experience” after graduation. It's much easier to gather that experience early than scramble around in the job market. Try to scope the job around your field of study. Typically, internships can be taken for class credit which allows you to ease your wallet and course load. Campus companies always need student help - which helps with the commute - and major brands seek “on-campus ambassadors” to push their product to your friends and classmates.

College

can be one of the most rewarding parts of a lifetime. But it can also

be stressful, expensive, and all-consuming. Plus finances are rarely on

the academic roster for those not pursuing a business-oriented degree.

In order to get the most out of education, it's essential students seek

out the opportunities available to only them. Below are a few things

students should “get” before they graduate.

College

can be one of the most rewarding parts of a lifetime. But it can also

be stressful, expensive, and all-consuming. Plus finances are rarely on

the academic roster for those not pursuing a business-oriented degree.

In order to get the most out of education, it's essential students seek

out the opportunities available to only them. Below are a few things

students should “get” before they graduate.Get a job - or at least an internship.

Classes and homework eat up most hours of the day, but a small part-time position can supplement income in big ways. Working while in school helps to overcome the hurdle of lacking actual “experience” after graduation. It's much easier to gather that experience early than scramble around in the job market. Try to scope the job around your field of study. Typically, internships can be taken for class credit which allows you to ease your wallet and course load. Campus companies always need student help - which helps with the commute - and major brands seek “on-campus ambassadors” to push their product to your friends and classmates.

The 86 Biggest Lies on Wall Street

The 86 Biggest Lies on Wall Street - A Must Read for Any Investor!

I have recently visited a biggest bookshop in my city and spotted "The 86 Biggest Lies on Wall Street"

by John R. Talbott which came as new. Have a look deep inside the pages

as usual and found it have something special for an investor like me.

It deals with 86 biggest lies on wall street which provides sporadic

insight to some of the common assumptions that later land to great

mistakes.

I have recently visited a biggest bookshop in my city and spotted "The 86 Biggest Lies on Wall Street"

by John R. Talbott which came as new. Have a look deep inside the pages

as usual and found it have something special for an investor like me.

It deals with 86 biggest lies on wall street which provides sporadic

insight to some of the common assumptions that later land to great

mistakes.

In the investment mistake side, I have attracted to a lie named "Invest only on monopoly businesses". The explanation by John in this section is very nice because this advice, even continuously giving my Jim Crammer, would affect the free market system by John's perspective. Another area he covered is the mistake happens to investors by pointing more to the EBITDA data because of possible errors may happen to investors and which lead them to a decision of investing is some stocks by considering it is cheap but it would be in high valuation in reality.

I have recently visited a biggest bookshop in my city and spotted "The 86 Biggest Lies on Wall Street"

by John R. Talbott which came as new. Have a look deep inside the pages

as usual and found it have something special for an investor like me.

It deals with 86 biggest lies on wall street which provides sporadic

insight to some of the common assumptions that later land to great

mistakes.

I have recently visited a biggest bookshop in my city and spotted "The 86 Biggest Lies on Wall Street"

by John R. Talbott which came as new. Have a look deep inside the pages

as usual and found it have something special for an investor like me.

It deals with 86 biggest lies on wall street which provides sporadic

insight to some of the common assumptions that later land to great

mistakes.

In the investment mistake side, I have attracted to a lie named "Invest only on monopoly businesses". The explanation by John in this section is very nice because this advice, even continuously giving my Jim Crammer, would affect the free market system by John's perspective. Another area he covered is the mistake happens to investors by pointing more to the EBITDA data because of possible errors may happen to investors and which lead them to a decision of investing is some stocks by considering it is cheap but it would be in high valuation in reality.

Commercial Property Investment Basics- How to Check Out A Commercial Property

Editor's note: This guest post offered by Sachin

This article covers the basic processes for investigating commercial property investment options

Commercial

property investment can be an excellent investment opportunity, but it

can bring with it more than a few problems. If you’re buying commercial

property, you’re also making a major capital investment, and the risks

start before you even pick up the phone. New commercial real estate

software and property valuation software are now being used by

professionals as risk management tools as much as anything else.

Commercial

property investment can be an excellent investment opportunity, but it

can bring with it more than a few problems. If you’re buying commercial

property, you’re also making a major capital investment, and the risks

start before you even pick up the phone. New commercial real estate

software and property valuation software are now being used by

professionals as risk management tools as much as anything else.

Operating costs for shops are also very high. Some shopping areas are particularly expensive and can’t attract or keep tenants.

This article covers the basic processes for investigating commercial property investment options

Commercial

property investment can be an excellent investment opportunity, but it

can bring with it more than a few problems. If you’re buying commercial

property, you’re also making a major capital investment, and the risks

start before you even pick up the phone. New commercial real estate

software and property valuation software are now being used by

professionals as risk management tools as much as anything else.

Commercial

property investment can be an excellent investment opportunity, but it

can bring with it more than a few problems. If you’re buying commercial

property, you’re also making a major capital investment, and the risks

start before you even pick up the phone. New commercial real estate

software and property valuation software are now being used by

professionals as risk management tools as much as anything else.Operating costs for shops are also very high. Some shopping areas are particularly expensive and can’t attract or keep tenants.

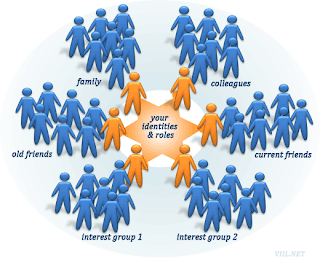

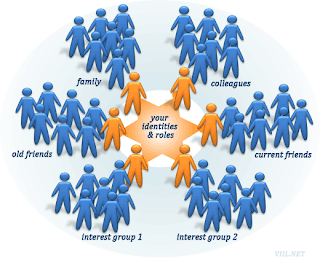

How to Leverage Your Social Network to Find Perfect Jobs

From Editor: This is a guest post from Andrew Hunter Co-founder of Job Search Engine Adzuna

The

last 10 years has seen a seismic shift in the way job seekers and

employers are connected to each other. Gone are the days (in the most

part) of employers stumping up £5k to a recruiter or headhunter to lock

down a candidate. Job seekers have also realized that new avenues have

opened up for them to connect with potential employers and land a job.

Social Media can sometimes tip the balance between getting hired and

getting fired and those that embrace it are learning that it can be an

excellent string to the job hunters bow.

The

last 10 years has seen a seismic shift in the way job seekers and

employers are connected to each other. Gone are the days (in the most

part) of employers stumping up £5k to a recruiter or headhunter to lock

down a candidate. Job seekers have also realized that new avenues have

opened up for them to connect with potential employers and land a job.

Social Media can sometimes tip the balance between getting hired and

getting fired and those that embrace it are learning that it can be an

excellent string to the job hunters bow.

Here are 5 social media tips, which will help you in the job hunting process:

1. Get yourself on LinkedIn (everyone else is there) – LinkedIn is the largest professional social network on the planet and if you're not on it, you're missing out. It's a great platform for exchanging business ideas, flirting with potential employers and connecting with old and existing colleagues.

The

last 10 years has seen a seismic shift in the way job seekers and

employers are connected to each other. Gone are the days (in the most

part) of employers stumping up £5k to a recruiter or headhunter to lock

down a candidate. Job seekers have also realized that new avenues have

opened up for them to connect with potential employers and land a job.

Social Media can sometimes tip the balance between getting hired and

getting fired and those that embrace it are learning that it can be an

excellent string to the job hunters bow.

The

last 10 years has seen a seismic shift in the way job seekers and

employers are connected to each other. Gone are the days (in the most

part) of employers stumping up £5k to a recruiter or headhunter to lock

down a candidate. Job seekers have also realized that new avenues have

opened up for them to connect with potential employers and land a job.

Social Media can sometimes tip the balance between getting hired and

getting fired and those that embrace it are learning that it can be an

excellent string to the job hunters bow.Here are 5 social media tips, which will help you in the job hunting process:

1. Get yourself on LinkedIn (everyone else is there) – LinkedIn is the largest professional social network on the planet and if you're not on it, you're missing out. It's a great platform for exchanging business ideas, flirting with potential employers and connecting with old and existing colleagues.

Gold Demand Statistics by World Gold Council for Q2 2011

Here

is an interesting Gold Demand Statistics for Q2 2011 provided by World

Gold Council a market development organization for the gold industry.

Working within the investment, jewellery and technology sectors, as well

as engaging in government affairs, our purpose is to provide industry

leadership, whilst stimulating and sustaining demand for gold. World

Gold Council develop gold-backed solutions, services and markets, based

on true market insight. As a result, WGC create structural shifts in

demand for gold across key market sectors.

Here

is an interesting Gold Demand Statistics for Q2 2011 provided by World

Gold Council a market development organization for the gold industry.

Working within the investment, jewellery and technology sectors, as well

as engaging in government affairs, our purpose is to provide industry

leadership, whilst stimulating and sustaining demand for gold. World

Gold Council develop gold-backed solutions, services and markets, based

on true market insight. As a result, WGC create structural shifts in

demand for gold across key market sectors.

World Gold Council provides insight into the international gold markets, helping people to better understand the wealth preservation qualities of gold and its role in meeting the social and environmental needs of society.

- Global gold demand in the second quarter of 2011 totalled 919.8t, down 17% from the remarkably strong levels of 1,107t in the second quarter of 2010. Gold demand in value terms grew by 5% year-on-year reaching US$44.5bn up from US$42.6bn in the second quarter of 2010. This is the second highest quarterly value on record, only fractionally below the US$44.7bn record that occurred in the fourth quarter in 2010.

Determine Your Business Type before you Start Your New Business

Editor's note: This guest post written by M. Garcia of Arizona Legal Briefcase

There

are many ways to structure your new business, so it is very important

for you to determine which structure is best for you and your new

business. You have several options when starting your new company.

Your choices are to form a corporation, an LLC (Limited Liability

Company), a partnership, or a sole proprietorship. Your choice will

depend on who will own the business and what its activities will be.

There

are many ways to structure your new business, so it is very important

for you to determine which structure is best for you and your new

business. You have several options when starting your new company.

Your choices are to form a corporation, an LLC (Limited Liability

Company), a partnership, or a sole proprietorship. Your choice will

depend on who will own the business and what its activities will be.

Preliminary Questions when Starting a Business

You will need to determine which one is the best fit for your new business. This is an important decision. You will need to ask yourself some questions to help you determine which business structure will work for your new business. Keep in mind that what might work for your friends?

There

are many ways to structure your new business, so it is very important

for you to determine which structure is best for you and your new

business. You have several options when starting your new company.

Your choices are to form a corporation, an LLC (Limited Liability

Company), a partnership, or a sole proprietorship. Your choice will

depend on who will own the business and what its activities will be.

There

are many ways to structure your new business, so it is very important

for you to determine which structure is best for you and your new

business. You have several options when starting your new company.

Your choices are to form a corporation, an LLC (Limited Liability

Company), a partnership, or a sole proprietorship. Your choice will

depend on who will own the business and what its activities will be.Preliminary Questions when Starting a Business

You will need to determine which one is the best fit for your new business. This is an important decision. You will need to ask yourself some questions to help you determine which business structure will work for your new business. Keep in mind that what might work for your friends?

Why & How We Can Teach Our Children on the Merits of Property Investment

Editor's note: This guest post contributed by Jack Photon

One

of the best things a parent can teach a child is how to manage their

personal finances. Parents teach this both through words and actions.

Beyond the basics such as how to manage a credit card, balance a check

book and budget, parents can also teach their children the merits of

property investment.

One

of the best things a parent can teach a child is how to manage their

personal finances. Parents teach this both through words and actions.

Beyond the basics such as how to manage a credit card, balance a check

book and budget, parents can also teach their children the merits of

property investment.

Owning a home can be a rewarding experience, or it can be a devastating experience that can ultimately lead to bankruptcy. Financially savvy parents can teach their teen and teenage children several important lessons when it comes to buying a home:

One

of the best things a parent can teach a child is how to manage their

personal finances. Parents teach this both through words and actions.

Beyond the basics such as how to manage a credit card, balance a check

book and budget, parents can also teach their children the merits of

property investment.

One

of the best things a parent can teach a child is how to manage their

personal finances. Parents teach this both through words and actions.

Beyond the basics such as how to manage a credit card, balance a check

book and budget, parents can also teach their children the merits of

property investment.Owning a home can be a rewarding experience, or it can be a devastating experience that can ultimately lead to bankruptcy. Financially savvy parents can teach their teen and teenage children several important lessons when it comes to buying a home:

How Greed Kills You in Stock Market

Stock market is not the place for emotions, especially greed and fear. Greed is directly connected to bull and fear connected to bear market,

the two phases dominates stock markets to make real investors rich.

When people approaches stock market with greed, prizes would start

zooming up because of heavy buying with a speculation on possible

uptrend of prices. Other hand, when traders fear about the losses, they

start selling stocks which would drag down the stock prices heavily.

Stock market is not the place for emotions, especially greed and fear. Greed is directly connected to bull and fear connected to bear market,

the two phases dominates stock markets to make real investors rich.

When people approaches stock market with greed, prizes would start

zooming up because of heavy buying with a speculation on possible

uptrend of prices. Other hand, when traders fear about the losses, they

start selling stocks which would drag down the stock prices heavily.

Traders generally interested to purchase and sell shares in the same day to book profit. To get rich immediate, people considering trading activities are the best. With such greedy mentality, thousands of people getting attracted to stock market day trading everyday. There is nothing, but just greed to become rich in a fortnight.

Google Acquires Motorola Mobility for $12.5 billion

Google

Inc. said Monday it is buying cell phone maker Motorola Mobility

Holdings Inc. for $12.5 billion in cash. This is the ever biggest

acquisition by internet giant as the part of its serious intention of

expanding business to beyond core internet business.

Google

Inc. said Monday it is buying cell phone maker Motorola Mobility

Holdings Inc. for $12.5 billion in cash. This is the ever biggest

acquisition by internet giant as the part of its serious intention of

expanding business to beyond core internet business.

This deal suspected Google's agenda to provide total hardware and software experience like Apple.

With a $40.00 per share, Google will pay a 63 percent premium to Motorola's closing price on Friday.

"Motorola Mobility's total commitment to Android has created a natural fit for our two companies," said Google CEO Larry Page in a statement. "Together, we will create amazing user experiences that supercharge the entire Android ecosystem for the benefit of consumers, partners and developers."

How to Invest Effectively in the Stock Market Online

Editor's note: This is a guest post from Elias Cortez, a freelance writer

Online

trading can be done by anyone as long as you have, of course, computer,

sufficient funds to open an account, and ability to invest in the

market – this includes your good financial history. Therefore, if anyone

can do online trading, ordinary people can own a stock as well, as most

analysts see eye to eye that average people trading stock is a great sign of financial victory.

Online

trading can be done by anyone as long as you have, of course, computer,

sufficient funds to open an account, and ability to invest in the

market – this includes your good financial history. Therefore, if anyone

can do online trading, ordinary people can own a stock as well, as most

analysts see eye to eye that average people trading stock is a great sign of financial victory.

The Purpose of Investing in the Stock Market

First and foremost, the primary purpose of investing in the stock market is to make a profit and build your wealth to ensure a bright future. Basically, you become a shareholder in the company whenever you purchase a stock. Online investing can be done anytime, anywhere at your own pace via internet. Therefore, maximize your time researching what companies are best to buy stocks in and determine the appropriate techniques in order to prevent losses every time you trade.

For people who frequently use the internet, the stock investing has become trouble-free and even more interesting. People who are into online investing generate an online account through any online brokerage firm.

Online

trading can be done by anyone as long as you have, of course, computer,

sufficient funds to open an account, and ability to invest in the

market – this includes your good financial history. Therefore, if anyone

can do online trading, ordinary people can own a stock as well, as most

analysts see eye to eye that average people trading stock is a great sign of financial victory.

Online

trading can be done by anyone as long as you have, of course, computer,

sufficient funds to open an account, and ability to invest in the

market – this includes your good financial history. Therefore, if anyone

can do online trading, ordinary people can own a stock as well, as most

analysts see eye to eye that average people trading stock is a great sign of financial victory.The Purpose of Investing in the Stock Market

First and foremost, the primary purpose of investing in the stock market is to make a profit and build your wealth to ensure a bright future. Basically, you become a shareholder in the company whenever you purchase a stock. Online investing can be done anytime, anywhere at your own pace via internet. Therefore, maximize your time researching what companies are best to buy stocks in and determine the appropriate techniques in order to prevent losses every time you trade.

For people who frequently use the internet, the stock investing has become trouble-free and even more interesting. People who are into online investing generate an online account through any online brokerage firm.

Know All About Form 16 – The 13 Components of Form 16 to Be an Informed TaxPayer

Editor's Note: This is a guest post from Ramalingam of Holistic Investment Planners

Most

of us are aware of Form 16 given by our employers before April 30th

each year that give details of the income earned, and tax deducted at

source and paid to the government. This certificate proves useful in filing income tax returns.

In addition banks also issuing Form 16 and Form16A to pension holders

and those that earn interest income, with no Form 16 required when TDS

is not deducted from salary. Knowing about Form 16 helps us to be a

well-informed taxpayer and do better tax planning.

Most

of us are aware of Form 16 given by our employers before April 30th

each year that give details of the income earned, and tax deducted at

source and paid to the government. This certificate proves useful in filing income tax returns.

In addition banks also issuing Form 16 and Form16A to pension holders

and those that earn interest income, with no Form 16 required when TDS

is not deducted from salary. Knowing about Form 16 helps us to be a

well-informed taxpayer and do better tax planning.

The 13 components of Form 16 are:

1) PAN that stands for Permanent Account Number, a 10 digit alpha-numeric code that is generated by the Income Tax Department of India. It is mandatory for everyone- NRI, PIO & companies that wishes to conduct business, file and pay taxes, invest, buy and sell property, open a demat or bank account to have this number in India. The need

Most

of us are aware of Form 16 given by our employers before April 30th

each year that give details of the income earned, and tax deducted at

source and paid to the government. This certificate proves useful in filing income tax returns.

In addition banks also issuing Form 16 and Form16A to pension holders

and those that earn interest income, with no Form 16 required when TDS

is not deducted from salary. Knowing about Form 16 helps us to be a

well-informed taxpayer and do better tax planning.

Most

of us are aware of Form 16 given by our employers before April 30th

each year that give details of the income earned, and tax deducted at

source and paid to the government. This certificate proves useful in filing income tax returns.

In addition banks also issuing Form 16 and Form16A to pension holders

and those that earn interest income, with no Form 16 required when TDS

is not deducted from salary. Knowing about Form 16 helps us to be a

well-informed taxpayer and do better tax planning.The 13 components of Form 16 are:

1) PAN that stands for Permanent Account Number, a 10 digit alpha-numeric code that is generated by the Income Tax Department of India. It is mandatory for everyone- NRI, PIO & companies that wishes to conduct business, file and pay taxes, invest, buy and sell property, open a demat or bank account to have this number in India. The need

No comments:

Post a Comment