This article is a result of my long time research to identify the

secrets behind creating perfect personal budget. In my study, I found 5

points to follow to make a budget perfect. Here are those points I am

sharing for you. There are lots of other factors involved to the

creation of successful personal budgeting, but I have collected these 5

points among them, from the real world and personal experiences.

Personal

budgeting is not a single hour or day process. Time is the major

element helps people to identify all necessary requirements. I will

explain these are in detail.

Personal

budgeting is not a single hour or day process. Time is the major

element helps people to identify all necessary requirements. I will

explain these are in detail.

Initial Preparation for Identifying Income and Expenses

Personal budgeting means, getting an idea and control over the inflow and out flow of our money. For a person, it is necessary to identify his monthly inflow's and outflow's to support personal budget creation to a great extend. You can do it but, remember, inflow's and outflow's always vary in each month. For example, if a person following my previous featured active-active-passive income generation methods, his present month net income may be 1000 bucks and next month it may 950 bucks and third month it will go up to 1100 bucks. If a person planning his budget, as per the information from present month, his budget fails certainly in the next month because of changes in the income. To solve this issues and identify right income and expenses, an individual required to track his income and expenses for at least 4 months to get a real average about his monthly income and expenses. With the help of writing down each and every income and expenses for few months, he can easily analyze the result to identify possible variations to reach with an exact average total from both income and expenses.

Personal

budgeting is not a single hour or day process. Time is the major

element helps people to identify all necessary requirements. I will

explain these are in detail.

Personal

budgeting is not a single hour or day process. Time is the major

element helps people to identify all necessary requirements. I will

explain these are in detail.Initial Preparation for Identifying Income and Expenses

Personal budgeting means, getting an idea and control over the inflow and out flow of our money. For a person, it is necessary to identify his monthly inflow's and outflow's to support personal budget creation to a great extend. You can do it but, remember, inflow's and outflow's always vary in each month. For example, if a person following my previous featured active-active-passive income generation methods, his present month net income may be 1000 bucks and next month it may 950 bucks and third month it will go up to 1100 bucks. If a person planning his budget, as per the information from present month, his budget fails certainly in the next month because of changes in the income. To solve this issues and identify right income and expenses, an individual required to track his income and expenses for at least 4 months to get a real average about his monthly income and expenses. With the help of writing down each and every income and expenses for few months, he can easily analyze the result to identify possible variations to reach with an exact average total from both income and expenses.

How to Prevent a Professional Killer Being Your Fund Manager

'Fund Manager' is a fantastic title! Fund managers are the group who

always walking with incomparable burden on their shoulder which coming

from investors hope. A fund manager can easily make any investor king or

convert as beggars. Mutual fund houses generally have a pool of well

qualified and experienced fund managers. They are responsible to manage

investor’s money by investing them intelligently on various instruments

to generate maximum returns. If any fund manager fails to do such, or

fail to meet the hope of investors, he is not only losing investor’s

trust, but also ruining the reputation of fund house.

Building a reputation as a great fund manager is not as easy as we think. It required extra ordinary skills. A fund manager should have some must qualities and able to work under enormous pressure. Those who have invested or showing interest on mutual fund products, must know the major risks associated to their investments. If she ever went through the document associated with a mutual fund, may saw the section ‘Risks’. In this section, investors get informed with all possible risks associated with that particular mutual fund product. If you read little, you may see a term called 'Fund Manager Risk' in the line. Generally, most of us never pay much attention to it and ignore this term as a usual one in all mutual fund documents. But dear investor, this is the only term in that mutual fund document, can decide whether you are going to get returns from your investments or be a beggar later!!

In this contest, here are some most important points for investors to identify and avoid possible money losing risks by knowing the fund manager capability and disadvantages maximum as possible. Remember, analyzing a fund manager capability and capacity is not so easy. But same time, you can have access to all the information if you really work for it.

Lots of factors influencing to decide the risk associated to a Fund manager. Personal qualities and organizational policies are the most important two factors among it. Below are some most important factors which can decide ‘the level of risk’ associated with your fund manager:

Building a reputation as a great fund manager is not as easy as we think. It required extra ordinary skills. A fund manager should have some must qualities and able to work under enormous pressure. Those who have invested or showing interest on mutual fund products, must know the major risks associated to their investments. If she ever went through the document associated with a mutual fund, may saw the section ‘Risks’. In this section, investors get informed with all possible risks associated with that particular mutual fund product. If you read little, you may see a term called 'Fund Manager Risk' in the line. Generally, most of us never pay much attention to it and ignore this term as a usual one in all mutual fund documents. But dear investor, this is the only term in that mutual fund document, can decide whether you are going to get returns from your investments or be a beggar later!!

In this contest, here are some most important points for investors to identify and avoid possible money losing risks by knowing the fund manager capability and disadvantages maximum as possible. Remember, analyzing a fund manager capability and capacity is not so easy. But same time, you can have access to all the information if you really work for it.

Lots of factors influencing to decide the risk associated to a Fund manager. Personal qualities and organizational policies are the most important two factors among it. Below are some most important factors which can decide ‘the level of risk’ associated with your fund manager:

Case Study: Mutual Fund Investing Mistakes I Made as a Beginner

As title says, here is a case study on my personal mutual fund

investing activities and the experiences. In this case study, I reveal

the mistakes and errors happened to me as a beginner and steps I have

taken to overcome these in the future. Those who have already read my Investment Biography,

I have posted some time back, might know when and how I started direct

stock investing on 1993. Even though, 10 years later, I have started

investing on mutual funds and later realized the mistakes I have made.

Like any other investor, I was investing to mutual fund and continuously

committing errors until I have found the same and rectified it.

Photo by: juhansonin

Photo by: juhansonin

Let me take some time to recall my investing experience. When recalling my direct stock investing experience, I feel totally happy on all action I have made because of the effort I had put to create my own stock selection criterion to research, buy and even, sell the stocks. These self made criterion still playing major roles for me as an investor. When coming to my mutual fund investing experience, I still wonder, how could I still commit some big investing mistakes that should never happen to me because I am an experienced investor! . Also I again feel sad while thinking, how I forgot to make a perfect mutual fund selection and investing criterion prior to start investing!

Below are the list of major mutual fund investing mistakes happened to me as a beginner:

I have identified my first mistake from my strong feeling on the decision I have made to invest on mutual funds was totally wrong. With this feeling, I slowly put myself to the requirements of identifying a satisfied answer to a major question, "Why an experienced stock market investor gave his money to a third person, to whom he don't know whether is an idiot or a right investment manager, to manage? I still don't have a right answer to this but I agree this as one of my mistake. This question always irritated me and I felt very bad whenever thinking why I invested on mutual funds. This committed error lead me to stop investing on mutual funds unnecessarily and study on the most important risk factor associated to any Mutual Fund; "Fund Manager Risk" (Tomorrow I will post a detailed article on Fund Manager risk and what are the factors supporting this risks)

Photo by: juhansonin

Photo by: juhansoninLet me take some time to recall my investing experience. When recalling my direct stock investing experience, I feel totally happy on all action I have made because of the effort I had put to create my own stock selection criterion to research, buy and even, sell the stocks. These self made criterion still playing major roles for me as an investor. When coming to my mutual fund investing experience, I still wonder, how could I still commit some big investing mistakes that should never happen to me because I am an experienced investor! . Also I again feel sad while thinking, how I forgot to make a perfect mutual fund selection and investing criterion prior to start investing!

Below are the list of major mutual fund investing mistakes happened to me as a beginner:

I have identified my first mistake from my strong feeling on the decision I have made to invest on mutual funds was totally wrong. With this feeling, I slowly put myself to the requirements of identifying a satisfied answer to a major question, "Why an experienced stock market investor gave his money to a third person, to whom he don't know whether is an idiot or a right investment manager, to manage? I still don't have a right answer to this but I agree this as one of my mistake. This question always irritated me and I felt very bad whenever thinking why I invested on mutual funds. This committed error lead me to stop investing on mutual funds unnecessarily and study on the most important risk factor associated to any Mutual Fund; "Fund Manager Risk" (Tomorrow I will post a detailed article on Fund Manager risk and what are the factors supporting this risks)

Highly Effective Interview Guide Part3

We have reached to the third and final part of "Highly Effective

Interview Guide". In this part, I would like to explain some of the

effective tips I have practiced to do at the time of interview and

assist to research and develop fail proof answers to some most famous,

but difficult to crack questions. Remember most of this tricks

applicable to direct interview but not for telephonic.

In front of an Interviewer or board - Things to Remember

In front of an Interviewer or board - Things to Remember

1. Arrive early to the interview site at least 1 hour before the time of interview schedule.

2. Realize, interviewers are there to select you. Not to fire. Be always comfort with this feeling. It would reduce unnecessary tensions and help you to be confident to perform maximum.

3. Have a final reference to the prepared company information and questions you have prepared. Prepare a cram type answer table for final minute reference. Having all important points in this cram sheet highly help you to refresh your knowledge on before the moment of starting interview.

4. Upon reaching in front of interviewer(s), give a smile and provide your CV to each interviewer there, separately. Remember to keep a CV with you. This will help self reference of dates if required.

5. Keep smiling. Do not show nervousness. Be serious to technical questions and be friendly to personal questions.

6. It's the time to learn first trick. Upon sitting in the chair, take a plain paper and place on the table along with a pen. This action is for nothing but, it will indirectly pass a message to the interviewers that you have prepared well for the interview and serious.) I have used this trick number of times and have not rejected from any interview I had appeared with this fantastic trick!

7. Use the paper effect to answer questions. Explaining any of your answers with the help of a piece of paper and pen by drawing the charts, numbers or whatever, will immediately attract interviewer’s attention and impression. It also have another advantage, the interviewer never try to ask you more questions about the subject by thinking you have good knowledge on the subject.

8. Impress them from your ignorance: Avoid the most dangerous three word "I don't Know" at any point of your interview. Admitting mistakes and ignorance is not a lose but it will add credit to your honesty. You can even use the word " I have to refer this ”, if you are not aware the answer of any questions. To impress them, immediately point the question to the paper which you kept in front of you. This action give you an impression as a good learner. The word ‘No’ is always considered as negative and employer may think that you are not a good learner or lazy.

In front of an Interviewer or board - Things to Remember

In front of an Interviewer or board - Things to Remember1. Arrive early to the interview site at least 1 hour before the time of interview schedule.

2. Realize, interviewers are there to select you. Not to fire. Be always comfort with this feeling. It would reduce unnecessary tensions and help you to be confident to perform maximum.

3. Have a final reference to the prepared company information and questions you have prepared. Prepare a cram type answer table for final minute reference. Having all important points in this cram sheet highly help you to refresh your knowledge on before the moment of starting interview.

4. Upon reaching in front of interviewer(s), give a smile and provide your CV to each interviewer there, separately. Remember to keep a CV with you. This will help self reference of dates if required.

5. Keep smiling. Do not show nervousness. Be serious to technical questions and be friendly to personal questions.

6. It's the time to learn first trick. Upon sitting in the chair, take a plain paper and place on the table along with a pen. This action is for nothing but, it will indirectly pass a message to the interviewers that you have prepared well for the interview and serious.) I have used this trick number of times and have not rejected from any interview I had appeared with this fantastic trick!

7. Use the paper effect to answer questions. Explaining any of your answers with the help of a piece of paper and pen by drawing the charts, numbers or whatever, will immediately attract interviewer’s attention and impression. It also have another advantage, the interviewer never try to ask you more questions about the subject by thinking you have good knowledge on the subject.

8. Impress them from your ignorance: Avoid the most dangerous three word "I don't Know" at any point of your interview. Admitting mistakes and ignorance is not a lose but it will add credit to your honesty. You can even use the word " I have to refer this ”, if you are not aware the answer of any questions. To impress them, immediately point the question to the paper which you kept in front of you. This action give you an impression as a good learner. The word ‘No’ is always considered as negative and employer may think that you are not a good learner or lazy.

Highly Effective Interview Guide Part2

This is the second part of 'Highly Effective Interview Guide' as the

continuation of previous. Here, we are dealing with the technical

approach to an interview to grab enormous success with each interview

that you attend. This article specially focused to the required resume

features and hacks.

Photo By: KrishnanD

Photo By: KrishnanD

Rule #5 Technical Approach to Interview and its success – Things to remember

1. Curriculum Vitae

2. Source of Job Openings/Interview Call

3. Technical Interview Preparation

4. Pre Research about company

5. Your portfolio

6. In front of the interview Board

7. Post interview

8. Most Beautiful and Easy working Solution

I am starting a very precise tool to succeed each and every interview. Follow this, practice then apply to real world… enjoy the wonderful result…

1. Curriculum Vitae

If your CV is an eye candy, you are in half way of the success. Make it well managed. A perfect CV should provide all the required information to a person looking on it. Upon going through your CV, If any employer raises a doubt at any point that he really want and is not there in your CV, mean your CV is not perfect!. Include all the information that any employer required.

A good CV should have the content arrangements as follows in most time:

a. Name and Present, Permanent addresses, Telephone Numbers, Email, Mobile Number

b. Your objective

c. Employment History (Sorting Order: most recent job first….):

1. Company Name

2. Company Profile in very brief (i.e. Multinational IT Services company and global leader in Airline software Industry etc.. etc… )

3. Your Designation

4. Job Period from

5. Job Period to

6. Company web site

7. Work Description

8. Major Achievements, if any,

Photo By: KrishnanD

Photo By: KrishnanDRule #5 Technical Approach to Interview and its success – Things to remember

1. Curriculum Vitae

2. Source of Job Openings/Interview Call

3. Technical Interview Preparation

4. Pre Research about company

5. Your portfolio

6. In front of the interview Board

7. Post interview

8. Most Beautiful and Easy working Solution

I am starting a very precise tool to succeed each and every interview. Follow this, practice then apply to real world… enjoy the wonderful result…

1. Curriculum Vitae

If your CV is an eye candy, you are in half way of the success. Make it well managed. A perfect CV should provide all the required information to a person looking on it. Upon going through your CV, If any employer raises a doubt at any point that he really want and is not there in your CV, mean your CV is not perfect!. Include all the information that any employer required.

A good CV should have the content arrangements as follows in most time:

a. Name and Present, Permanent addresses, Telephone Numbers, Email, Mobile Number

b. Your objective

c. Employment History (Sorting Order: most recent job first….):

1. Company Name

2. Company Profile in very brief (i.e. Multinational IT Services company and global leader in Airline software Industry etc.. etc… )

3. Your Designation

4. Job Period from

5. Job Period to

6. Company web site

7. Work Description

8. Major Achievements, if any,

Highly Effective Interview Guide Part1

To plan your finance and start investing, you first required a right

job. Those who have tried a lot for a job and still not succeeded,

should read this article. These are some highly succeeded tips I had

practiced to secure best jobs in my career, all the time. Whether you

are a beginner or experienced, I am sure, following these tips will

bring you high success. I can proudly say, I have authenticity for these

tips, which I have developed as my own. I have stories of huge

successes through practicing these tips. I have successfully completed

dozens of interviews by practicing these tips, without any single point

of failure. Some time I had received multiple offers from excellent

companies to put me in trouble by confusion to select a company.

Attending interviews to grab the offers is an art. To be like, a person required to develop fail proof ideas and practice them continuously. Below are some workouts I have done and thought I would share these tips with readers for their betterment in career.

This article cut down as 3 parts where I am covering some important rules in this first part. Technical interview preparation, one of the core of this article will be covered in the second part. Ideas to be a successful candidate in front of employers or interview boards, will be covered as last part. Confirm you are reading all three parts and it is worth taking printouts of these parts to refer at any point.

Rule #1 - Never apply to a good company

Yes. My success originally started from this rule. At the beginning of my job search, I took extra care to not apply to any best companies. Instead, I had sharpen my core and supportive skills along with soft skills to get full confidence to crack interviews with best companies. If you really would like to grab success by following this document, my first and best advice is, avoid applying to best companies until you are fully able and confident to do so. Applying to a good company required you to grab the job. Or you may lose the chance for life. Once lost, you generally never get an another chance to attend the interview with same company again. So, don't take a try. Stop applying to good companies immediately and continue reading all three parts of this article. At the end, you will be able to understand why I said to not apply to good companies now.

Attending interviews to grab the offers is an art. To be like, a person required to develop fail proof ideas and practice them continuously. Below are some workouts I have done and thought I would share these tips with readers for their betterment in career.

This article cut down as 3 parts where I am covering some important rules in this first part. Technical interview preparation, one of the core of this article will be covered in the second part. Ideas to be a successful candidate in front of employers or interview boards, will be covered as last part. Confirm you are reading all three parts and it is worth taking printouts of these parts to refer at any point.

Rule #1 - Never apply to a good company

Yes. My success originally started from this rule. At the beginning of my job search, I took extra care to not apply to any best companies. Instead, I had sharpen my core and supportive skills along with soft skills to get full confidence to crack interviews with best companies. If you really would like to grab success by following this document, my first and best advice is, avoid applying to best companies until you are fully able and confident to do so. Applying to a good company required you to grab the job. Or you may lose the chance for life. Once lost, you generally never get an another chance to attend the interview with same company again. So, don't take a try. Stop applying to good companies immediately and continue reading all three parts of this article. At the end, you will be able to understand why I said to not apply to good companies now.

Portfolio Balance Model - A Case Study

“Balance is beautiful.” ~Miyoko Ohno

Those

who all maintaining an investment portfolio naturally have two question

to get answers. First, “how do it balance upon age?” and next, “what

are the investment instruments to balance the portfolio?” This article

originally wrote to give a perfect answer to the first question, How do

one balance portfolio based on age?

Those

who all maintaining an investment portfolio naturally have two question

to get answers. First, “how do it balance upon age?” and next, “what

are the investment instruments to balance the portfolio?” This article

originally wrote to give a perfect answer to the first question, How do

one balance portfolio based on age?

However, before starting this article, I would like to give a simple, understandable answer to the possible second question “What are the investment instruments to balance the portfolio?”. Answer to this question is really simple. A portfolio balancing is an act of including high risk investment instruments like stocks, mutual funds, commodities and low risk instruments like fixed deposits, mutual fund fixed maturity plans in a correct proportion depends on the age and risk taking capacity of the person who builds the investments portfolio. It clearly tells, a portfolio should have a right proportion of two candidates, high risk investment instruments and guaranteed investment products.

Portfolio Balance Model - A Case Study

Portfolio balancing is an action to balance the instruments from both, high risk and guaranteed, by adding or removing upon the age and risk profile of the person time to time. Other than age and risk profile, there are various factors influencing the balancing act but these two are important than any.

I have already posted an article with Money Hacker earlier but, though I will clarify little more to give better understanding to readers than the original article. Let us move to the core of this article. We are starting with the financial experts Golden Portfolio Balancing Rule: “Reduce your age from 100. Resulted percentage of your total money should go to the high risk, high growth investments and rest should invest to guaranteed instruments”.

I know you have not understood anything. So I will clarify this with a simple example. Suppose you are in the age of 25 and planning to create a portfolio with mix of high risk investments and guaranteed investments. To identify how much percentage you need to invest on both instruments, you are reducing your age of 25 from 100 and getting a result of 75. With this result, you are investing 75% of your money to high risk investments like equities and equity mutual funds or commodities or whatever it is. Rest 25%, i.e. the percentage similar to your age, of money you are investing to the guaranteed instruments like fixed deposits, traditional insurance policies government secured papers etc., and you are now very happy because you have got a well balanced portfolio upon your age and what expert financial planners recommending.

I know you have not understood anything. So I will clarify this with a simple example. Suppose you are in the age of 25 and planning to create a portfolio with mix of high risk investments and guaranteed investments. To identify how much percentage you need to invest on both instruments, you are reducing your age of 25 from 100 and getting a result of 75. With this result, you are investing 75% of your money to high risk investments like equities and equity mutual funds or commodities or whatever it is. Rest 25%, i.e. the percentage similar to your age, of money you are investing to the guaranteed instruments like fixed deposits, traditional insurance policies government secured papers etc., and you are now very happy because you have got a well balanced portfolio upon your age and what expert financial planners recommending.

Wait a minute…. There is a really confusing, hidden problem with this calculation:

From the mouth of experts, people should build and balance their portfolio when younger. But, when he reaches to the age of retirement, his portfolio should have maximum debt and minimum equity exposure. i.e. 90% debt and only 10% equity.

Suppose, now your age is 25. Subtracting 25 from 100 will result 75. In that case, your portfolio should have 75% of equity exposure and 25% in debt instruments. I agree.

As per the balancing advice,

Those

who all maintaining an investment portfolio naturally have two question

to get answers. First, “how do it balance upon age?” and next, “what

are the investment instruments to balance the portfolio?” This article

originally wrote to give a perfect answer to the first question, How do

one balance portfolio based on age?

Those

who all maintaining an investment portfolio naturally have two question

to get answers. First, “how do it balance upon age?” and next, “what

are the investment instruments to balance the portfolio?” This article

originally wrote to give a perfect answer to the first question, How do

one balance portfolio based on age?However, before starting this article, I would like to give a simple, understandable answer to the possible second question “What are the investment instruments to balance the portfolio?”. Answer to this question is really simple. A portfolio balancing is an act of including high risk investment instruments like stocks, mutual funds, commodities and low risk instruments like fixed deposits, mutual fund fixed maturity plans in a correct proportion depends on the age and risk taking capacity of the person who builds the investments portfolio. It clearly tells, a portfolio should have a right proportion of two candidates, high risk investment instruments and guaranteed investment products.

Portfolio Balance Model - A Case Study

Portfolio balancing is an action to balance the instruments from both, high risk and guaranteed, by adding or removing upon the age and risk profile of the person time to time. Other than age and risk profile, there are various factors influencing the balancing act but these two are important than any.

I have already posted an article with Money Hacker earlier but, though I will clarify little more to give better understanding to readers than the original article. Let us move to the core of this article. We are starting with the financial experts Golden Portfolio Balancing Rule: “Reduce your age from 100. Resulted percentage of your total money should go to the high risk, high growth investments and rest should invest to guaranteed instruments”.

I know you have not understood anything. So I will clarify this with a simple example. Suppose you are in the age of 25 and planning to create a portfolio with mix of high risk investments and guaranteed investments. To identify how much percentage you need to invest on both instruments, you are reducing your age of 25 from 100 and getting a result of 75. With this result, you are investing 75% of your money to high risk investments like equities and equity mutual funds or commodities or whatever it is. Rest 25%, i.e. the percentage similar to your age, of money you are investing to the guaranteed instruments like fixed deposits, traditional insurance policies government secured papers etc., and you are now very happy because you have got a well balanced portfolio upon your age and what expert financial planners recommending.

I know you have not understood anything. So I will clarify this with a simple example. Suppose you are in the age of 25 and planning to create a portfolio with mix of high risk investments and guaranteed investments. To identify how much percentage you need to invest on both instruments, you are reducing your age of 25 from 100 and getting a result of 75. With this result, you are investing 75% of your money to high risk investments like equities and equity mutual funds or commodities or whatever it is. Rest 25%, i.e. the percentage similar to your age, of money you are investing to the guaranteed instruments like fixed deposits, traditional insurance policies government secured papers etc., and you are now very happy because you have got a well balanced portfolio upon your age and what expert financial planners recommending.

Wait a minute…. There is a really confusing, hidden problem with this calculation:

From the mouth of experts, people should build and balance their portfolio when younger. But, when he reaches to the age of retirement, his portfolio should have maximum debt and minimum equity exposure. i.e. 90% debt and only 10% equity.

Suppose, now your age is 25. Subtracting 25 from 100 will result 75. In that case, your portfolio should have 75% of equity exposure and 25% in debt instruments. I agree.

As per the balancing advice,

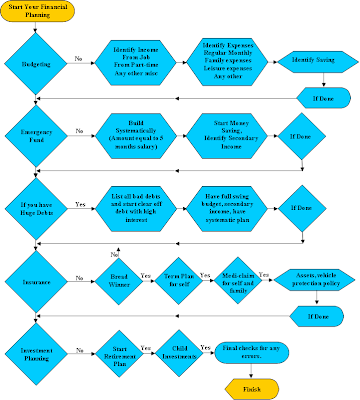

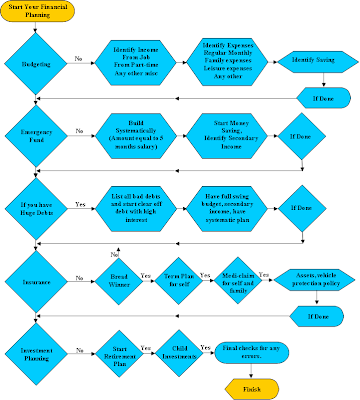

Financial Planning Process Chart

Here is a simple financial planning process chart to follow and

structure your personal financial plan for life in a better way. I have

confirmed no points have been missed in this chart, but I have not given

any detailed information with this chart. It is a basic chart to plan

your finance by identifying all those involved to the process. You can

click on the chart to enlarge it.

Financial Planning Process Chart

I

am sure, following this chart help you to understand the basics of

financial planning process in a better way. There are lots of efforts

involved to shape the financial planning in a better, structured and

stable way. You can access the step by step financial planning guide,

adding as my next post soon, to support this flowchart.

I

am sure, following this chart help you to understand the basics of

financial planning process in a better way. There are lots of efforts

involved to shape the financial planning in a better, structured and

stable way. You can access the step by step financial planning guide,

adding as my next post soon, to support this flowchart.

Time being, you will be able to find some of the beautiful articles on financial planning with Money Hacker. Keep visiting and reading. Add your suggestions and ideas to the comment form here to make this project as a perfect one.

If interested, you can visit my another project, learn financial planning through football. It is a very interesting eight part series, comparing the financial planning process to a soccer game to teach the basics in a better way. This series can be accessed here:

Another article describing necessary areas a person required build skill set to make a perfect financial plan for life. It is a must read article and can be found here:

Financial Planning Process Chart

I

am sure, following this chart help you to understand the basics of

financial planning process in a better way. There are lots of efforts

involved to shape the financial planning in a better, structured and

stable way. You can access the step by step financial planning guide,

adding as my next post soon, to support this flowchart.

I

am sure, following this chart help you to understand the basics of

financial planning process in a better way. There are lots of efforts

involved to shape the financial planning in a better, structured and

stable way. You can access the step by step financial planning guide,

adding as my next post soon, to support this flowchart.Time being, you will be able to find some of the beautiful articles on financial planning with Money Hacker. Keep visiting and reading. Add your suggestions and ideas to the comment form here to make this project as a perfect one.

If interested, you can visit my another project, learn financial planning through football. It is a very interesting eight part series, comparing the financial planning process to a soccer game to teach the basics in a better way. This series can be accessed here:

Another article describing necessary areas a person required build skill set to make a perfect financial plan for life. It is a must read article and can be found here:

Top Listed Financial Planning Articles on Money Hacker

For all our late comers, there are chances to miss out some of the

best articles posted in previous years. In this context, Money Hacker

listing some of the useful articles that posted previously. Each of this

article are special in its kind to provide wisdom on personal financial

planning, financial adviser selection and understand how money grows. I

hope, you will enjoy this links and comment to let me know what do you

think about my effort and your valuable suggestions.

1. Points To Remember When Managing Financial Resources - Is an article from the section of personal financial planning, originally posted on 2nd February, 2008, explaining some of the important points to your attention when planning personal finance. Points mentioned in this article generally not getting full attention from individuals as well as financial planners, at the beginning of planning. This is a true article exposing all those points to remember when planning finance. Have a look.

2. Personal Financial Planning thoughts and strategies - Posted on 24th October, 2008, this article explaining some of the important points an individual needs to keep in mind when preparing a personal financial plan to work. Points in this article intend to lead the personal financial plan to a more structured way. It is certainly an interesting read to get all awareness to plan and create good financial planning structure.

3. Independent Financial Adviser Selection - Posted on 27th November, 2008, it has all the clear cut information on selecting a financial adviser. It described the qualifications and qualities a person look and analyze on a financial planned to identify the suitability to select him as your adviser. I am sure, this article is the best in its kind, highly useful to people. Read to get excellent idea on financial adviser selection.

4. Rule of 72 for Compounding - Posted on 27th December, 2007 explaining what is 72 rule and how it works. 72 rule applies to identify the time required to double your money with given interest rate. This article have nice examples to know how it works. This is an article specially good for fixed deposit interested people through having low risk taking capacity to invest money on high risk instruments like stocks etc.

5. 15 Financial planning mistakes - Posted on 15th March 2009, this article listing the most common, 15 financial planning mistakes. It is a comprehensive list included all possible errors to help individual to get aware and avoid this errors when planning finance. This article also helps to assess your present financial plan against each points to know whether you have committed any listed big mistake(s) or not.

6. 5 Financial Life Categories - Posted on 30th June, 2009 explaining the categories of a financial planning cycle. This article can consider as a mini step by step personal financial planning article.

Hope you will enjoy reading these articles. I expect your suggestions as well as your opinions frequently.

1. Points To Remember When Managing Financial Resources - Is an article from the section of personal financial planning, originally posted on 2nd February, 2008, explaining some of the important points to your attention when planning personal finance. Points mentioned in this article generally not getting full attention from individuals as well as financial planners, at the beginning of planning. This is a true article exposing all those points to remember when planning finance. Have a look.

2. Personal Financial Planning thoughts and strategies - Posted on 24th October, 2008, this article explaining some of the important points an individual needs to keep in mind when preparing a personal financial plan to work. Points in this article intend to lead the personal financial plan to a more structured way. It is certainly an interesting read to get all awareness to plan and create good financial planning structure.

3. Independent Financial Adviser Selection - Posted on 27th November, 2008, it has all the clear cut information on selecting a financial adviser. It described the qualifications and qualities a person look and analyze on a financial planned to identify the suitability to select him as your adviser. I am sure, this article is the best in its kind, highly useful to people. Read to get excellent idea on financial adviser selection.

4. Rule of 72 for Compounding - Posted on 27th December, 2007 explaining what is 72 rule and how it works. 72 rule applies to identify the time required to double your money with given interest rate. This article have nice examples to know how it works. This is an article specially good for fixed deposit interested people through having low risk taking capacity to invest money on high risk instruments like stocks etc.

5. 15 Financial planning mistakes - Posted on 15th March 2009, this article listing the most common, 15 financial planning mistakes. It is a comprehensive list included all possible errors to help individual to get aware and avoid this errors when planning finance. This article also helps to assess your present financial plan against each points to know whether you have committed any listed big mistake(s) or not.

6. 5 Financial Life Categories - Posted on 30th June, 2009 explaining the categories of a financial planning cycle. This article can consider as a mini step by step personal financial planning article.

Hope you will enjoy reading these articles. I expect your suggestions as well as your opinions frequently.

Top 5 Inspirational Books on Value Investing

“A book is a gift you can open again and again.” Garrison Keillor

Books

are the best companion to knowledge savvy investors. Value investing is

not a knowledge but it is an art inspiring by passion and knowledge.

There are several books available on investments, but very few

motivational books available on value investing. Such books have a

history of decades and still favorites of value investors across the

world. In my findings, I have found Top 5 Inspiring Books on Value

Investing, most of them are still classic and some of them are fantastic

but still no most of the value investors even not heard the title

about. It is a right collection to acquire to your library as a classic

collection.

Each

of the investing books in this lists have its own specialty. None of

them duplicates any points in this guides. Each of this guides are

special with the subject covering in it. A combination of this guides

can provide enormous knowledge to any investor to be a perfect value

investor. Have a look on the list below:

Each

of the investing books in this lists have its own specialty. None of

them duplicates any points in this guides. Each of this guides are

special with the subject covering in it. A combination of this guides

can provide enormous knowledge to any investor to be a perfect value

investor. Have a look on the list below:

Top 5 Inspirational Books on Value Investing

1. The Intelligent Investor

The

Intelligent investor written by Benjamin Graham, 'Father of Value

Investing', published in 1949 considers an an investment classics that

remain bestsellers to this day. I don't remember how many times I have

read this book. I still reading this precious value investing bible. It

can consider as the king of all value investing books ever published in

the world. Benjamin Grahams 2 most famous allegories, 'Mr. Market' and 'Margin of Safety'

originally introduced to the investing world through this guide only.

The Intelligent Investor considered as a must read for any person

serious about investing in the stock market. While this book is not

meant for a beginner, reading it does give plenty of structure to help

you organize your approach to value investing. Buy this guide

The

Intelligent investor written by Benjamin Graham, 'Father of Value

Investing', published in 1949 considers an an investment classics that

remain bestsellers to this day. I don't remember how many times I have

read this book. I still reading this precious value investing bible. It

can consider as the king of all value investing books ever published in

the world. Benjamin Grahams 2 most famous allegories, 'Mr. Market' and 'Margin of Safety'

originally introduced to the investing world through this guide only.

The Intelligent Investor considered as a must read for any person

serious about investing in the stock market. While this book is not

meant for a beginner, reading it does give plenty of structure to help

you organize your approach to value investing. Buy this guide

2. Common Stocks and uncommon Profits

"Common

Stocks and uncommon Profits" written by American investment genius

Philip Arthur Fisher, well known as Philip Fisher, originally published

in 1958. Philip Fisher considered as a pioneer in the field of Growth

Investing. When I have completed reading the book about 5 times, I have

equipped with must have qualities for selecting a business to invest and

upon completion of my reading to 10 times, it made me difficult to find

a company to invest. Quality of his advise in this guide on the

selection of a business is something unexplainable, thrilling and deep

penetrating with wonderful knowledge. As the only author highly admired

by legend investor Warren Buffett for his classic writing and knowledge,

Philip Fisher provided eight cutting edge investing principles to

the investors for successful investing. Any true follower of the

investment advice and style of Philip Fisher, will be able to make

investments 'for ever'. Buy this guide

"Common

Stocks and uncommon Profits" written by American investment genius

Philip Arthur Fisher, well known as Philip Fisher, originally published

in 1958. Philip Fisher considered as a pioneer in the field of Growth

Investing. When I have completed reading the book about 5 times, I have

equipped with must have qualities for selecting a business to invest and

upon completion of my reading to 10 times, it made me difficult to find

a company to invest. Quality of his advise in this guide on the

selection of a business is something unexplainable, thrilling and deep

penetrating with wonderful knowledge. As the only author highly admired

by legend investor Warren Buffett for his classic writing and knowledge,

Philip Fisher provided eight cutting edge investing principles to

the investors for successful investing. Any true follower of the

investment advice and style of Philip Fisher, will be able to make

investments 'for ever'. Buy this guide

3. Security Analysis

"Security

Analysis" is a trough but ever best qualitative and quantitative

business analysis guide from Benjamin Graham. First edition of 'Security

Analysis' published in 1934, no investment book in history had either

the immediate impact, or the long-term relevance and value, of its first

edition in 1934. It was among few guide continuously in print for more

than sixty years from its original publication and one of the most

admired and most discussed analysis guide in this world. When it come to

the original focus of this book, it is a timeless guidance and advice

to analyze business quality through careful analysis of balance sheets.

The one who have read and familiar about Security Analysis will be able

to understand any trap or errors in the balance sheet immediately. When I

have read the guide as first, it was difficult for me to understand the

intelligent methods Graham explaining to stimulate our analyzing power.

When I have went through multiple times, it put me to the most

comfortable side to analyze and understand the balance sheet to a great

degree. While the guide covering bond investing, Graham explained the

difference of valuation points on each bond and equity to analyze the

business using right factors. It is a must read as well as a pearl in

investment library. Buy this guide

"Security

Analysis" is a trough but ever best qualitative and quantitative

business analysis guide from Benjamin Graham. First edition of 'Security

Analysis' published in 1934, no investment book in history had either

the immediate impact, or the long-term relevance and value, of its first

edition in 1934. It was among few guide continuously in print for more

than sixty years from its original publication and one of the most

admired and most discussed analysis guide in this world. When it come to

the original focus of this book, it is a timeless guidance and advice

to analyze business quality through careful analysis of balance sheets.

The one who have read and familiar about Security Analysis will be able

to understand any trap or errors in the balance sheet immediately. When I

have read the guide as first, it was difficult for me to understand the

intelligent methods Graham explaining to stimulate our analyzing power.

When I have went through multiple times, it put me to the most

comfortable side to analyze and understand the balance sheet to a great

degree. While the guide covering bond investing, Graham explained the

difference of valuation points on each bond and equity to analyze the

business using right factors. It is a must read as well as a pearl in

investment library. Buy this guide

4. Common Stocks as Long Term Investments

I

am certain that most of the readers might haven't heard about this

valuable investment guide. “Common Stocks as Long Term Investments" is a

masterpiece of Edgar Lawrence Smith originally published in 1928. The

studies found in this book are the record of a failure, the failure of

facts to sustain a preconceived theory. Bonds have certain attributes. A

diversification of common stocks has its own attributes, which differs

from bonds. Each class of investment has its useful purpose and its

proper place in any investment plan. A clearer understanding of their

differing attributes may help to determine the relative proportion of

each of these two classes of securities which will best serve the

investment requirements and purposes of each investor. This book not

being famous with investors because of its age as an old investing

guide. Reading this guide provide you enormous knowledge on each and

every factors need to be pointed when analyzing bonds or stocks.

I

am certain that most of the readers might haven't heard about this

valuable investment guide. “Common Stocks as Long Term Investments" is a

masterpiece of Edgar Lawrence Smith originally published in 1928. The

studies found in this book are the record of a failure, the failure of

facts to sustain a preconceived theory. Bonds have certain attributes. A

diversification of common stocks has its own attributes, which differs

from bonds. Each class of investment has its useful purpose and its

proper place in any investment plan. A clearer understanding of their

differing attributes may help to determine the relative proportion of

each of these two classes of securities which will best serve the

investment requirements and purposes of each investor. This book not

being famous with investors because of its age as an old investing

guide. Reading this guide provide you enormous knowledge on each and

every factors need to be pointed when analyzing bonds or stocks.

In this investing guide, smith concluded three reasons why stocks beat bonds as long term investments:

First: inflation is more likely than deflation and bonds don't have any protection against inflation. In inflationary times bonds lose purchasing power even as the face value remains the same. Stocks, to the contrary, grow in value often beyond inflation as I will explain below. Second: for a bond to qualify as high grade, the issuing company has to have earnings above and beyond what is required to pay off the interest and the principal of the bond and this extra income accrues to the stockholders, not to the bond holders. Third: population growth requires growth of products and services and the companies that provide them grow accordingly. Improving standard of living has the same effect, people demand more and better products and services and the companies supplying them grow accordingly. This growth is above and beyond inflation as otherwise there would be no improvement in the standard of living, quite the contrary.

5. The Theory of Investment Value

Finally,

“The Theory of Investment Value” is a work from John Burr Williams

first printed in 1938 famous on ‘Dividend Discount Model’. More than a

book “The Theory of Investment Value” was a Ph.D. thesis at Harvard in

1937. In his 1992 published Capital Ideas, Peter Bernstein says “Williams

combined original theoretical concepts with enlightening and

entertaining commentary based on his own experiences in the

rough-and-tumble world of investment.” Williams' discovery was to project an estimate that offers intrinsic value and it is called the 'Dividend Discount Model'

which is still used today by professional investors on the

institutional side of markets. "The Theory of Investment Value" is still

in print almost seven decades after it was first published, as a

serious academic works on valuation, shows you how to calculate

intrinsic value and is full of math. Any math savvy investor must go for

this guide.

Finally,

“The Theory of Investment Value” is a work from John Burr Williams

first printed in 1938 famous on ‘Dividend Discount Model’. More than a

book “The Theory of Investment Value” was a Ph.D. thesis at Harvard in

1937. In his 1992 published Capital Ideas, Peter Bernstein says “Williams

combined original theoretical concepts with enlightening and

entertaining commentary based on his own experiences in the

rough-and-tumble world of investment.” Williams' discovery was to project an estimate that offers intrinsic value and it is called the 'Dividend Discount Model'

which is still used today by professional investors on the

institutional side of markets. "The Theory of Investment Value" is still

in print almost seven decades after it was first published, as a

serious academic works on valuation, shows you how to calculate

intrinsic value and is full of math. Any math savvy investor must go for

this guide.

As a value investor, to get exact knowledge, above mentioned books are worth having and reading. Most of them are not a kind of book to read once to keep somewhere. Each of this guide teaching knowledge on various subjects and as the sole authority on what it is teaching. Buy, read and add to your investment collection for referring time to time, provide you enormous knowledge and wisdom.

Comment if you liked this article, to know me your opinion.

Each

of the investing books in this lists have its own specialty. None of

them duplicates any points in this guides. Each of this guides are

special with the subject covering in it. A combination of this guides

can provide enormous knowledge to any investor to be a perfect value

investor. Have a look on the list below:

Each

of the investing books in this lists have its own specialty. None of

them duplicates any points in this guides. Each of this guides are

special with the subject covering in it. A combination of this guides

can provide enormous knowledge to any investor to be a perfect value

investor. Have a look on the list below:Top 5 Inspirational Books on Value Investing

1. The Intelligent Investor

The

Intelligent investor written by Benjamin Graham, 'Father of Value

Investing', published in 1949 considers an an investment classics that

remain bestsellers to this day. I don't remember how many times I have

read this book. I still reading this precious value investing bible. It

can consider as the king of all value investing books ever published in

the world. Benjamin Grahams 2 most famous allegories, 'Mr. Market' and 'Margin of Safety'

originally introduced to the investing world through this guide only.

The Intelligent Investor considered as a must read for any person

serious about investing in the stock market. While this book is not

meant for a beginner, reading it does give plenty of structure to help

you organize your approach to value investing. Buy this guide

The

Intelligent investor written by Benjamin Graham, 'Father of Value

Investing', published in 1949 considers an an investment classics that

remain bestsellers to this day. I don't remember how many times I have

read this book. I still reading this precious value investing bible. It

can consider as the king of all value investing books ever published in

the world. Benjamin Grahams 2 most famous allegories, 'Mr. Market' and 'Margin of Safety'

originally introduced to the investing world through this guide only.

The Intelligent Investor considered as a must read for any person

serious about investing in the stock market. While this book is not

meant for a beginner, reading it does give plenty of structure to help

you organize your approach to value investing. Buy this guide2. Common Stocks and uncommon Profits

"Common

Stocks and uncommon Profits" written by American investment genius

Philip Arthur Fisher, well known as Philip Fisher, originally published

in 1958. Philip Fisher considered as a pioneer in the field of Growth

Investing. When I have completed reading the book about 5 times, I have

equipped with must have qualities for selecting a business to invest and

upon completion of my reading to 10 times, it made me difficult to find

a company to invest. Quality of his advise in this guide on the

selection of a business is something unexplainable, thrilling and deep

penetrating with wonderful knowledge. As the only author highly admired

by legend investor Warren Buffett for his classic writing and knowledge,

Philip Fisher provided eight cutting edge investing principles to

the investors for successful investing. Any true follower of the

investment advice and style of Philip Fisher, will be able to make

investments 'for ever'. Buy this guide

"Common

Stocks and uncommon Profits" written by American investment genius

Philip Arthur Fisher, well known as Philip Fisher, originally published

in 1958. Philip Fisher considered as a pioneer in the field of Growth

Investing. When I have completed reading the book about 5 times, I have

equipped with must have qualities for selecting a business to invest and

upon completion of my reading to 10 times, it made me difficult to find

a company to invest. Quality of his advise in this guide on the

selection of a business is something unexplainable, thrilling and deep

penetrating with wonderful knowledge. As the only author highly admired

by legend investor Warren Buffett for his classic writing and knowledge,

Philip Fisher provided eight cutting edge investing principles to

the investors for successful investing. Any true follower of the

investment advice and style of Philip Fisher, will be able to make

investments 'for ever'. Buy this guide3. Security Analysis

"Security

Analysis" is a trough but ever best qualitative and quantitative

business analysis guide from Benjamin Graham. First edition of 'Security

Analysis' published in 1934, no investment book in history had either

the immediate impact, or the long-term relevance and value, of its first

edition in 1934. It was among few guide continuously in print for more

than sixty years from its original publication and one of the most

admired and most discussed analysis guide in this world. When it come to

the original focus of this book, it is a timeless guidance and advice

to analyze business quality through careful analysis of balance sheets.

The one who have read and familiar about Security Analysis will be able

to understand any trap or errors in the balance sheet immediately. When I

have read the guide as first, it was difficult for me to understand the

intelligent methods Graham explaining to stimulate our analyzing power.

When I have went through multiple times, it put me to the most

comfortable side to analyze and understand the balance sheet to a great

degree. While the guide covering bond investing, Graham explained the

difference of valuation points on each bond and equity to analyze the

business using right factors. It is a must read as well as a pearl in

investment library. Buy this guide

"Security

Analysis" is a trough but ever best qualitative and quantitative

business analysis guide from Benjamin Graham. First edition of 'Security

Analysis' published in 1934, no investment book in history had either

the immediate impact, or the long-term relevance and value, of its first

edition in 1934. It was among few guide continuously in print for more

than sixty years from its original publication and one of the most

admired and most discussed analysis guide in this world. When it come to

the original focus of this book, it is a timeless guidance and advice

to analyze business quality through careful analysis of balance sheets.

The one who have read and familiar about Security Analysis will be able

to understand any trap or errors in the balance sheet immediately. When I

have read the guide as first, it was difficult for me to understand the

intelligent methods Graham explaining to stimulate our analyzing power.

When I have went through multiple times, it put me to the most

comfortable side to analyze and understand the balance sheet to a great

degree. While the guide covering bond investing, Graham explained the

difference of valuation points on each bond and equity to analyze the

business using right factors. It is a must read as well as a pearl in

investment library. Buy this guide4. Common Stocks as Long Term Investments

I

am certain that most of the readers might haven't heard about this

valuable investment guide. “Common Stocks as Long Term Investments" is a

masterpiece of Edgar Lawrence Smith originally published in 1928. The

studies found in this book are the record of a failure, the failure of

facts to sustain a preconceived theory. Bonds have certain attributes. A

diversification of common stocks has its own attributes, which differs

from bonds. Each class of investment has its useful purpose and its

proper place in any investment plan. A clearer understanding of their

differing attributes may help to determine the relative proportion of

each of these two classes of securities which will best serve the

investment requirements and purposes of each investor. This book not

being famous with investors because of its age as an old investing

guide. Reading this guide provide you enormous knowledge on each and

every factors need to be pointed when analyzing bonds or stocks.

I

am certain that most of the readers might haven't heard about this

valuable investment guide. “Common Stocks as Long Term Investments" is a

masterpiece of Edgar Lawrence Smith originally published in 1928. The

studies found in this book are the record of a failure, the failure of

facts to sustain a preconceived theory. Bonds have certain attributes. A

diversification of common stocks has its own attributes, which differs

from bonds. Each class of investment has its useful purpose and its

proper place in any investment plan. A clearer understanding of their

differing attributes may help to determine the relative proportion of

each of these two classes of securities which will best serve the

investment requirements and purposes of each investor. This book not

being famous with investors because of its age as an old investing

guide. Reading this guide provide you enormous knowledge on each and

every factors need to be pointed when analyzing bonds or stocks.In this investing guide, smith concluded three reasons why stocks beat bonds as long term investments:

First: inflation is more likely than deflation and bonds don't have any protection against inflation. In inflationary times bonds lose purchasing power even as the face value remains the same. Stocks, to the contrary, grow in value often beyond inflation as I will explain below. Second: for a bond to qualify as high grade, the issuing company has to have earnings above and beyond what is required to pay off the interest and the principal of the bond and this extra income accrues to the stockholders, not to the bond holders. Third: population growth requires growth of products and services and the companies that provide them grow accordingly. Improving standard of living has the same effect, people demand more and better products and services and the companies supplying them grow accordingly. This growth is above and beyond inflation as otherwise there would be no improvement in the standard of living, quite the contrary.

5. The Theory of Investment Value

Finally,

“The Theory of Investment Value” is a work from John Burr Williams

first printed in 1938 famous on ‘Dividend Discount Model’. More than a

book “The Theory of Investment Value” was a Ph.D. thesis at Harvard in

1937. In his 1992 published Capital Ideas, Peter Bernstein says “Williams

combined original theoretical concepts with enlightening and

entertaining commentary based on his own experiences in the

rough-and-tumble world of investment.” Williams' discovery was to project an estimate that offers intrinsic value and it is called the 'Dividend Discount Model'

which is still used today by professional investors on the

institutional side of markets. "The Theory of Investment Value" is still

in print almost seven decades after it was first published, as a

serious academic works on valuation, shows you how to calculate

intrinsic value and is full of math. Any math savvy investor must go for

this guide.

Finally,

“The Theory of Investment Value” is a work from John Burr Williams

first printed in 1938 famous on ‘Dividend Discount Model’. More than a

book “The Theory of Investment Value” was a Ph.D. thesis at Harvard in

1937. In his 1992 published Capital Ideas, Peter Bernstein says “Williams

combined original theoretical concepts with enlightening and

entertaining commentary based on his own experiences in the

rough-and-tumble world of investment.” Williams' discovery was to project an estimate that offers intrinsic value and it is called the 'Dividend Discount Model'

which is still used today by professional investors on the

institutional side of markets. "The Theory of Investment Value" is still

in print almost seven decades after it was first published, as a

serious academic works on valuation, shows you how to calculate

intrinsic value and is full of math. Any math savvy investor must go for

this guide.As a value investor, to get exact knowledge, above mentioned books are worth having and reading. Most of them are not a kind of book to read once to keep somewhere. Each of this guide teaching knowledge on various subjects and as the sole authority on what it is teaching. Buy, read and add to your investment collection for referring time to time, provide you enormous knowledge and wisdom.

Comment if you liked this article, to know me your opinion.

Motivate Self to Generate 3 Way Income

Article written by Sherin Dev; Follow me in Twitter or Facebook . To get latest news and articles Subscribe for free!

"Good management is better than good income." Portuguese Proverb

"Good management is better than good income." Portuguese Proverb

Did you ever heard 'failure' as a result of continuous efforts? No chance. Result of any effort with positive mind, whatever it is, ultimately come to success! Time may decide the result sometime, but the ultimate result will be a 'success'. When I am writing this article, have kept this truth in mind through out the process. Motivating self to identify 3 way income stream is possible by each of us. In this article, I am introducing '3 way income generating ideas' to understand better and work around.

When follow experts for getting ideas on generating additional income, most of them recommend to have a full time job for steady income and do some sort of part time job or business to generate additional income to support the main stream. Of course, this will do better for most of us to support our family. But, whenever there are some possibility in front of us to generate a 'Passive' income as a third stream, we will not lose anything for dig little to have a try. The word 'passive' I have used throughout in this article with a sense 'an activity that doesn't required active interference from a person'. I suggest you to generate income from three ways than above said, two traditional methods.

"Good management is better than good income." Portuguese Proverb

"Good management is better than good income." Portuguese ProverbDid you ever heard 'failure' as a result of continuous efforts? No chance. Result of any effort with positive mind, whatever it is, ultimately come to success! Time may decide the result sometime, but the ultimate result will be a 'success'. When I am writing this article, have kept this truth in mind through out the process. Motivating self to identify 3 way income stream is possible by each of us. In this article, I am introducing '3 way income generating ideas' to understand better and work around.

When follow experts for getting ideas on generating additional income, most of them recommend to have a full time job for steady income and do some sort of part time job or business to generate additional income to support the main stream. Of course, this will do better for most of us to support our family. But, whenever there are some possibility in front of us to generate a 'Passive' income as a third stream, we will not lose anything for dig little to have a try. The word 'passive' I have used throughout in this article with a sense 'an activity that doesn't required active interference from a person'. I suggest you to generate income from three ways than above said, two traditional methods.

Top 7 Skill set to Financial Prominence

"If

money is your hope for independence you will never have it. The only

real security that a man will have in this world is a reserve of

knowledge, experience, and ability" - Henry Ford

Article written by Sherin Dev; Follow me in Twitter or Facebook . To get latest news and articles Subscribe for free!

Life

is so complicated to manage. Sometime it may appears as rock solid and

some time like a melting cream. Money also have similar nature. We may

sometime surprise by see how easily some people managing their money and

might think how would they got such skills to manage money such a

systematic way without much difficulties? You can find the answer for

this question right here in this article, 'Top 7 Skill set to Financial

Prominence', to build extraordinary skills to manage your money in a

better, structured way!

Life

is so complicated to manage. Sometime it may appears as rock solid and

some time like a melting cream. Money also have similar nature. We may

sometime surprise by see how easily some people managing their money and

might think how would they got such skills to manage money such a

systematic way without much difficulties? You can find the answer for

this question right here in this article, 'Top 7 Skill set to Financial

Prominence', to build extraordinary skills to manage your money in a

better, structured way!

When some situation approaches that force you independent management of money i.e. got your first job, marriage, moved with family to an Independent home etc., you will be in deep trouble by lack of financial planning knowledge and experience. It is better to assess yourself early to identify the skills you have and build most required skill sets. To do such, measure your present knowledge against Top 7 Most Required Financial Skill set below, to get a right picture:

Article written by Sherin Dev; Follow me in Twitter or Facebook . To get latest news and articles Subscribe for free!

Life

is so complicated to manage. Sometime it may appears as rock solid and

some time like a melting cream. Money also have similar nature. We may

sometime surprise by see how easily some people managing their money and

might think how would they got such skills to manage money such a

systematic way without much difficulties? You can find the answer for

this question right here in this article, 'Top 7 Skill set to Financial

Prominence', to build extraordinary skills to manage your money in a

better, structured way!

Life

is so complicated to manage. Sometime it may appears as rock solid and

some time like a melting cream. Money also have similar nature. We may

sometime surprise by see how easily some people managing their money and

might think how would they got such skills to manage money such a

systematic way without much difficulties? You can find the answer for

this question right here in this article, 'Top 7 Skill set to Financial

Prominence', to build extraordinary skills to manage your money in a

better, structured way!When some situation approaches that force you independent management of money i.e. got your first job, marriage, moved with family to an Independent home etc., you will be in deep trouble by lack of financial planning knowledge and experience. It is better to assess yourself early to identify the skills you have and build most required skill sets. To do such, measure your present knowledge against Top 7 Most Required Financial Skill set below, to get a right picture:

Graham's Mr. Market Allegory

Any investor who want to be a right value investor must read and

understand what meant by two most famous value investing allegories from

the 'Father of Value Investing' Benjamin Graham. His most admired

allegories "Mr. Market" and "Margin of Safety", attracted huge number of

investors world wide and now it is your turn to understand both. I have

already posted an article on the allegory ""Margin of Safety"", some times back, and here is the simplified idea on the second one "Mr. Market".

Let us close this section with something in the nature of a parable. Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them.Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly. If you are a prudent investor or a sensible businessman, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interest in the enterprise? Only in case you agree with him, or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position.

No comments:

Post a Comment